Modelo Sc 2644 Form

What is the Modelo SC 2644?

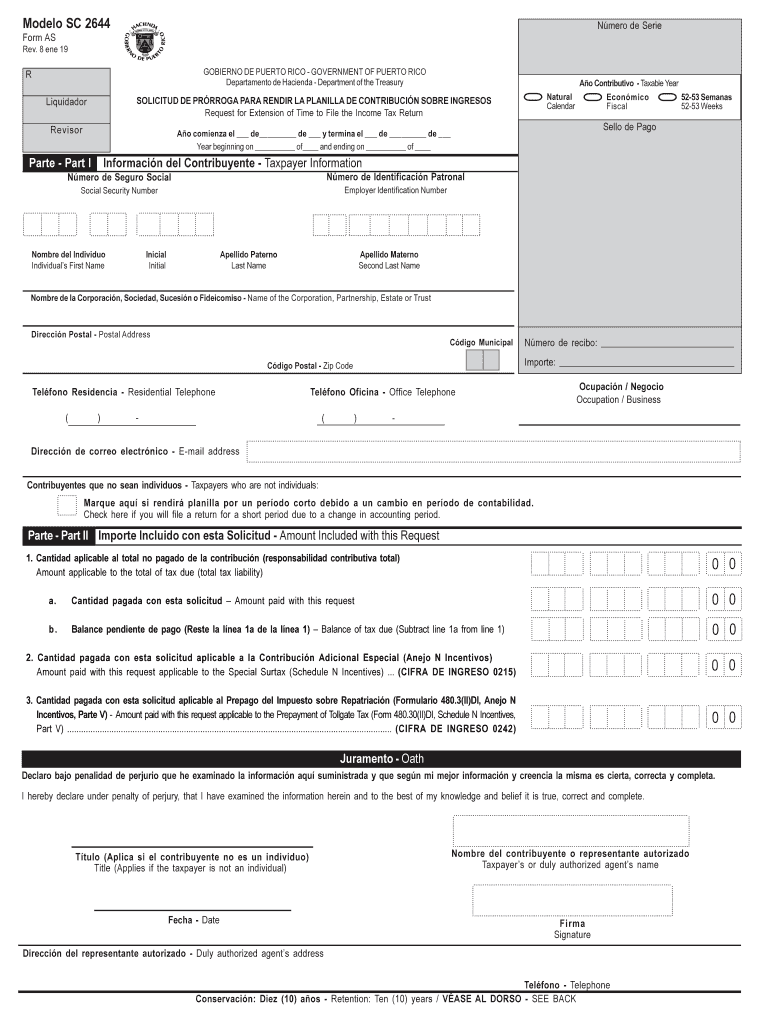

The Modelo SC 2644 is a tax form used in Puerto Rico for reporting income and calculating tax obligations. This form is essential for individuals and businesses to ensure compliance with local tax laws. It serves as a declaration of income and allows taxpayers to claim deductions, credits, and other tax benefits applicable under Puerto Rican tax regulations. Understanding the purpose and requirements of the Modelo SC 2644 is crucial for accurate tax reporting.

Steps to Complete the Modelo SC 2644

Completing the Modelo SC 2644 requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents, including income statements, previous tax returns, and any applicable deduction records.

- Begin filling out the form by entering personal information, such as name, address, and taxpayer identification number.

- Report all sources of income, ensuring that each source is accurately documented.

- Claim any deductions and credits you are eligible for, following the guidelines provided in the instructions.

- Review the completed form for accuracy and completeness before submission.

Legal Use of the Modelo SC 2644

The Modelo SC 2644 is legally binding when filled out correctly and submitted within the designated time frame. To ensure its legal validity, taxpayers must adhere to the guidelines set forth by the Puerto Rico Department of Treasury. This includes providing accurate information, signing the form where required, and maintaining compliance with all relevant tax laws. Electronic submissions are also accepted, provided they meet the legal requirements for eSignatures.

How to Obtain the Modelo SC 2644

Taxpayers can obtain the Modelo SC 2644 from various sources. The form is available on the official website of the Puerto Rico Department of Treasury. Additionally, it can be accessed through tax preparation software that supports Puerto Rican tax forms. For those who prefer physical copies, local tax offices may also provide printed versions of the form. Ensuring you have the most current version is important for compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Modelo SC 2644 are crucial for avoiding penalties. Typically, the deadline aligns with the federal tax filing dates, but it can vary based on specific circumstances. Taxpayers should be aware of any extensions or changes announced by the Puerto Rico Department of Treasury. Keeping a calendar of important dates, including submission deadlines and payment due dates, can help ensure timely compliance.

Required Documents

When completing the Modelo SC 2644, certain documents are necessary to support the information provided. These may include:

- W-2 forms or 1099 forms for reporting income.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

- Documentation for any tax credits claimed.

Having these documents ready will facilitate a smoother filing process and help ensure accuracy.

Quick guide on how to complete ao contributivo taxable year

Prepare Modelo Sc 2644 seamlessly on any gadget

Digital document administration has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious alternative to conventional printed and signed forms, allowing you to locate the necessary document and securely keep it online. airSlate SignNow equips you with all the tools required to generate, alter, and electronically sign your documents promptly without hold-ups. Manage Modelo Sc 2644 across any platform with airSlate SignNow's Android or iOS applications and streamline any document-centric workflow today.

The simplest way to modify and eSign Modelo Sc 2644 effortlessly

- Obtain Modelo Sc 2644 and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this task.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to send your form – via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, monotonous form searching, or mistakes that necessitate printing out new document versions. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Modify and eSign Modelo Sc 2644 and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ao contributivo taxable year

How to make an electronic signature for your Ao Contributivo Taxable Year in the online mode

How to make an eSignature for the Ao Contributivo Taxable Year in Google Chrome

How to make an eSignature for signing the Ao Contributivo Taxable Year in Gmail

How to make an electronic signature for the Ao Contributivo Taxable Year right from your mobile device

How to create an eSignature for the Ao Contributivo Taxable Year on iOS

How to generate an eSignature for the Ao Contributivo Taxable Year on Android devices

People also ask

-

What is the Puerto Rico modelo offered by airSlate SignNow?

The Puerto Rico modelo in airSlate SignNow refers to our tailored eSignature solution designed specifically for businesses operating in Puerto Rico. It allows users to send and sign documents electronically, making the process faster and more efficient. This model ensures compliance with local regulations and provides an intuitive user experience.

-

How much does the Puerto Rico modelo cost?

The pricing for the Puerto Rico modelo varies based on the features and the number of users. airSlate SignNow offers competitive rates to suit businesses of all sizes, ensuring a cost-effective solution. For detailed pricing, you can visit our website or contact our sales team.

-

What features does the Puerto Rico modelo include?

The Puerto Rico modelo includes features such as customizable templates, advanced security options, and integration capabilities with popular software. Users can also benefit from tracking document status in real-time and using mobile-friendly interfaces for on-the-go signing. These robust features streamline your document management process.

-

How can the Puerto Rico modelo benefit my business?

Implementing the Puerto Rico modelo can signNowly enhance your business operations by reducing paperwork and accelerating document turnaround times. With eSigning capabilities, you can expedite contract negotiations and approvals, thus improving overall productivity. Furthermore, it helps in maintaining compliance with local laws, which is crucial for business continuity.

-

What integrations are available with the Puerto Rico modelo?

The Puerto Rico modelo offers seamless integrations with a variety of popular applications, including CRM systems, project management tools, and cloud storage services. This interoperability ensures that your team can work efficiently across different platforms without losing context or accessibility. You can easily integrate airSlate SignNow with tools you already use.

-

Is the Puerto Rico modelo secure for sensitive documents?

Yes, security is a top priority for the Puerto Rico modelo. airSlate SignNow utilizes industry-standard encryption protocols to protect your sensitive documents throughout the signing process. Additionally, it includes features like audit trails and two-factor authentication to enhance security and compliance.

-

Can I customize the documents in the Puerto Rico modelo?

Absolutely, the Puerto Rico modelo allows users to customize documents extensively. Businesses can create templates specific to their needs, including branding elements like logos and personalized messaging. This feature helps maintain a professional appearance while ensuring consistency across all your documents.

Get more for Modelo Sc 2644

- Civil service exam announcementstown of colonie form

- Download bemployee physical formb nurse connection staffing inc

- Form sw4 1 nys

- New york task force 2 form

- Unpaid wage claim form industrial commission of arizona

- Pre job briefing new construction application information form csu

- Reimbursement of travel expense bwc state oh form

- Employee fmla leave request form

Find out other Modelo Sc 2644

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template