1099 G Form

What is the 1099 G Form

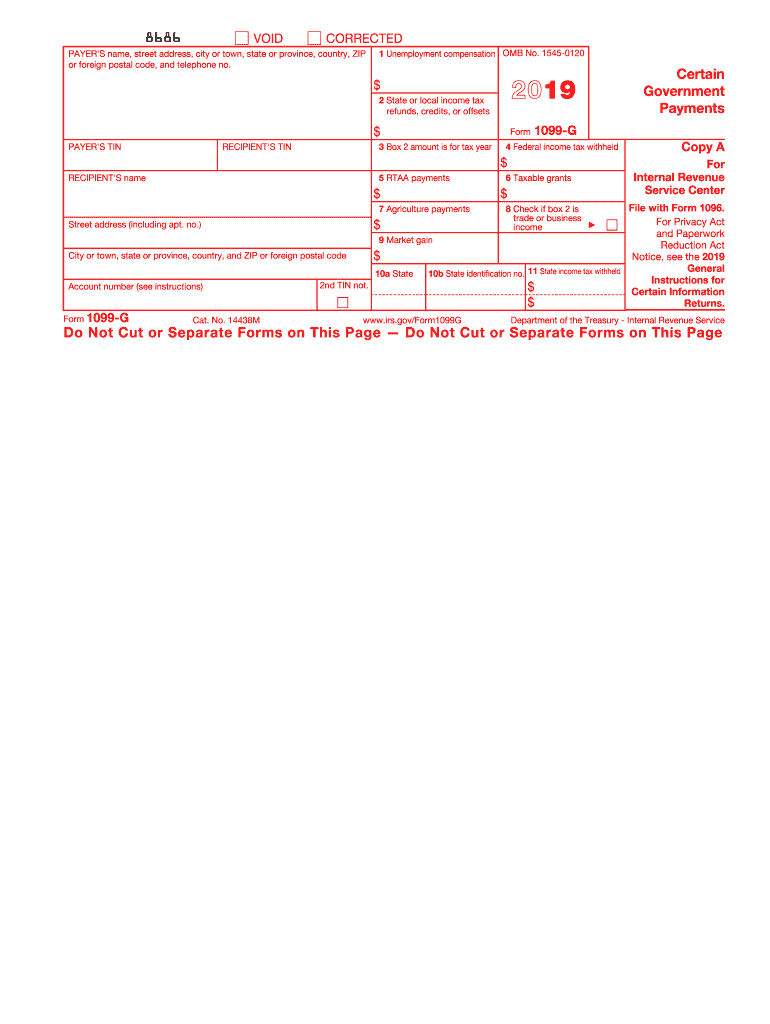

The 2 G form is a tax document used in the United States to report certain types of government payments. This form is typically issued by state and local governments to individuals who have received unemployment compensation, state tax refunds, or other government payments. The information reported on the 1099 G is essential for taxpayers as it helps them accurately report their income when filing their federal tax returns.

How to use the 1099 G Form

Using the 2 G form involves several key steps. First, ensure you receive the form from the relevant government agency if you have received any applicable payments. Next, review the information on the form for accuracy, including your name, Social Security number, and the amounts reported. When filing your taxes, include the amounts from the 1099 G on your tax return, as this income must be reported to the IRS. Proper use of this form helps prevent discrepancies that could lead to audits or penalties.

Steps to complete the 1099 G Form

Completing the 2 G form requires careful attention to detail. Start by entering your personal information, including your name and address. Next, fill in the amounts received in the appropriate boxes, such as unemployment compensation or state tax refunds. Be sure to check the form for any specific instructions related to your state or the type of payment received. After completing the form, keep a copy for your records and submit it as required, either to the IRS or your state tax agency.

Legal use of the 1099 G Form

The legal use of the 2 G form is crucial for compliance with tax regulations. This form must be accurately filled out and submitted to ensure that all reported income is accounted for. Failure to report income from the 1099 G can lead to penalties, including fines and interest on unpaid taxes. It is essential to understand the legal obligations associated with this form and to maintain accurate records in case of an audit by the IRS or state tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the 2 G form are important to adhere to in order to avoid penalties. Typically, the form must be issued to recipients by January thirty-first of the year following the tax year. Additionally, the IRS requires that copies of the 1099 G be filed by the end of February if submitting by mail, or by the end of March if filing electronically. Keeping track of these deadlines ensures compliance and helps prevent any issues with tax filings.

Who Issues the Form

The 2 G form is usually issued by state and local government agencies. These agencies are responsible for reporting payments made to individuals, such as unemployment benefits or tax refunds. It is important for recipients to ensure they receive this form from the correct issuing agency to accurately report their income on their tax returns.

Quick guide on how to complete notice see the 2019

Complete 1099 G Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage 1099 G Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign 1099 G Form with ease

- Locate 1099 G Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you want to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate issues with lost or mislaid documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device you prefer. Modify and eSign 1099 G Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the notice see the 2019

How to make an electronic signature for the Notice See The 2019 online

How to create an electronic signature for the Notice See The 2019 in Chrome

How to make an electronic signature for signing the Notice See The 2019 in Gmail

How to make an eSignature for the Notice See The 2019 straight from your mobile device

How to create an electronic signature for the Notice See The 2019 on iOS

How to make an electronic signature for the Notice See The 2019 on Android OS

People also ask

-

What is the 2019 1099 g form used for?

The 2019 1099 g form is used to report certain government payments, such as unemployment compensation and state tax refunds. This form is essential for individuals who received these payments, as it details the amounts that must be reported on their tax returns.

-

How can I access the 2019 1099 g form using airSlate SignNow?

You can easily access the 2019 1099 g form through airSlate SignNow by utilizing our document management features. Simply upload the form or create it using our templates, and then you can eSign and send it securely to recipients.

-

Is the 2019 1099 g form expensive to process with airSlate SignNow?

No, the processing of the 2019 1099 g form with airSlate SignNow is cost-effective. Our pricing plans are designed to accommodate businesses of all sizes, ensuring that you can manage your documents without breaking the bank.

-

What features does airSlate SignNow offer for managing the 2019 1099 g form?

airSlate SignNow offers various features for managing the 2019 1099 g form, including eSigning, document tracking, and customizable templates. These features simplify the document workflow and enhance efficiency in handling tax documents.

-

Can I integrate airSlate SignNow with other tools for the 2019 1099 g form?

Yes, airSlate SignNow can be integrated with various tools and applications, making it easy to manage the 2019 1099 g form alongside your existing systems. This integration helps streamline the process and improves overall productivity.

-

What are the benefits of using airSlate SignNow for the 2019 1099 g form?

Using airSlate SignNow for the 2019 1099 g form offers several benefits, including quick and secure eSigning, document management, and an intuitive user interface. These advantages help you complete your tax documentation swiftly and accurately.

-

How secure is my information when sending the 2019 1099 g form with airSlate SignNow?

Your information is highly secure when sending the 2019 1099 g form with airSlate SignNow. Our platform employs robust encryption and security measures to protect your sensitive data during transmission and storage.

Get more for 1099 G Form

- Utilizaci n de formatos abiertos en la difusi n de informaci n uoc

- This notice is for those who did not homeschool in maine during the previous school year maine form

- Game developer contract template form

- Garbage collection contract template form

- Garden contract template form

- Garden maintenance contract template form

- Garden service contract template form

- Gardener contract template form

Find out other 1099 G Form

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy