Schedule 2K 1 Beneficiary's Massachusetts Information

What is the Schedule 2K 1 Beneficiary's Massachusetts Information

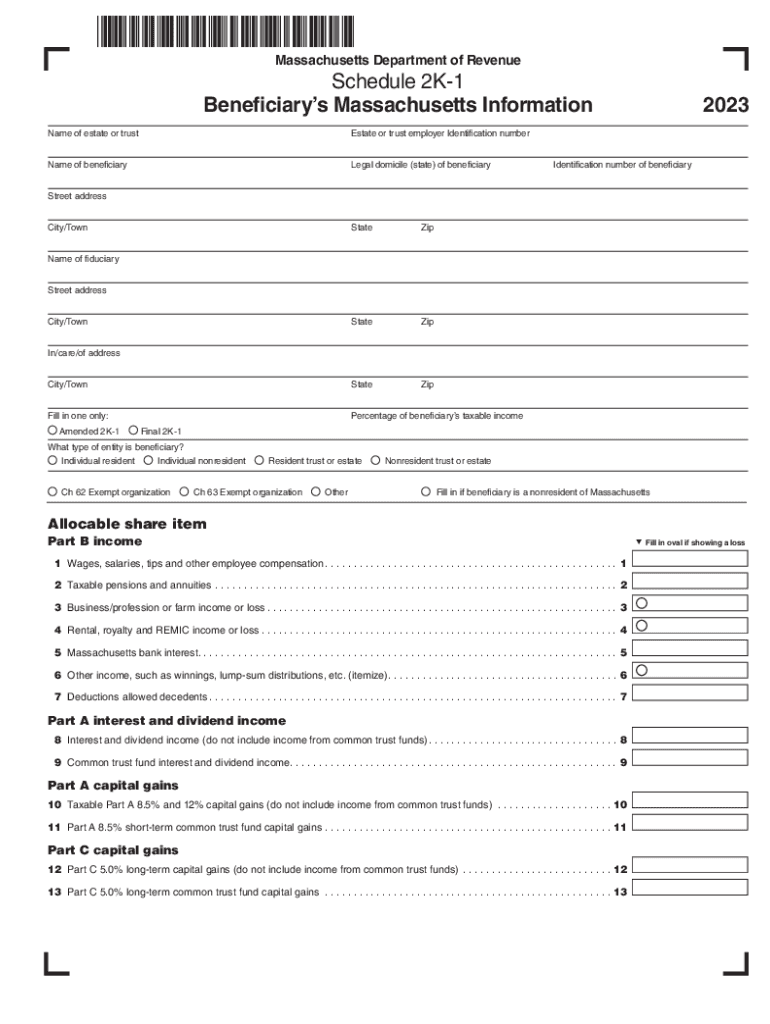

The Schedule 2K 1 Beneficiary's Massachusetts Information is a tax form used by beneficiaries of certain trusts and estates in Massachusetts. This form provides essential information regarding the income that beneficiaries receive from these entities. It is crucial for accurately reporting income on individual tax returns and ensuring compliance with state tax laws. The form includes details such as the beneficiary's share of income, deductions, and credits that may affect their tax liability.

How to use the Schedule 2K 1 Beneficiary's Massachusetts Information

To use the Schedule 2K 1 Beneficiary's Massachusetts Information, beneficiaries must first receive the completed form from the estate or trust. Once received, beneficiaries should carefully review the information provided, ensuring it accurately reflects their share of income and deductions. This information is then used to complete the individual Massachusetts tax return, specifically in the sections related to income and deductions. Accurate reporting is essential to avoid discrepancies with the Massachusetts Department of Revenue.

Steps to complete the Schedule 2K 1 Beneficiary's Massachusetts Information

Completing the Schedule 2K 1 Beneficiary's Massachusetts Information involves several steps:

- Obtain the form from the estate or trust administrator.

- Review the form for accuracy, checking all reported income and deductions.

- Transfer the relevant information to your Massachusetts tax return, ensuring it is placed in the correct sections.

- Keep a copy of the form for your records, as it may be needed for future reference or audits.

Legal use of the Schedule 2K 1 Beneficiary's Massachusetts Information

The Schedule 2K 1 Beneficiary's Massachusetts Information serves a legal purpose in the context of tax reporting. It is used to ensure that beneficiaries report their income accurately to the Massachusetts Department of Revenue. Failure to report income as indicated on this form can lead to penalties and interest on unpaid taxes. Therefore, understanding the legal implications of this form is vital for beneficiaries to remain compliant with state tax laws.

Key elements of the Schedule 2K 1 Beneficiary's Massachusetts Information

Key elements of the Schedule 2K 1 Beneficiary's Massachusetts Information include:

- Beneficiary's Name and Address: Identifies the individual receiving the income.

- Entity Information: Details about the trust or estate, including its name and identification number.

- Income Distribution: Specifies the types of income distributed to the beneficiary, such as dividends, interest, and capital gains.

- Deductions and Credits: Lists any deductions or credits that the beneficiary may claim on their tax return.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule 2K 1 Beneficiary's Massachusetts Information align with the general tax filing deadlines in Massachusetts. Typically, beneficiaries must ensure that the form is completed and submitted by April fifteenth of the following tax year. It is important to stay informed about any changes to deadlines, as they can vary based on specific circumstances or state announcements.

Quick guide on how to complete schedule 2k 1 beneficiarys massachusetts information

Complete Schedule 2K 1 Beneficiary's Massachusetts Information effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without any delays. Manage Schedule 2K 1 Beneficiary's Massachusetts Information on any platform using airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

The easiest way to edit and eSign Schedule 2K 1 Beneficiary's Massachusetts Information without breaking a sweat

- Locate Schedule 2K 1 Beneficiary's Massachusetts Information and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Schedule 2K 1 Beneficiary's Massachusetts Information to ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule 2k 1 beneficiarys massachusetts information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule 2K 1 Beneficiary's Massachusetts Information?

Schedule 2K 1 Beneficiary's Massachusetts Information is a tax form used to report income, deductions, and credits for beneficiaries of estates or trusts in Massachusetts. It provides essential details that beneficiaries need to accurately file their state tax returns. Understanding this form is crucial for compliance with Massachusetts tax laws.

-

How can airSlate SignNow help with Schedule 2K 1 Beneficiary's Massachusetts Information?

airSlate SignNow simplifies the process of sending and eSigning documents related to Schedule 2K 1 Beneficiary's Massachusetts Information. Our platform allows users to easily create, share, and sign necessary tax documents securely and efficiently. This streamlines the workflow for both tax professionals and beneficiaries.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including options for individuals and teams. Our pricing is designed to be cost-effective, ensuring that you can manage your Schedule 2K 1 Beneficiary's Massachusetts Information without breaking the bank. Visit our website for detailed pricing information and to find the plan that suits you best.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features for effective document management, including customizable templates, secure eSigning, and real-time tracking of document status. These features are particularly beneficial when handling Schedule 2K 1 Beneficiary's Massachusetts Information, ensuring that all documents are processed efficiently and securely.

-

Is airSlate SignNow compliant with Massachusetts tax regulations?

Yes, airSlate SignNow is designed to comply with various state regulations, including those related to Schedule 2K 1 Beneficiary's Massachusetts Information. Our platform ensures that all documents are handled in accordance with legal requirements, providing peace of mind for users managing sensitive tax information.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with popular tax preparation software, making it easier to manage your Schedule 2K 1 Beneficiary's Massachusetts Information alongside your other financial documents. This seamless integration enhances productivity and ensures that all your tax-related tasks are streamlined.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents, including Schedule 2K 1 Beneficiary's Massachusetts Information, offers numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick eSigning and document sharing, which can signNowly speed up the tax filing process for beneficiaries and tax professionals alike.

Get more for Schedule 2K 1 Beneficiary's Massachusetts Information

Find out other Schedule 2K 1 Beneficiary's Massachusetts Information

- Electronic signature Virginia Prenuptial Agreement Template Free

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer