Sales Tax Vendor Liability Notice, Rules and Forms

Understanding the Oklahoma Sales Tax Exemption

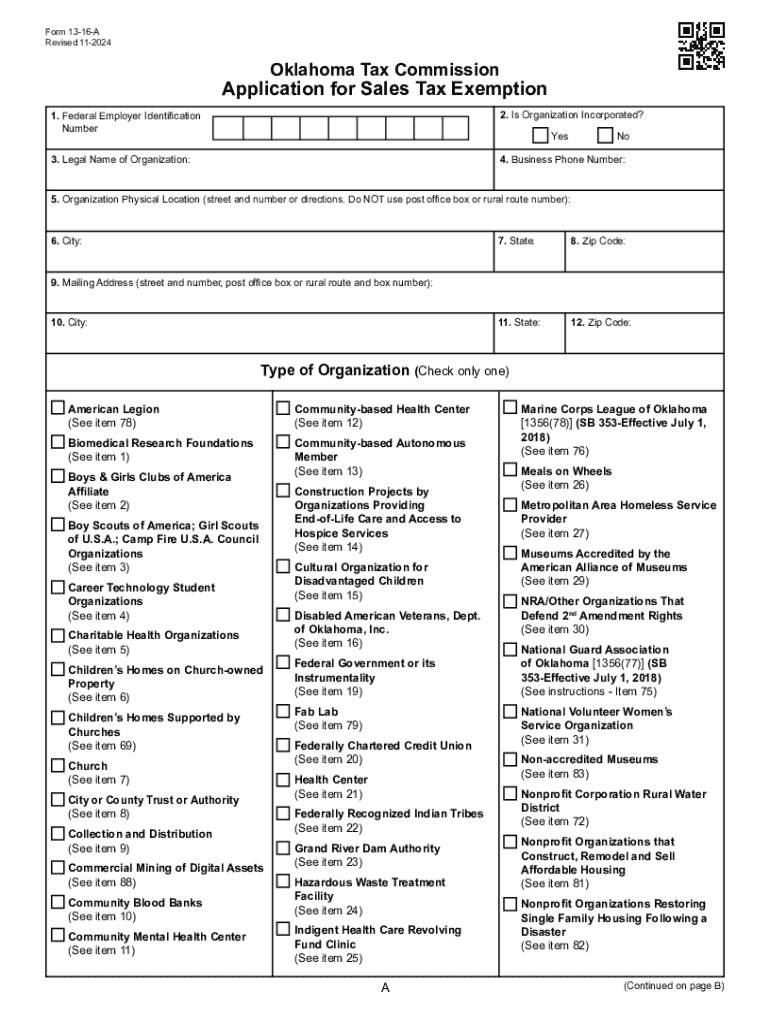

The Oklahoma sales tax exemption allows certain entities to purchase goods and services without paying sales tax. This exemption is typically available to non-profit organizations, governmental agencies, and specific types of businesses that meet eligibility criteria defined by the state. Understanding the rules surrounding this exemption is crucial for businesses and organizations looking to save on costs associated with sales tax.

Eligibility Criteria for Sales Tax Exemption

To qualify for the Oklahoma sales tax exemption, applicants must meet specific criteria. Generally, eligible entities include:

- Non-profit organizations recognized under 501(c)(3) of the Internal Revenue Code.

- Governmental entities, including state and local agencies.

- Certain educational institutions and religious organizations.

It is essential to review the detailed eligibility requirements to ensure compliance and avoid potential penalties.

Steps to Complete the Sales Tax Exemption Form

Filling out the Oklahoma sales tax exemption form involves several steps:

- Gather necessary documentation, including proof of eligibility, such as tax-exempt status letters.

- Complete the exemption form accurately, providing all required information.

- Submit the form to the appropriate state agency for approval.

Ensuring that all details are correct can expedite the approval process and help avoid delays.

Form Submission Methods

The completed Oklahoma sales tax exemption form can be submitted through various methods:

- Online submission via the Oklahoma Tax Commission website.

- Mailing the form to the designated office address.

- In-person submission at local tax offices.

Selecting the most convenient submission method can facilitate a smoother process.

Penalties for Non-Compliance

Failure to comply with the rules governing the Oklahoma sales tax exemption can result in significant penalties. These may include:

- Back taxes owed on purchases made without valid exemption.

- Fines imposed for incorrect or fraudulent use of the exemption.

Understanding these penalties emphasizes the importance of proper compliance when utilizing the sales tax exemption.

Key Elements of the Sales Tax Exemption Form

The Oklahoma sales tax exemption form includes several key elements that applicants must complete:

- Name and address of the entity applying for the exemption.

- Type of organization and its tax-exempt status.

- Details of the purchases for which the exemption is requested.

Providing accurate information in these sections is vital for the approval of the exemption request.

Quick guide on how to complete sales tax vendor liability notice rules and forms

Effortlessly prepare Sales Tax Vendor Liability Notice, Rules And Forms on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Sales Tax Vendor Liability Notice, Rules And Forms on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The easiest way to modify and eSign Sales Tax Vendor Liability Notice, Rules And Forms with minimal effort

- Obtain Sales Tax Vendor Liability Notice, Rules And Forms and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Decide how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Sales Tax Vendor Liability Notice, Rules And Forms and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales tax vendor liability notice rules and forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Oklahoma sales tax exemption PDF?

An Oklahoma sales tax exemption PDF is a document that allows eligible businesses and organizations to claim exemption from sales tax on certain purchases. This PDF form must be completed and submitted to vendors to avoid sales tax charges. Understanding how to properly fill out and use this document can save your business money.

-

How can airSlate SignNow help with Oklahoma sales tax exemption PDFs?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning Oklahoma sales tax exemption PDFs. With our user-friendly interface, you can easily manage your documents and ensure they are signed quickly. This streamlines the process and helps you maintain compliance with tax regulations.

-

Is there a cost associated with using airSlate SignNow for Oklahoma sales tax exemption PDFs?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our plans are designed to be cost-effective, allowing you to manage your Oklahoma sales tax exemption PDFs without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing tax exemption documents?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage for your Oklahoma sales tax exemption PDFs. These features enhance document management efficiency and ensure that your important files are easily accessible and organized.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax management software. This allows you to streamline your processes and manage your Oklahoma sales tax exemption PDFs alongside your other financial documents, enhancing overall productivity.

-

What are the benefits of using airSlate SignNow for eSigning tax exemption forms?

Using airSlate SignNow for eSigning Oklahoma sales tax exemption PDFs offers numerous benefits, including faster turnaround times and reduced paper usage. Our platform ensures that your documents are signed securely and stored safely, making it easier to track and manage your tax exemption forms.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your Oklahoma sales tax exemption PDFs. You can trust that your sensitive information is safe while using our platform, allowing you to focus on your business without worrying about data bsignNowes.

Get more for Sales Tax Vendor Liability Notice, Rules And Forms

- Interrogatories to defendant for motor vehicle accident oklahoma form

- Llc notices resolutions and other operations forms package oklahoma

- Notice of dishonored check criminal keywords bad check bounced check oklahoma form

- Mutual wills containing last will and testaments for man and woman living together not married with no children oklahoma form

- Mutual wills package of last wills and testaments for man and woman living together not married with adult children oklahoma form

- Mutual wills or last will and testaments for man and woman living together not married with minor children oklahoma form

- Non marital cohabitation living together agreement oklahoma form

- Bondsmen form

Find out other Sales Tax Vendor Liability Notice, Rules And Forms

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template