Delaware Form 1100 Corporate Income Tax Return

What is the Delaware Form 1100 Corporate Income Tax Return

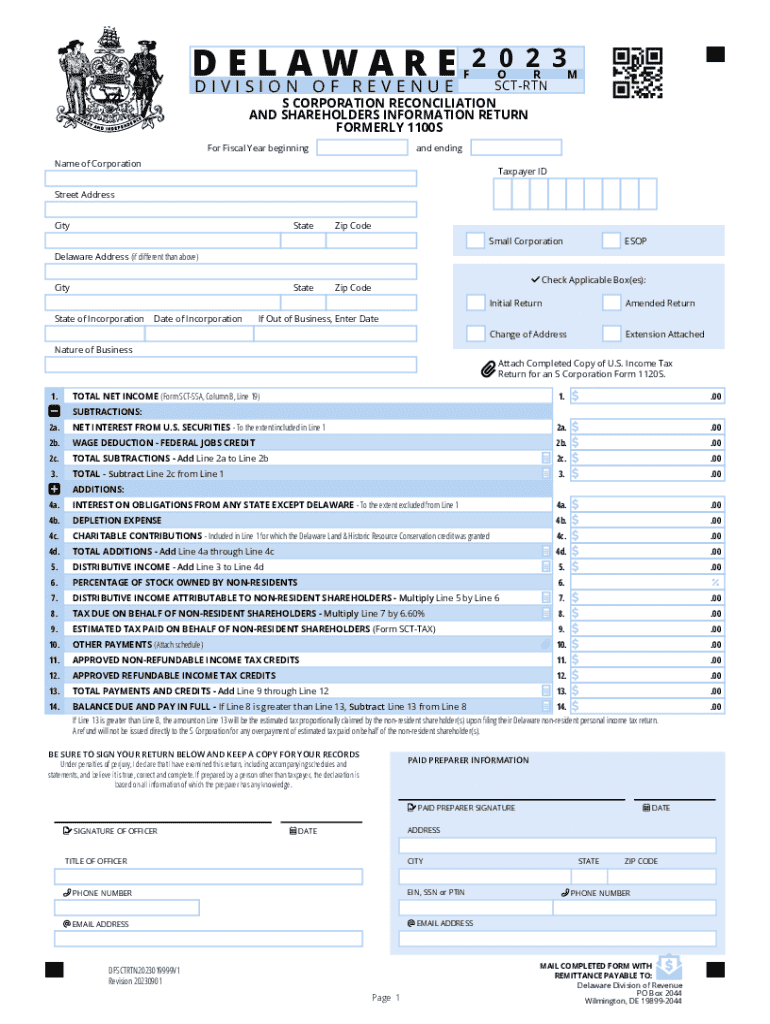

The Delaware Form 1100 is the Corporate Income Tax Return used by corporations operating in Delaware to report their income, calculate their tax liability, and fulfill their tax obligations. This form is essential for both domestic and foreign corporations doing business in the state. It ensures compliance with Delaware's tax laws and provides a framework for corporations to disclose their financial activities.

Steps to complete the Delaware Form 1100 Corporate Income Tax Return

Completing the Delaware Form 1100 involves several key steps:

- Gather necessary financial documents, including income statements and balance sheets.

- Calculate total income and allowable deductions according to Delaware tax regulations.

- Fill out the form accurately, ensuring all sections are completed, including income, deductions, and credits.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the designated deadline to avoid penalties.

Key elements of the Delaware Form 1100 Corporate Income Tax Return

Understanding the key elements of the Delaware Form 1100 is crucial for accurate filing. Important components include:

- Income Reporting: Corporations must report all income earned during the tax year.

- Deductions: Various deductions are available, including operating expenses and certain tax credits.

- Tax Rate: The applicable corporate tax rate must be applied to the taxable income.

- Signature: An authorized representative must sign the form to validate the submission.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing the Delaware Form 1100. The standard due date is typically the fifteenth day of the fourth month following the end of the tax year. For corporations on a calendar year, this means the form is due by April 15. Extensions may be available, but they must be requested in advance to avoid late filing penalties.

Form Submission Methods

The Delaware Form 1100 can be submitted through various methods to accommodate different preferences. Corporations can choose to file:

- Online: Using the Delaware Division of Revenue's online portal for electronic submission.

- By Mail: Sending a paper copy of the completed form to the appropriate tax office.

- In-Person: Delivering the form directly to the local tax office if preferred.

Penalties for Non-Compliance

Failure to comply with the filing requirements of the Delaware Form 1100 can result in significant penalties. These may include:

- Late Filing Penalties: A percentage of the unpaid tax may be assessed for each month the return is late.

- Interest Charges: Interest on any unpaid tax will accrue from the due date until payment is made.

- Potential Legal Action: Continued non-compliance may lead to further legal repercussions, including liens or levies.

Quick guide on how to complete delaware form 1100 corporate income tax return

Prepare Delaware Form 1100 Corporate Income Tax Return seamlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the proper form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without holdups. Manage Delaware Form 1100 Corporate Income Tax Return on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Delaware Form 1100 Corporate Income Tax Return effortlessly

- Find Delaware Form 1100 Corporate Income Tax Return and select Get Form to get started.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to submit your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Delaware Form 1100 Corporate Income Tax Return and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the delaware form 1100 corporate income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Delaware Form 1100S instructions?

The Delaware Form 1100S instructions provide detailed guidance on how to complete and file the form for S corporations in Delaware. This includes information on eligibility, required documentation, and deadlines to ensure compliance with state regulations.

-

How can airSlate SignNow help with Delaware Form 1100S?

airSlate SignNow simplifies the process of preparing and signing Delaware Form 1100S by providing an intuitive platform for document management. Users can easily upload, edit, and eSign their forms, ensuring a smooth filing experience.

-

Is there a cost associated with using airSlate SignNow for Delaware Form 1100S?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that streamline the completion of Delaware Form 1100S, making it a cost-effective solution for businesses.

-

What features does airSlate SignNow offer for managing Delaware Form 1100S?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time collaboration. These tools enhance the efficiency of completing Delaware Form 1100S and ensure that all necessary steps are followed.

-

Can I integrate airSlate SignNow with other software for Delaware Form 1100S?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing users to streamline their workflow when handling Delaware Form 1100S. This ensures that all relevant data is easily accessible and manageable.

-

What are the benefits of using airSlate SignNow for Delaware Form 1100S?

Using airSlate SignNow for Delaware Form 1100S provides numerous benefits, including time savings, enhanced accuracy, and improved compliance. The platform's user-friendly interface makes it easy for businesses to manage their forms efficiently.

-

How secure is airSlate SignNow when handling Delaware Form 1100S?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive information. This ensures that your Delaware Form 1100S and other documents are safe during the signing and filing process.

Get more for Delaware Form 1100 Corporate Income Tax Return

- Mutual wills package of last wills and testaments for man and woman living together not married with adult children oregon form

- Mutual wills or last will and testaments for man and woman living together not married with minor children oregon form

- Oregon cohabitation form

- Paternity law and procedure handbook oregon form

- Bill of sale in connection with sale of business by individual or corporate seller oregon form

- Injury illness workers or form

- Report job injury form

- Office lease agreement oregon form

Find out other Delaware Form 1100 Corporate Income Tax Return

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure