1098 Instructions Mortgage Interest Statement Form

What is the 1098 Instructions Mortgage Interest Statement

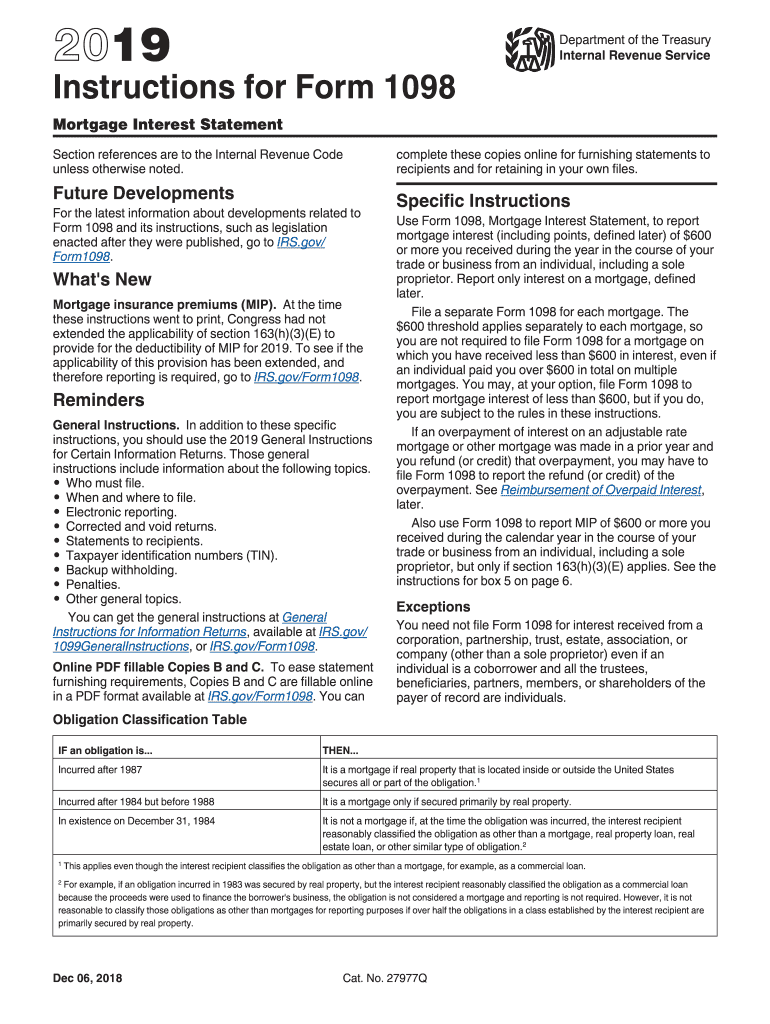

The IRS 1098 Instructions form, also known as the mortgage interest statement, is a crucial document for homeowners in the United States. This form is used by lenders to report the amount of mortgage interest paid by the borrower during the tax year. It provides essential information that taxpayers need to claim mortgage interest deductions on their federal income tax returns. Understanding this form is vital for accurately reporting income and maximizing potential tax benefits.

Steps to complete the 1098 Instructions Mortgage Interest Statement

Completing the 1098 Instructions form involves several key steps:

- Gather necessary information, including your mortgage details and the total interest paid during the year.

- Obtain the form from your lender, who is required to provide it if you paid $600 or more in interest.

- Fill in your personal information, including your name, address, and Social Security number.

- Enter the mortgage interest amount reported by your lender on the form.

- Review the completed form for accuracy before submission.

Legal use of the 1098 Instructions Mortgage Interest Statement

The legal use of the 1098 Instructions form is significant for tax compliance. This form serves as a record of the mortgage interest paid, which is often deductible on your tax return. To ensure its legal validity, the form must be filled out correctly and submitted to the IRS along with your tax return. Failure to accurately report this information can lead to penalties or disallowed deductions, impacting your overall tax liability.

Who Issues the Form

The 1098 Instructions form is issued by mortgage lenders, including banks, credit unions, and other financial institutions. These lenders are obligated to provide this form to borrowers who have paid $600 or more in mortgage interest during the tax year. It is essential for borrowers to receive this form in a timely manner, as it contains critical information needed for tax preparation.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the 1098 Instructions form is crucial for compliance. Typically, lenders must send out the form to borrowers by January 31 of the following year. Borrowers should ensure they have received their form by this date to prepare their tax returns accurately. The deadline for filing your tax return, including the information from the 1098 form, is usually April 15, unless extended due to weekends or holidays.

Examples of using the 1098 Instructions Mortgage Interest Statement

Using the 1098 Instructions form can vary based on individual circumstances. For example, a homeowner who itemizes deductions on their tax return can use the information from the form to claim mortgage interest as a deduction. Conversely, a taxpayer who takes the standard deduction may not need to use the form in the same way. Understanding how to apply the information from the 1098 form based on your tax situation is essential for maximizing tax benefits.

Quick guide on how to complete 2019 instructions for form 1098 instructions for form 1098 mortgage interest statement

Complete 1098 Instructions Mortgage Interest Statement effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly without delays. Handle 1098 Instructions Mortgage Interest Statement on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign 1098 Instructions Mortgage Interest Statement without hassle

- Locate 1098 Instructions Mortgage Interest Statement and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive content with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet-ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign 1098 Instructions Mortgage Interest Statement and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 instructions for form 1098 instructions for form 1098 mortgage interest statement

How to make an electronic signature for your 2019 Instructions For Form 1098 Instructions For Form 1098 Mortgage Interest Statement online

How to make an electronic signature for your 2019 Instructions For Form 1098 Instructions For Form 1098 Mortgage Interest Statement in Google Chrome

How to generate an eSignature for signing the 2019 Instructions For Form 1098 Instructions For Form 1098 Mortgage Interest Statement in Gmail

How to create an electronic signature for the 2019 Instructions For Form 1098 Instructions For Form 1098 Mortgage Interest Statement straight from your mobile device

How to create an eSignature for the 2019 Instructions For Form 1098 Instructions For Form 1098 Mortgage Interest Statement on iOS devices

How to create an eSignature for the 2019 Instructions For Form 1098 Instructions For Form 1098 Mortgage Interest Statement on Android

People also ask

-

What is the IRS 1098 instructions form?

The IRS 1098 instructions form is a tax document used to report mortgage interest, student loan interest, or tuition payments. It's essential for taxpayers to accurately fill out this form to ensure compliance with IRS regulations and benefit from applicable tax deductions.

-

How can airSlate SignNow help with the IRS 1098 instructions form?

airSlate SignNow provides a user-friendly platform to electronically fill out and eSign your IRS 1098 instructions form. This streamlines the process, reduces paper usage, and ensures your forms are securely stored and easily accessible.

-

Is there a cost associated with using airSlate SignNow for the IRS 1098 instructions form?

Yes, airSlate SignNow offers several pricing plans to cater to different business needs. Each plan provides features that allow for creating and managing forms, including the IRS 1098 instructions form, while ensuring cost-efficiency.

-

What features does airSlate SignNow offer for managing the IRS 1098 instructions form?

airSlate SignNow includes features like document templates, eSigning, and secure storage specifically designed to simplify the process of managing the IRS 1098 instructions form. These tools help users to complete and submit their forms quickly and efficiently.

-

Can I integrate airSlate SignNow with other tools for the IRS 1098 instructions form?

Absolutely! airSlate SignNow integrates with various third-party applications, enhancing your workflow when working on the IRS 1098 instructions form. This allows you to automate processes and connect with tools you already use for accounting and document management.

-

What benefits can I expect from using airSlate SignNow for the IRS 1098 instructions form?

Using airSlate SignNow for the IRS 1098 instructions form offers increased efficiency and accuracy. With eSigning capabilities and easy document management, you can ensure your tax filings are completed swiftly while minimizing the risk of errors.

-

Is airSlate SignNow user-friendly for completing the IRS 1098 instructions form?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the IRS 1098 instructions form, regardless of technical skill. Its intuitive interface guides users through the process, ensuring clarity and simplicity.

Get more for 1098 Instructions Mortgage Interest Statement

Find out other 1098 Instructions Mortgage Interest Statement

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word