1099 K Form

What is the 1099 K Form

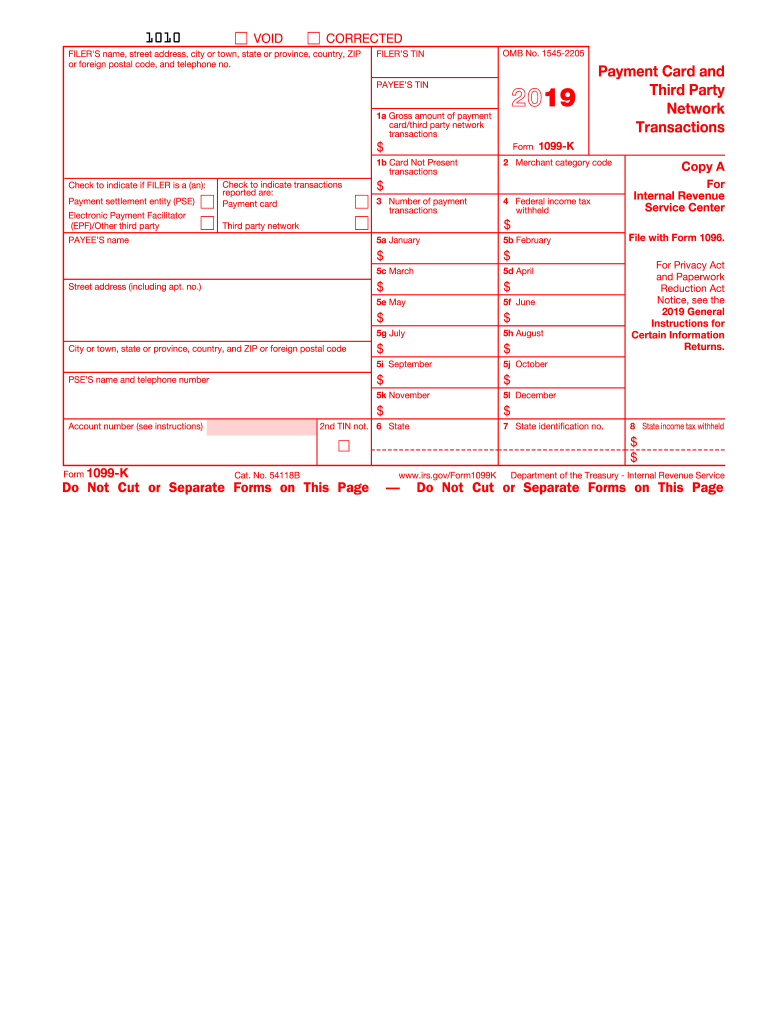

The 1099 K form is a tax document used to report payment card and third-party network transactions. It is issued by payment settlement entities, such as credit card companies and online payment platforms, to report the gross amount of all reportable transactions made during the tax year. This form is essential for individuals and businesses that receive payments through these channels, as it helps the IRS track income that may not be reported elsewhere.

How to use the 1099 K Form

Using the 1099 K form involves several steps. First, taxpayers should review the information reported on the form to ensure accuracy. This includes verifying the total amount reported and ensuring that it matches their own records. If discrepancies are found, it is important to contact the issuer of the form for corrections. Taxpayers must then report the income from the 1099 K on their tax returns, typically on Schedule C for self-employed individuals or as part of their business income.

Steps to complete the 1099 K Form

Completing the 1099 K form requires attention to detail. Here are the key steps:

- Gather all necessary information, including your business name, address, and taxpayer identification number.

- Collect transaction details from your payment processor, including the gross amount of payments received.

- Fill out the form accurately, ensuring that all information matches your records.

- Submit the completed form to the IRS by the required deadline, typically by January 31 of the following year.

Legal use of the 1099 K Form

The legal use of the 1099 K form is governed by IRS regulations. It is a requirement for any business or individual who receives payments through payment cards or third-party networks to report this income accurately. Failure to report income as shown on the 1099 K can lead to penalties and interest on unpaid taxes. It is crucial for taxpayers to maintain accurate records and ensure compliance with tax laws to avoid legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 K form are critical to ensure compliance with IRS regulations. The form must be submitted to the IRS by January 31 of the year following the tax year. Additionally, recipients of the form should receive their copies by the same date. It is important to mark these dates on your calendar to avoid late penalties and ensure timely reporting of income.

Who Issues the Form

The 1099 K form is issued by payment settlement entities, which include banks, credit card companies, and online payment processors like PayPal. These entities are responsible for tracking and reporting the total amount of payments made to merchants and service providers during the tax year. Understanding who issues the form can help taxpayers identify where to obtain their 1099 K for accurate tax reporting.

Quick guide on how to complete 2019 form 1099 k payment card and third party network transactions

Effortlessly Prepare 1099 K Form on Any Device

Managing documents online has become increasingly favored by both organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly, without any holdups. Handle 1099 K Form on any device utilizing airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to Alter and eSign 1099 K Form with Ease

- Obtain 1099 K Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive details using specific tools offered by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or via an invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from the device of your choice. Modify and eSign 1099 K Form to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 1099 k payment card and third party network transactions

How to create an eSignature for the 2019 Form 1099 K Payment Card And Third Party Network Transactions online

How to generate an electronic signature for your 2019 Form 1099 K Payment Card And Third Party Network Transactions in Chrome

How to create an electronic signature for signing the 2019 Form 1099 K Payment Card And Third Party Network Transactions in Gmail

How to generate an eSignature for the 2019 Form 1099 K Payment Card And Third Party Network Transactions from your smart phone

How to make an eSignature for the 2019 Form 1099 K Payment Card And Third Party Network Transactions on iOS devices

How to create an eSignature for the 2019 Form 1099 K Payment Card And Third Party Network Transactions on Android

People also ask

-

What is the 1099 K Form and why do I need it?

The 1099 K Form is a tax document used to report payment card and third-party network transactions. If your business processes payments through platforms like PayPal or Stripe, you may need to file this form to comply with IRS regulations. Understanding the 1099 K Form is crucial for accurate tax reporting and avoiding penalties.

-

How can airSlate SignNow help with the 1099 K Form?

airSlate SignNow simplifies the process of preparing and sending the 1099 K Form by allowing you to eSign and manage documents securely. With our user-friendly interface, you can quickly gather signatures and ensure compliance with tax reporting requirements. This streamlines your workflow and saves time during tax season.

-

Is there a cost associated with using airSlate SignNow for the 1099 K Form?

airSlate SignNow offers various pricing plans that cater to different business needs, including features for managing the 1099 K Form. Our plans are designed to be cost-effective while providing essential functionalities for document management and eSigning. Explore our pricing page to find the plan that suits your requirements.

-

Can I integrate airSlate SignNow with my accounting software for the 1099 K Form?

Yes, airSlate SignNow integrates seamlessly with various accounting software, making it easy to manage your 1099 K Form and other tax documents. By connecting your accounting tools, you can automate document generation and ensure that your financial records are up to date. This integration enhances efficiency and accuracy in your tax reporting.

-

What features does airSlate SignNow offer for managing the 1099 K Form?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document storage specifically for managing the 1099 K Form. These tools help you create, send, and track your tax documents efficiently. Additionally, our platform ensures that your documents are securely stored and easily accessible when needed.

-

How does airSlate SignNow ensure the security of my 1099 K Form?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the 1099 K Form. Our platform uses advanced encryption protocols to protect your data during transmission and storage. You can confidently manage your tax documents, knowing they are secure and compliant with industry standards.

-

What support does airSlate SignNow provide for users with the 1099 K Form?

airSlate SignNow offers comprehensive customer support to assist users with any questions regarding the 1099 K Form. Our support team is available through various channels, including live chat and email, to provide guidance and clarify any concerns you might have. We also offer helpful resources and documentation to aid you in the process.

Get more for 1099 K Form

Find out other 1099 K Form

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed