MW506AE Application for Certificate of Full or Partial Exemption MW506AE Application for Certificate of Full or Partial Exemptio Form

What is the MW506AE Application?

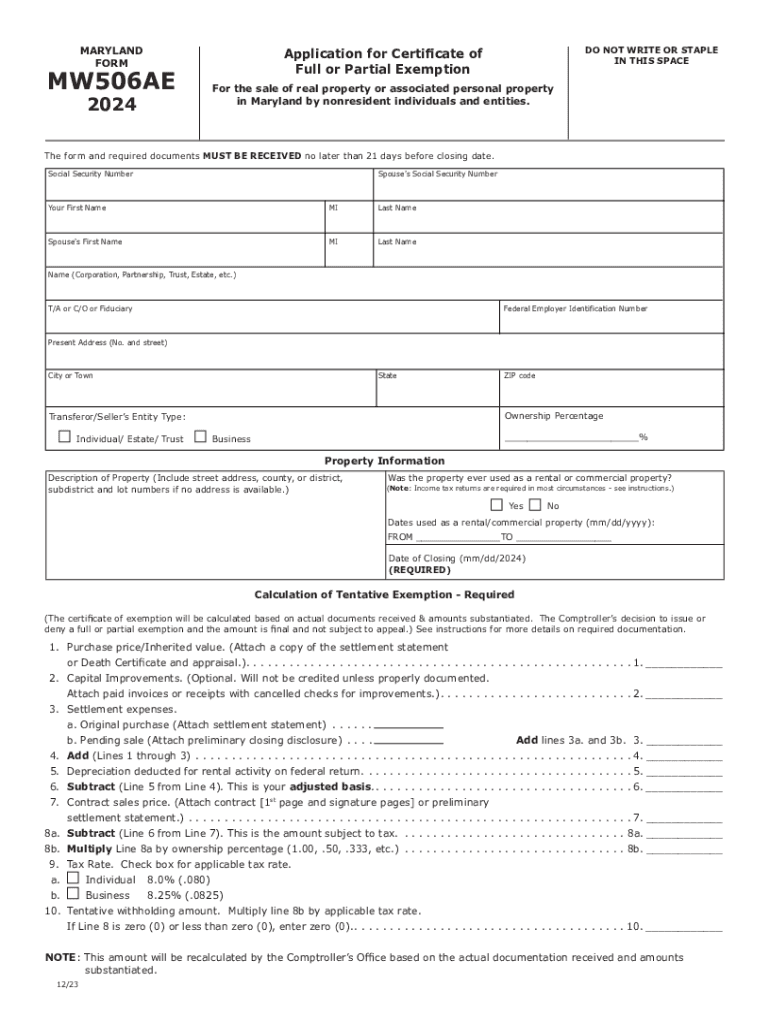

The MW506AE is an application form used in Maryland for obtaining a Certificate of Full or Partial Exemption from the withholding tax for non-resident sellers. This form is essential for individuals or businesses engaged in real estate transactions where withholding tax may apply. By submitting the MW506AE, applicants can request an exemption based on specific eligibility criteria, which can significantly reduce their tax burden during the sale of property.

Steps to Complete the MW506AE Application

Completing the MW506AE application involves several straightforward steps:

- Gather necessary information, including the seller's details, property information, and the reason for exemption.

- Fill out the form accurately, ensuring all required fields are completed.

- Attach any supporting documentation that may be necessary to substantiate the exemption request.

- Review the application for accuracy before submission to avoid delays.

Eligibility Criteria for the MW506AE Application

To qualify for the MW506AE application, applicants must meet specific eligibility criteria set forth by the Maryland State Department of Assessments and Taxation. Generally, these criteria include:

- Being a non-resident seller of real estate in Maryland.

- Providing valid reasons for requesting a withholding tax exemption.

- Meeting any additional requirements outlined in the Maryland tax regulations.

Required Documents for Submission

When submitting the MW506AE application, certain documents may be required to support the exemption request. These documents can include:

- Proof of non-residency, such as a driver's license or state ID from another state.

- Documentation related to the property being sold, including purchase agreements or deeds.

- Any prior correspondence with the Maryland tax authorities regarding withholding tax.

Form Submission Methods

The MW506AE application can be submitted through various methods, allowing flexibility for applicants. These methods include:

- Online submission through the Maryland State Department of Assessments and Taxation website.

- Mailing the completed form and supporting documents to the appropriate tax office.

- In-person submission at designated state offices for immediate processing.

Key Elements of the MW506AE Application

Understanding the key elements of the MW506AE application is crucial for a successful submission. Important components include:

- The seller's name and contact information.

- Details of the property transaction, including the address and sale price.

- Specific reasons for requesting an exemption, clearly articulated in the application.

Quick guide on how to complete mw506ae application for certificate of full or partial exemption mw506ae application for certificate of full or partial

Prepare MW506AE Application For Certificate Of Full Or Partial Exemption MW506AE Application For Certificate Of Full Or Partial Exemptio easily on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, edit, and eSign your documents swiftly without delays. Handle MW506AE Application For Certificate Of Full Or Partial Exemption MW506AE Application For Certificate Of Full Or Partial Exemptio on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to edit and eSign MW506AE Application For Certificate Of Full Or Partial Exemption MW506AE Application For Certificate Of Full Or Partial Exemptio effortlessly

- Find MW506AE Application For Certificate Of Full Or Partial Exemption MW506AE Application For Certificate Of Full Or Partial Exemptio and click Get Form to begin.

- Utilize the features we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and eSign MW506AE Application For Certificate Of Full Or Partial Exemption MW506AE Application For Certificate Of Full Or Partial Exemptio and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mw506ae application for certificate of full or partial exemption mw506ae application for certificate of full or partial

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the maryland mw506ae 2024 form and why is it important?

The maryland mw506ae 2024 form is a crucial document for Maryland taxpayers, specifically for those who need to report their income tax withholding. Completing this form accurately ensures compliance with state tax regulations and helps avoid penalties. Understanding its requirements can streamline your tax filing process.

-

How can airSlate SignNow assist with the maryland mw506ae 2024 form?

airSlate SignNow provides an efficient platform for electronically signing and sending the maryland mw506ae 2024 form. With its user-friendly interface, you can easily fill out, sign, and share the document securely. This simplifies the process and saves time, making tax season less stressful.

-

What are the pricing options for using airSlate SignNow for the maryland mw506ae 2024?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting from a basic plan to more advanced options. Each plan includes features that facilitate the signing and management of documents like the maryland mw506ae 2024. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the maryland mw506ae 2024?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage, all of which enhance the management of the maryland mw506ae 2024 form. These tools help ensure that your documents are organized and easily accessible. Additionally, you can automate reminders for signers to expedite the process.

-

Are there any integrations available with airSlate SignNow for the maryland mw506ae 2024?

Yes, airSlate SignNow integrates seamlessly with various applications, including CRM systems and cloud storage services. This allows you to streamline your workflow when handling the maryland mw506ae 2024 form. By connecting your existing tools, you can enhance productivity and ensure a smooth document management experience.

-

What are the benefits of using airSlate SignNow for the maryland mw506ae 2024?

Using airSlate SignNow for the maryland mw506ae 2024 offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick electronic signatures, which can signNowly speed up the submission process. Additionally, your documents are stored securely, ensuring compliance and peace of mind.

-

Is airSlate SignNow compliant with Maryland state regulations for the maryland mw506ae 2024?

Yes, airSlate SignNow is designed to comply with Maryland state regulations, ensuring that your use of the maryland mw506ae 2024 form meets legal requirements. The platform employs industry-standard security measures to protect your data. This compliance helps you avoid potential legal issues while managing your tax documents.

Get more for MW506AE Application For Certificate Of Full Or Partial Exemption MW506AE Application For Certificate Of Full Or Partial Exemptio

- Affidavit lien mechanics form

- Quitclaim deed from individual to husband and wife texas form

- Warranty deed from individual to husband and wife texas form

- Enhanced life estate or lady bird quitclaim deed individual to individual texas form

- Lady bird deed 497327228 form

- Executors deed of distribution individual executor to individual beneficiary texas form

- Texas homestead form

- Quitclaim deed from corporation to husband and wife texas form

Find out other MW506AE Application For Certificate Of Full Or Partial Exemption MW506AE Application For Certificate Of Full Or Partial Exemptio

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word