W4app Form

What is the W-4P?

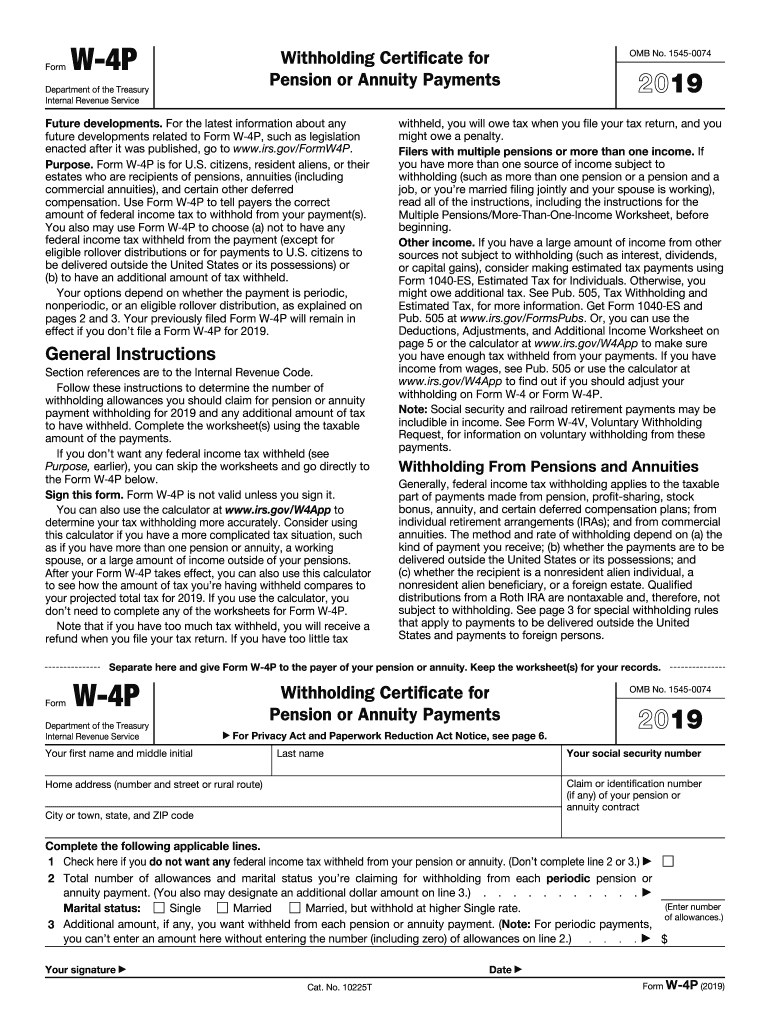

The W-4P form, or 2019 IRS annuity form, is used by individuals to request federal income tax withholding on pension or annuity payments. This form is essential for those receiving retirement benefits, as it helps ensure that the correct amount of taxes is withheld from these payments. By accurately completing the W-4P, taxpayers can manage their tax obligations effectively and avoid underpayment penalties.

Steps to Complete the W-4P

Completing the W-4P involves several straightforward steps:

- Provide your personal information, including your name, address, and Social Security number.

- Indicate your marital status, which affects your withholding rate.

- Specify the amount of federal income tax you want withheld from your pension or annuity payments.

- Sign and date the form to certify that the information provided is accurate.

After completing the form, you should submit it to your pension plan administrator or the entity responsible for your annuity payments.

IRS Guidelines for the W-4P

The IRS provides specific guidelines for completing the W-4P to ensure compliance with tax regulations. It is important to refer to the official IRS instructions when filling out the form. The guidelines detail how to calculate the appropriate withholding amount based on your expected income and tax situation. Understanding these guidelines can help you make informed decisions about your tax withholding preferences.

Required Documents for the W-4P

When completing the W-4P, you may need several documents to ensure accuracy:

- Your Social Security number.

- Information about your pension or annuity plan.

- Previous tax returns to assess your tax situation.

Having these documents on hand can streamline the process and help you fill out the form correctly.

Form Submission Methods

The W-4P can be submitted in various ways, depending on the requirements of your pension plan or annuity provider. Common submission methods include:

- Online submission through your pension provider's portal.

- Mailing a physical copy of the form to the appropriate address.

- In-person submission at the office of your pension administrator.

It is advisable to confirm the preferred submission method with your provider to ensure timely processing.

Penalties for Non-Compliance

Failure to submit the W-4P or inaccuracies in the information provided can lead to penalties. If too little tax is withheld, you may face underpayment penalties when filing your tax return. It is crucial to review your withholding preferences periodically, especially if your financial situation changes, to avoid potential tax liabilities.

Quick guide on how to complete future developments related to form w4p such as legislation

Effortlessly Prepare W4app on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage W4app on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign W4app with Ease

- Obtain W4app and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or hide sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to store your edits.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate the printing of new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and electronically sign W4app to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the future developments related to form w4p such as legislation

How to create an eSignature for the Future Developments Related To Form W4p Such As Legislation online

How to generate an electronic signature for your Future Developments Related To Form W4p Such As Legislation in Chrome

How to make an eSignature for signing the Future Developments Related To Form W4p Such As Legislation in Gmail

How to generate an electronic signature for the Future Developments Related To Form W4p Such As Legislation from your smartphone

How to make an eSignature for the Future Developments Related To Form W4p Such As Legislation on iOS

How to create an eSignature for the Future Developments Related To Form W4p Such As Legislation on Android devices

People also ask

-

What is the 2019 form w 4p and why is it important?

The 2019 form w 4p is a tax withholding form that helps employees determine the correct amount of federal income tax to withhold from their paychecks. It's important for managing tax liabilities and ensuring compliance with IRS regulations. Properly completing the 2019 form w 4p can help avoid under-withholding or over-withholding.

-

How can I securely eSign the 2019 form w 4p using airSlate SignNow?

You can securely eSign the 2019 form w 4p using airSlate SignNow by uploading the document to our platform and inviting the necessary signers. With our easy-to-use interface, you can add signatures, initials, and other required fields before sending it off for signature. This ensures your 2019 form w 4p is signed quickly and securely.

-

What are the pricing options for using airSlate SignNow for 2019 form w 4p?

airSlate SignNow offers several pricing plans that cater to different business needs. Each plan provides access to features that streamline the signing process, including templates for documents like the 2019 form w 4p. You can easily find a plan that fits your budget while ensuring compliance and efficiency.

-

What features does airSlate SignNow offer for handling the 2019 form w 4p?

airSlate SignNow offers a variety of features for handling the 2019 form w 4p, including customizable templates, automated workflows, and real-time tracking of document status. Our platform also ensures compliance with legal standards, providing a secure solution for eSigning sensitive documents like the 2019 form w 4p.

-

Can I integrate airSlate SignNow with other software for my 2019 form w 4p?

Yes, airSlate SignNow integrates seamlessly with popular software platforms, allowing you to manage your documents more effectively. You can connect your project management, CRM, or accounting tools to streamline the process of sending and signing the 2019 form w 4p. This enhances workflow efficiency and reduces the time spent on administrative tasks.

-

What benefits does airSlate SignNow provide for businesses needing the 2019 form w 4p?

airSlate SignNow simplifies the document management process, making it easier for businesses to collect signatures on the 2019 form w 4p. By utilizing our platform, you can reduce turnaround times, save on paper costs, and improve overall compliance. Our analytics tools also provide insights into your signing workflow.

-

Is it easy to fill out the 2019 form w 4p on airSlate SignNow?

Absolutely! Filling out the 2019 form w 4p on airSlate SignNow is straightforward. You can complete the necessary fields using our intuitive interface, making it easy to gather the required information. Once filled, you can quickly send the document for eSignature.

Get more for W4app

- Hearing to review the fire season and long form

- Counseling services form

- Compress pdf online same pdf quality less file size form

- Domestic employee services agreement form

- Certificate of discharge to merchant mariner certificate of discharge to merchant mariner form

- Cg 5310a form

- Application for approval revision of vessel pollution response plans form

- I751 interview form

Find out other W4app

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now