General Instructions for 1099 Form

What are the General Instructions for 1099?

The General Instructions for 1099 provide essential guidelines for individuals and businesses required to report various types of income to the Internal Revenue Service (IRS). These instructions outline the specific forms to use, the information to include, and the deadlines for submission. Understanding these guidelines is crucial for compliance and to avoid potential penalties.

How to Use the General Instructions for 1099

To effectively use the General Instructions for 1099, start by identifying the specific type of 1099 form applicable to your situation, such as 1099-MISC for miscellaneous income or 1099-INT for interest income. Review the instructions carefully to understand the reporting requirements, including what information is needed and how to fill out the form accurately. It's also important to familiarize yourself with the IRS guidelines regarding who must receive a 1099 form and the thresholds for reporting.

Steps to Complete the General Instructions for 1099

Completing the General Instructions for 1099 involves several key steps:

- Determine the correct 1099 form based on the type of income being reported.

- Gather necessary information, including payee details and amounts paid.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form to the IRS and provide copies to the recipients by the specified deadlines.

IRS Guidelines

IRS guidelines for the 1099 forms detail the requirements for reporting income, including specific thresholds that trigger the necessity of filing a 1099. For example, businesses must issue a 1099-MISC if they paid $600 or more to a non-employee for services. The IRS also provides information on electronic filing options and the use of third-party software to assist in completing and submitting these forms.

Filing Deadlines / Important Dates

Filing deadlines for 1099 forms vary depending on the type of form and the method of submission. Generally, forms must be sent to recipients by January thirty-first and filed with the IRS by February twenty-eighth if submitted on paper, or by March thirty-first if filed electronically. Staying aware of these deadlines is crucial to avoid late penalties and ensure compliance with IRS regulations.

Penalties for Non-Compliance

Failure to comply with the reporting requirements for 1099 forms can result in significant penalties. The IRS imposes fines for late filings, incorrect information, and failure to provide copies to recipients. Penalties can range from $50 to $550 per form, depending on how late the form is filed and whether the failure was intentional. Understanding these penalties emphasizes the importance of accurate and timely filing.

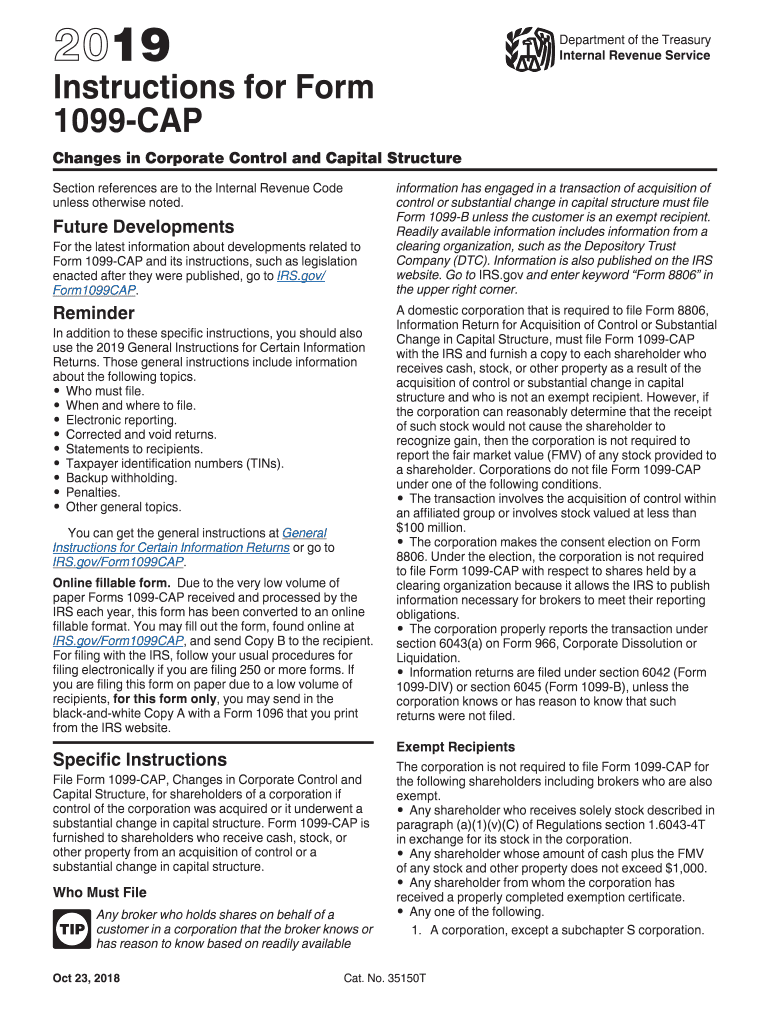

Quick guide on how to complete 2019 instructions for form 1099 cap instructions for form 1099 cap changes in corporate control and capital structure

Complete General Instructions For 1099 effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents quickly without any holdups. Handle General Instructions For 1099 on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to alter and eSign General Instructions For 1099 without any hassle

- Obtain General Instructions For 1099 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive details with tools designed by airSlate SignNow for this specific task.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any preferred device. Modify and eSign General Instructions For 1099 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 instructions for form 1099 cap instructions for form 1099 cap changes in corporate control and capital structure

How to create an electronic signature for your 2019 Instructions For Form 1099 Cap Instructions For Form 1099 Cap Changes In Corporate Control And Capital Structure in the online mode

How to make an eSignature for your 2019 Instructions For Form 1099 Cap Instructions For Form 1099 Cap Changes In Corporate Control And Capital Structure in Chrome

How to make an eSignature for signing the 2019 Instructions For Form 1099 Cap Instructions For Form 1099 Cap Changes In Corporate Control And Capital Structure in Gmail

How to create an eSignature for the 2019 Instructions For Form 1099 Cap Instructions For Form 1099 Cap Changes In Corporate Control And Capital Structure right from your mobile device

How to make an electronic signature for the 2019 Instructions For Form 1099 Cap Instructions For Form 1099 Cap Changes In Corporate Control And Capital Structure on iOS

How to create an electronic signature for the 2019 Instructions For Form 1099 Cap Instructions For Form 1099 Cap Changes In Corporate Control And Capital Structure on Android devices

People also ask

-

What is the 1099 cap in relation to airSlate SignNow?

The 1099 cap refers to the maximum amount that businesses can deduct for services from independent contractors in a tax year. With airSlate SignNow, you can easily manage 1099 forms and ensure compliance with IRS regulations by securely eSigning and storing these important documents.

-

How does airSlate SignNow help with 1099 forms?

AirSlate SignNow simplifies the process of creating, sending, and eSigning 1099 forms. Our platform allows you to quickly prepare these documents, ensuring that they are sent securely and can be signed electronically, which speeds up the tax filing process for both you and your contractors.

-

What is the pricing structure for airSlate SignNow when managing 1099 caps?

AirSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you’re a small business needing to manage a few 1099 forms or a larger corporation dealing with multiple contractors under the 1099 cap, our affordable plans provide the features you need without breaking the bank.

-

Is it easy to integrate airSlate SignNow with other accounting software for 1099 management?

Yes, airSlate SignNow offers seamless integrations with popular accounting software to facilitate your 1099 management process. By integrating with tools like QuickBooks and Xero, you can automatically sync your contractor information, making it simple to stay compliant within the 1099 cap.

-

What are the key benefits of using airSlate SignNow for 1099 forms?

Using airSlate SignNow for your 1099 forms presents numerous benefits, such as enhanced security, streamlined document workflows, and improved compliance with IRS regulations. Our easy-to-use platform ensures that you can manage and eSign 1099 forms efficiently, saving you time and effort.

-

Can airSlate SignNow assist with tracking 1099 forms throughout the tax season?

Absolutely! AirSlate SignNow provides tools that help you track the status of your 1099 forms throughout the tax season. With real-time updates and notifications, you can ensure that all documents are signed and submitted on time, helping you stay within the 1099 cap requirements.

-

What features should I look for in an eSigning solution for 1099 caps?

When choosing an eSigning solution for 1099 caps, look for features like document templates, secure storage, and comprehensive audit trails. airSlate SignNow offers all these features and more, allowing you to efficiently manage 1099 forms while maintaining high levels of security and compliance.

Get more for General Instructions For 1099

- Oregon museum grant program form

- Application for registered family child care home license form rf 266

- County property appraiser 1 oregon form

- Oregon court of appeals petition for judicial review form

- Oregon marine board bill of sale form

- Oregon petition for review administrative child support order form

- Collectoramp039s annual settlement missouri department of revenue form

- Provide all the numbers of the id this 555 55 555 777973295 form

Find out other General Instructions For 1099

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe