Log in Oklahoma Taxpayer Access Point Form

Understanding the Oklahoma Taxpayer Access Point

The Oklahoma Taxpayer Access Point (OTAP) is a secure online portal that allows taxpayers to manage their tax-related activities efficiently. Users can access various services, including filing state tax forms, checking the status of their tax returns, and making payments. This platform is designed to streamline the process for individuals and businesses alike, ensuring that all necessary forms, including Oklahoma tax commission forms, are easily accessible.

How to Access the Oklahoma Taxpayer Access Point

To access the Oklahoma Taxpayer Access Point, users must first visit the official OTAP website. Once there, you will find a login section where you can enter your credentials. If you are a new user, you will need to create an account by providing personal information such as your Social Security number, date of birth, and other identifying details. This step is crucial for establishing a secure connection to your tax information.

Steps to Complete Your Tax Forms Using OTAP

Filing your Oklahoma tax forms through the Oklahoma Taxpayer Access Point involves several straightforward steps:

- Log in to your OTAP account using your username and password.

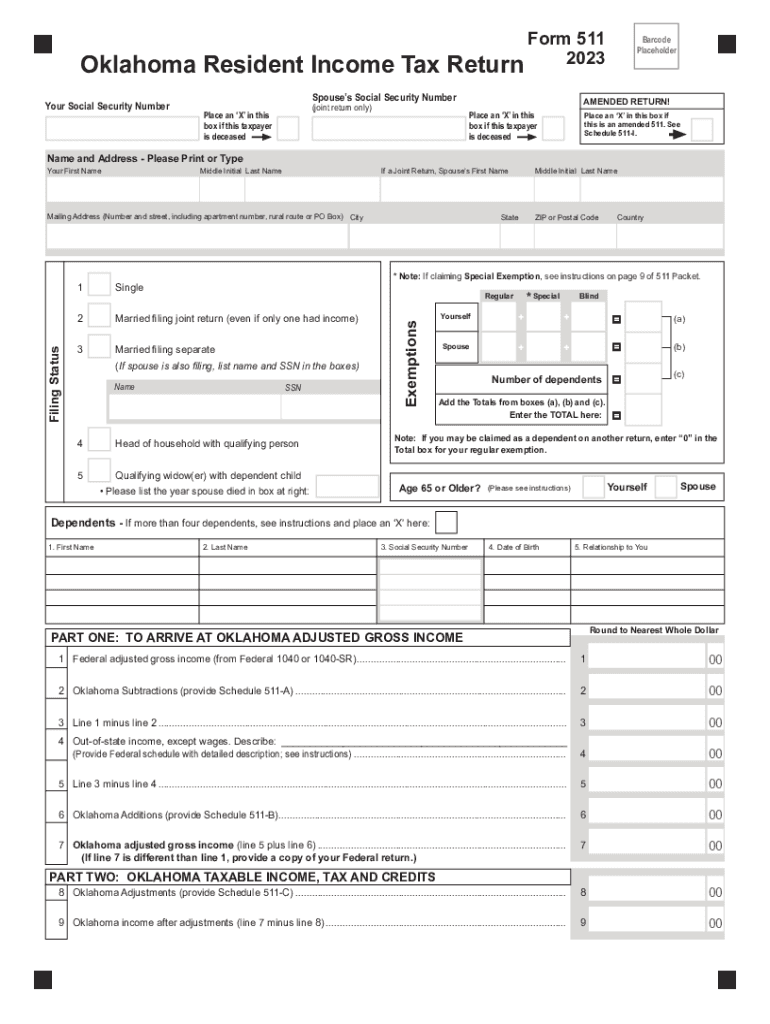

- Select the appropriate form you need to complete, such as the Oklahoma resident income tax return form or the Oklahoma tax return form 511.

- Fill out the required fields accurately, ensuring all information matches your financial records.

- Review your completed form for any errors or omissions.

- Submit your form electronically through the portal, or choose to print it for mailing if preferred.

Required Documents for Filing

When preparing to file your Oklahoma tax forms, it is essential to gather all necessary documents. Commonly required documents include:

- Your W-2 forms from employers, which report your annual wages.

- Any 1099 forms if you received income from freelance work or other sources.

- Documentation for deductions, such as mortgage interest statements or charitable contributions.

- Previous year’s tax return for reference.

Form Submission Methods

Oklahoma tax commission forms can be submitted through various methods. The most efficient way is via the Oklahoma Taxpayer Access Point, where you can file electronically. Alternatively, you can print your completed forms and mail them to the appropriate address. In-person submissions are also accepted at designated tax offices, providing flexibility based on your preference.

Key Elements of Compliance

Ensuring compliance with Oklahoma tax regulations is vital to avoid penalties. Key elements include:

- Filing your tax forms by the designated deadlines to prevent late fees.

- Providing accurate and complete information on your forms to avoid discrepancies.

- Keeping records of all submitted forms and correspondence for future reference.

Quick guide on how to complete log in oklahoma taxpayer access point

Accomplish Log In Oklahoma Taxpayer Access Point with ease on any gadget

Digital document management has gained traction among companies and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the proper format and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Log In Oklahoma Taxpayer Access Point on any gadget with the airSlate SignNow Android or iOS applications, and simplify any document-driven procedure today.

How to modify and eSign Log In Oklahoma Taxpayer Access Point effortlessly

- Obtain Log In Oklahoma Taxpayer Access Point and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Alter and eSign Log In Oklahoma Taxpayer Access Point and ensure excellent communication at any point in the document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the log in oklahoma taxpayer access point

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Oklahoma tax commission forms?

Oklahoma tax commission forms are official documents required for various tax-related processes in the state of Oklahoma. These forms are essential for filing taxes, claiming deductions, and ensuring compliance with state tax laws. Using airSlate SignNow, you can easily manage and eSign these forms to streamline your tax filing process.

-

How can airSlate SignNow help with Oklahoma tax commission forms?

airSlate SignNow provides a user-friendly platform to create, send, and eSign Oklahoma tax commission forms efficiently. Our solution simplifies the process by allowing you to fill out and sign forms electronically, reducing the time and effort needed for traditional paper-based methods. This ensures that your forms are submitted accurately and on time.

-

Are there any costs associated with using airSlate SignNow for Oklahoma tax commission forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, providing you with the tools necessary to manage Oklahoma tax commission forms without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing Oklahoma tax commission forms?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for Oklahoma tax commission forms. These features enhance your workflow by ensuring that all necessary information is captured and that you can monitor the status of your forms in real-time. This makes the entire process more efficient.

-

Can I integrate airSlate SignNow with other software for Oklahoma tax commission forms?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to manage Oklahoma tax commission forms alongside your existing tools. This integration capability enhances your productivity by enabling you to work within your preferred systems while ensuring compliance with tax regulations.

-

Is airSlate SignNow secure for handling Oklahoma tax commission forms?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Oklahoma tax commission forms are handled with the utmost care. Our platform uses advanced encryption and security protocols to protect your sensitive information. You can trust that your documents are safe while using our eSigning solution.

-

How can I get started with airSlate SignNow for Oklahoma tax commission forms?

Getting started with airSlate SignNow is easy! Simply sign up for an account on our website, choose a pricing plan that suits your needs, and start creating and managing your Oklahoma tax commission forms. Our intuitive interface and helpful resources will guide you through the process.

Get more for Log In Oklahoma Taxpayer Access Point

- Landlord tenant lease co signer agreement iowa form

- Application for sublease iowa form

- Inventory and condition of leased premises for pre lease and post lease iowa form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out iowa form

- Property manager agreement iowa form

- Agreement for delayed or partial rent payments iowa form

- Tenants maintenance repair request form iowa

- Guaranty attachment to lease for guarantor or cosigner iowa form

Find out other Log In Oklahoma Taxpayer Access Point

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy