Mw506ae Form

What is the Mw506ae

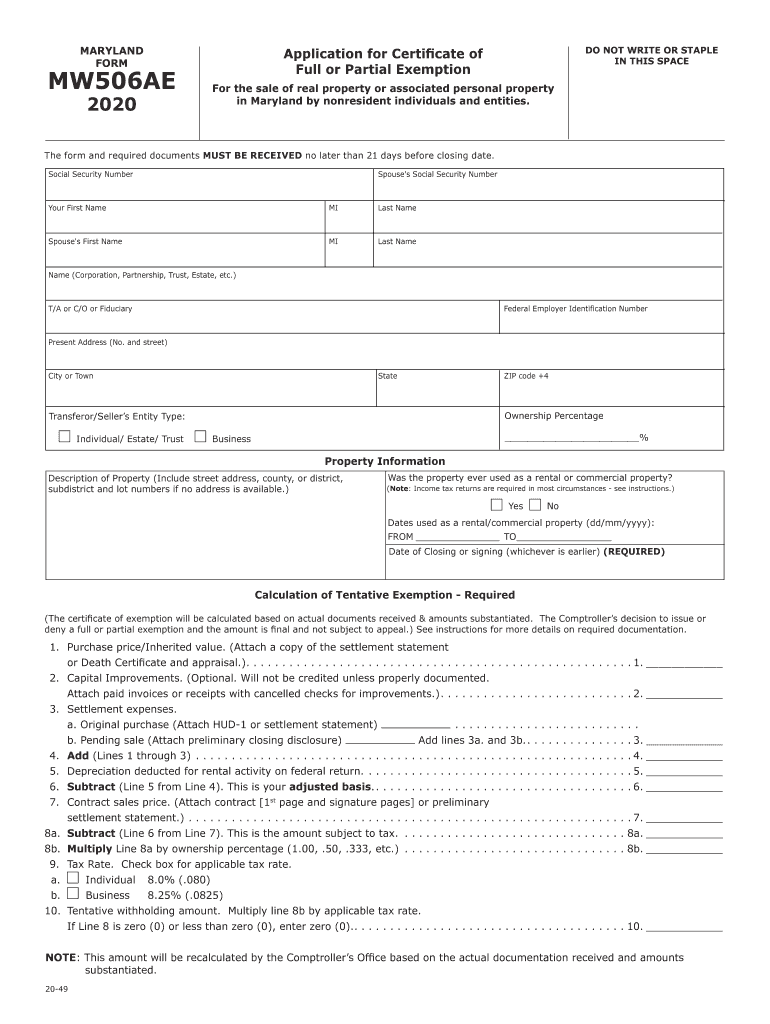

The state of Maryland form MW506AE is a tax document used primarily for reporting income tax withheld from non-resident employees. This form is essential for employers who need to comply with Maryland tax regulations when paying employees who do not reside in the state. The MW506AE helps ensure that the correct amount of state tax is withheld and reported to the Maryland Comptroller's office. This form is particularly relevant for businesses that operate across state lines and employ individuals who may not be subject to Maryland tax laws as residents.

How to use the Mw506ae

Using the MW506AE involves several steps to ensure accurate completion and compliance with state tax laws. Employers must first gather the necessary information about their non-resident employees, including their earnings and the amount of tax to be withheld. Once this data is collected, the employer can fill out the MW506AE form, detailing the employee's information and the withheld amounts. After completing the form, it must be submitted to the Maryland Comptroller's office, either electronically or via mail, depending on the employer's preference and the state's guidelines.

Steps to complete the Mw506ae

Completing the MW506AE requires careful attention to detail. Follow these steps for accurate submission:

- Gather employee information, including name, address, and Social Security number.

- Determine the total amount of wages paid to the non-resident employee during the tax period.

- Calculate the appropriate state tax withholding based on Maryland's tax rates.

- Fill out the MW506AE form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the Maryland Comptroller's office by the specified deadline.

Legal use of the Mw506ae

The MW506AE serves a critical legal function in ensuring compliance with Maryland's tax laws. When filled out correctly, it provides a legal record of the income tax withheld from non-resident employees. This form must be submitted in accordance with the deadlines set by the state to avoid penalties. Employers are legally obligated to withhold the correct amount of tax and report it accurately, making the MW506AE an essential part of their tax compliance strategy.

Filing Deadlines / Important Dates

Filing deadlines for the MW506AE are crucial for employers to avoid penalties. The form must typically be submitted by the last day of the month following the end of the quarter in which the wages were paid. For example, if wages are paid in the first quarter, the MW506AE should be filed by April 30. It is essential for employers to keep track of these deadlines to ensure timely compliance with Maryland tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The MW506AE can be submitted through various methods, providing flexibility for employers. Options include:

- Online Submission: Employers can file the MW506AE electronically through the Maryland Comptroller's online portal, which is often the quickest method.

- Mail Submission: The completed form can be printed and mailed to the Maryland Comptroller's office. Ensure to use the correct mailing address and allow sufficient time for delivery.

- In-Person Submission: Employers may also choose to deliver the form in person at designated Comptroller offices, which can be useful for resolving any immediate questions or concerns.

Quick guide on how to complete name corporation partnership trust estate etc

Complete Mw506ae effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without interruptions. Handle Mw506ae on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest method to edit and eSign Mw506ae seamlessly

- Obtain Mw506ae and click on Get Form to commence.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with features specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and eSign Mw506ae and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the name corporation partnership trust estate etc

How to create an electronic signature for the Name Corporation Partnership Trust Estate Etc online

How to make an eSignature for your Name Corporation Partnership Trust Estate Etc in Google Chrome

How to make an electronic signature for putting it on the Name Corporation Partnership Trust Estate Etc in Gmail

How to generate an electronic signature for the Name Corporation Partnership Trust Estate Etc from your smartphone

How to create an electronic signature for the Name Corporation Partnership Trust Estate Etc on iOS devices

How to make an eSignature for the Name Corporation Partnership Trust Estate Etc on Android

People also ask

-

What is the state of Maryland form mw506ae?

The state of Maryland form mw506ae is a tax form specifically designed for annual withholding reconciliation. It allows businesses to report the income tax withheld from employees throughout the year. This form is essential for ensuring compliance with state tax regulations.

-

How can airSlate SignNow help with the state of Maryland form mw506ae?

AirSlate SignNow streamlines the process of filling out and submitting the state of Maryland form mw506ae by offering easy-to-use electronic signatures and document management features. With our platform, you can securely send, eSign, and store this form, saving you time and reducing errors. This ensures your business stays compliant without unnecessary hassle.

-

Is there a cost associated with using airSlate SignNow for the state of Maryland form mw506ae?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. Our pricing plans are transparent and vary based on features and usage. Investing in airSlate SignNow can ultimately save you money by minimizing administrative errors and improving operational efficiency.

-

Can I integrate airSlate SignNow with other software for my state of Maryland form mw506ae?

Absolutely! AirSlate SignNow offers seamless integrations with various software and applications, enhancing your workflow for managing the state of Maryland form mw506ae. Whether you're using CRM systems, cloud storage services, or accounting software, our platform easily connects to help streamline your processes.

-

What security features does airSlate SignNow offer for the state of Maryland form mw506ae?

AirSlate SignNow prioritizes the security of your documents, including the state of Maryland form mw506ae. We use robust encryption protocols, secure data storage, and compliance with industry standards to protect sensitive information. You can trust that your documents are safe when using our eSigning platform.

-

How does eSigning the state of Maryland form mw506ae work with airSlate SignNow?

eSigning the state of Maryland form mw506ae with airSlate SignNow is simple and efficient. After uploading the form, you can easily add signatures for all required parties and customize the signing order. Once completed, the signed document is securely stored and can be shared with relevant stakeholders.

-

What benefits does airSlate SignNow provide for businesses handling the state of Maryland form mw506ae?

Using airSlate SignNow for the state of Maryland form mw506ae provides numerous benefits, including increased efficiency, reduced paper usage, and improved compliance. Our platform allows for fast turnaround times and easy tracking of document status, helping businesses manage their tax documentation more effectively.

Get more for Mw506ae

Find out other Mw506ae

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word