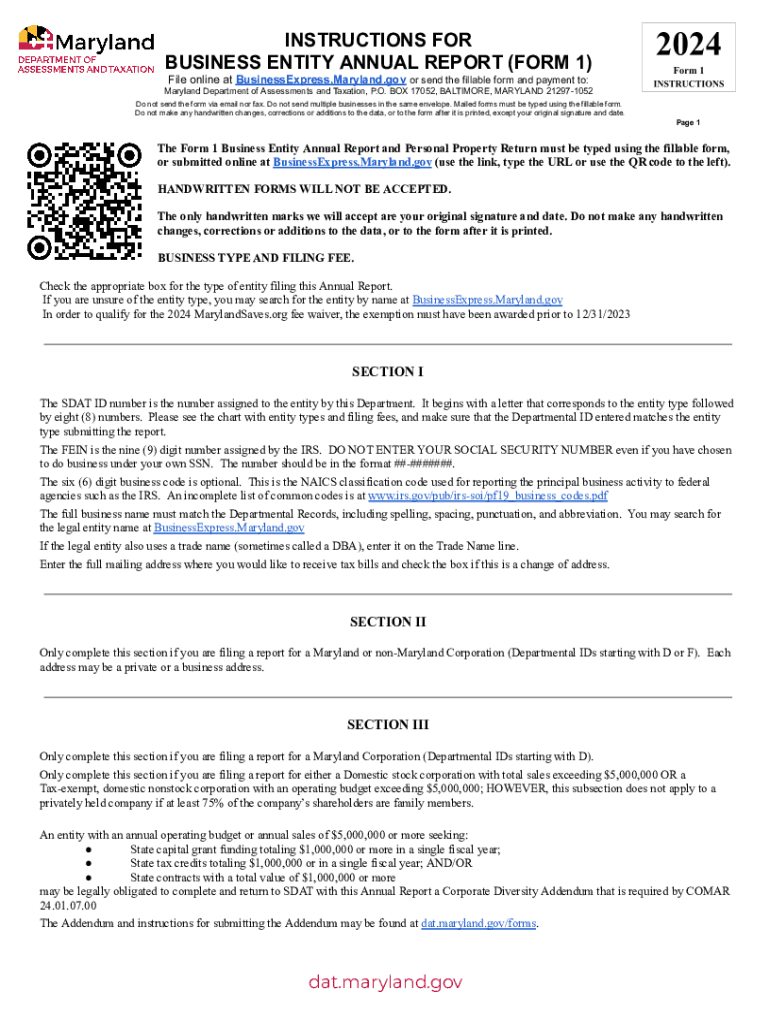

Instructions for Business Entity Annual Report Form 1

Understanding the Maryland Personal Property Tax Return Form 1

The Maryland Personal Property Tax Return Form 1 is a crucial document for businesses operating within the state. This form is used to report the personal property owned by a business, which may include equipment, furniture, and inventory. Accurate completion of this form is essential for ensuring compliance with state tax regulations and avoiding potential penalties.

Steps to Complete the Maryland Personal Property Tax Return Form 1

Completing the Maryland Personal Property Tax Return Form 1 involves several key steps:

- Gather all necessary information about your business's personal property, including descriptions and values.

- Fill out the form with accurate details, ensuring that all sections are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the specified deadline to avoid late fees.

Filing Deadlines for the Maryland Personal Property Tax Return

It is important to be aware of the filing deadlines associated with the Maryland Personal Property Tax Return Form 1. Typically, the form must be filed annually by April 15. If the deadline falls on a weekend or holiday, the due date may be adjusted accordingly. Late submissions can result in penalties, so timely filing is essential.

Required Documents for Filing

When preparing to file the Maryland Personal Property Tax Return Form 1, certain documents are necessary to support your submission. These may include:

- Records of all personal property owned by the business.

- Purchase invoices or receipts for significant assets.

- Previous year’s tax return for reference.

Penalties for Non-Compliance

Failure to file the Maryland Personal Property Tax Return Form 1 on time can lead to significant penalties. These may include financial fines and interest on unpaid taxes. Additionally, non-compliance can affect your business's standing with state authorities, potentially impacting future operations.

Who Issues the Maryland Personal Property Tax Return Form 1

The Maryland State Department of Assessments and Taxation is responsible for issuing the Personal Property Tax Return Form 1. This agency oversees the assessment and taxation of personal property within the state, ensuring that businesses meet their tax obligations.

Legal Use of the Maryland Personal Property Tax Return Form 1

The Maryland Personal Property Tax Return Form 1 is legally required for all businesses that own personal property in the state. Proper use of this form ensures compliance with Maryland tax laws and helps maintain transparency in business operations. It is advisable to consult with a tax professional if there are uncertainties regarding the completion or submission of this form.

Quick guide on how to complete instructions for business entity annual report form 1

Prepare Instructions For Business Entity Annual Report Form 1 effortlessly on any gadget

Online document management has gained traction among enterprises and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the correct form and safely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents swiftly without delays. Manage Instructions For Business Entity Annual Report Form 1 on any gadget using airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to edit and eSign Instructions For Business Entity Annual Report Form 1 with ease

- Find Instructions For Business Entity Annual Report Form 1 and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Highlight important portions of your documents or conceal sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all information and click the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Instructions For Business Entity Annual Report Form 1 to ensure outstanding communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for business entity annual report form 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to Maryland personal property?

airSlate SignNow is a digital solution that allows businesses to send and eSign documents efficiently. For those dealing with Maryland personal property, it simplifies the process of signing important documents, ensuring compliance and security.

-

How can airSlate SignNow help with managing Maryland personal property documents?

With airSlate SignNow, you can easily manage all your Maryland personal property documents in one place. The platform allows for quick eSigning, document sharing, and tracking, making it ideal for property management.

-

What are the pricing options for airSlate SignNow for Maryland personal property users?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of Maryland personal property users. Whether you are a small business or a large enterprise, you can find a plan that fits your budget while providing essential features.

-

What features does airSlate SignNow offer for Maryland personal property transactions?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document storage, all of which are beneficial for Maryland personal property transactions. These features streamline the signing process and enhance document management.

-

Are there any integrations available with airSlate SignNow for Maryland personal property?

Yes, airSlate SignNow integrates seamlessly with various applications that are commonly used in managing Maryland personal property. This includes CRM systems, cloud storage services, and other productivity tools, enhancing your workflow.

-

What are the benefits of using airSlate SignNow for Maryland personal property?

Using airSlate SignNow for Maryland personal property offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. It allows you to focus on your property management tasks without the hassle of traditional document handling.

-

Is airSlate SignNow secure for handling Maryland personal property documents?

Absolutely, airSlate SignNow prioritizes security, ensuring that all Maryland personal property documents are protected. The platform uses advanced encryption and complies with industry standards to safeguard your sensitive information.

Get more for Instructions For Business Entity Annual Report Form 1

- Tx limited partnership form

- Texas gift form

- Request for information from subcontractor corporation or llc texas

- Texas claimant form

- Quitclaim deed three individuals to one individual texas form

- General warrant deed life estate from individual to individual texas form

- Request to claimant for documents reflecting claim corporation or llc texas form

- Notice unpaid balance form

Find out other Instructions For Business Entity Annual Report Form 1

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple

- How To Sign New Jersey Non-Disturbance Agreement

- How To Sign Illinois Sales Invoice Template

- How Do I Sign Indiana Sales Invoice Template

- Sign North Carolina Equipment Sales Agreement Online

- Sign South Dakota Sales Invoice Template Free

- How Can I Sign Nevada Sales Proposal Template

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy