Wv it 141 Form

What is the WV IT 141?

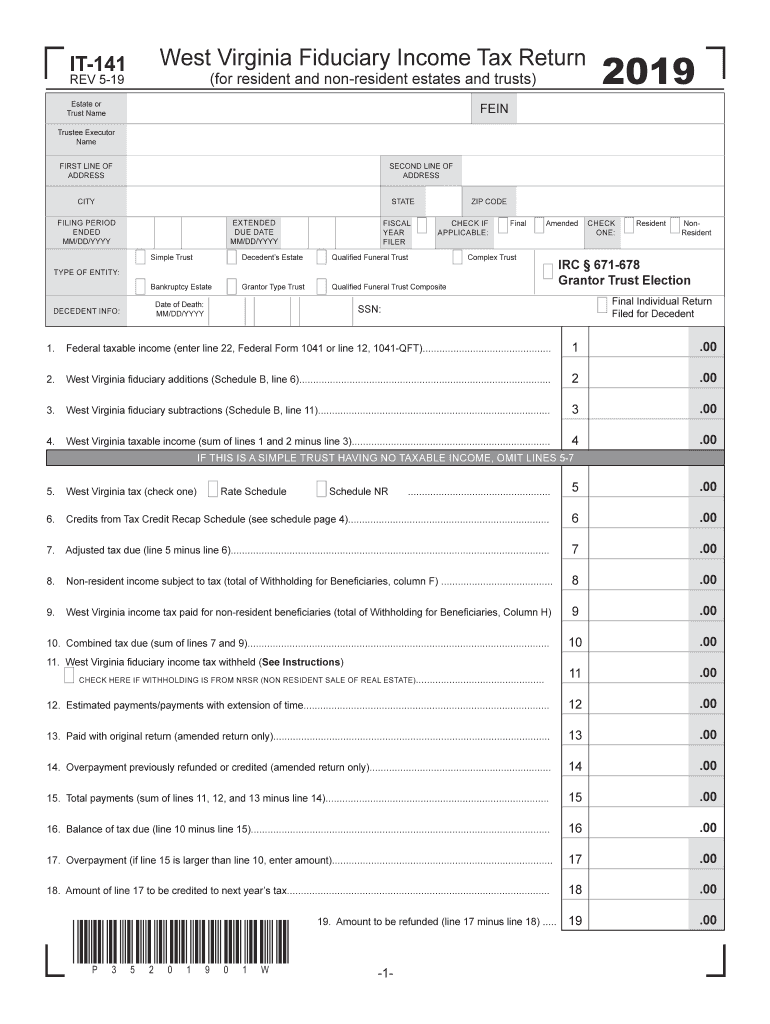

The WV IT 141 is a state tax form used by individuals and entities in West Virginia to report fiduciary income. This form is essential for estates and trusts that need to file a tax return in the state. It captures various income sources, deductions, and credits applicable to fiduciaries, ensuring compliance with West Virginia tax regulations. Understanding this form is crucial for accurate tax reporting and fulfilling legal obligations.

Steps to Complete the WV IT 141

Completing the WV IT 141 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and expense records related to the estate or trust. Next, follow these steps:

- Fill out the identification section, providing details about the fiduciary and the estate or trust.

- Report all income sources, including interest, dividends, and capital gains.

- Detail any deductions available to the fiduciary, such as administrative expenses or distributions to beneficiaries.

- Calculate the total taxable income and apply any applicable credits.

- Review the completed form for accuracy before submission.

Legal Use of the WV IT 141

The WV IT 141 is legally binding when completed correctly and submitted on time. It must adhere to the guidelines set forth by the West Virginia State Tax Department. Proper use of this form ensures that fiduciaries meet their tax obligations, which helps avoid penalties and interest for non-compliance. It's essential to maintain accurate records and documentation to support the information reported on the form.

Filing Deadlines / Important Dates

Filing deadlines for the WV IT 141 are crucial for compliance. Typically, the form must be filed by the fifteenth day of the fourth month following the close of the tax year. For estates and trusts with a calendar year-end, this means the due date is April 15. It is important to be aware of any extensions or changes in deadlines that may occur, especially in light of special circumstances or state announcements.

Form Submission Methods

The WV IT 141 can be submitted through various methods, providing flexibility for fiduciaries. The available submission methods include:

- Online submission through the West Virginia State Tax Department's e-filing system.

- Mailing a paper copy of the form to the appropriate tax office.

- In-person submission at designated tax offices, which can provide immediate confirmation of receipt.

Required Documents

To complete the WV IT 141 accurately, certain documents are required. These documents include:

- Financial statements for the estate or trust, detailing income and expenses.

- Records of distributions made to beneficiaries.

- Supporting documentation for any deductions claimed, such as invoices or receipts.

- Previous tax returns, if applicable, for reference and consistency.

Eligibility Criteria

Eligibility to file the WV IT 141 is generally limited to estates and trusts that have generated income during the tax year. This includes any fiduciary responsible for managing the financial affairs of an estate or trust. Understanding the eligibility criteria is essential for determining whether this form must be filed, as it impacts compliance with state tax laws.

Quick guide on how to complete rev 5 19

Complete Wv It 141 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Wv It 141 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign Wv It 141 effortlessly

- Locate Wv It 141 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Wv It 141 and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rev 5 19

How to make an eSignature for your Rev 5 19 in the online mode

How to generate an eSignature for your Rev 5 19 in Chrome

How to create an electronic signature for putting it on the Rev 5 19 in Gmail

How to generate an eSignature for the Rev 5 19 straight from your smartphone

How to make an electronic signature for the Rev 5 19 on iOS devices

How to make an electronic signature for the Rev 5 19 on Android

People also ask

-

What is Wv It 141 in relation to airSlate SignNow?

Wv It 141 refers to a specific feature or compliance standard within the airSlate SignNow platform. It ensures that all electronic signatures are legally binding and meet industry regulations. This means businesses can confidently use airSlate SignNow to manage their document workflows securely.

-

How does airSlate SignNow's Wv It 141 feature benefit my business?

The Wv It 141 feature in airSlate SignNow provides businesses with a streamlined way to manage electronic signatures while ensuring compliance. By using this feature, businesses can reduce paper usage, speed up document turnaround times, and maintain legal validity, ultimately enhancing productivity and efficiency.

-

Is there a cost associated with using the Wv It 141 feature in airSlate SignNow?

airSlate SignNow offers various pricing plans that include access to the Wv It 141 feature. Depending on your chosen plan, you can enjoy the benefits of electronic signatures and compliance at a competitive price. Additionally, airSlate SignNow often provides discounts for annual subscriptions.

-

What types of documents can I sign using the Wv It 141 feature?

With the Wv It 141 feature, you can sign a wide variety of documents, including contracts, agreements, and forms. airSlate SignNow supports multiple file formats, allowing you to upload and sign documents seamlessly. This versatility makes it ideal for businesses of all types.

-

Can airSlate SignNow's Wv It 141 integrate with other software?

Yes, airSlate SignNow's Wv It 141 feature integrates with numerous third-party applications, enhancing your workflow. Whether you use CRM systems, cloud storage, or project management tools, airSlate SignNow's integrations make it easy to streamline your processes. This connectivity helps you maintain efficiency across platforms.

-

How secure is the Wv It 141 feature in airSlate SignNow?

The Wv It 141 feature in airSlate SignNow prioritizes security by employing bank-level encryption and secure access protocols. This ensures that your documents and signatures are protected from unauthorized access. Businesses can trust airSlate SignNow to keep their sensitive information safe.

-

What support options are available for airSlate SignNow users utilizing Wv It 141?

Users of airSlate SignNow utilizing the Wv It 141 feature have access to comprehensive support options, including live chat, email support, and an extensive knowledge base. This ensures that any questions or issues you encounter can be resolved quickly and effectively. Additionally, training resources are available to help you maximize the use of the platform.

Get more for Wv It 141

- Temp food permit form

- Medical gas delaware form

- Division of child support enforcement application dhss delaware form

- Delaware water well licensing board application for license form

- Application for construction letter of approval form

- Property owners afdavit of evidence form

- Form tx comptroller 50 144 fill online printable

- Fillable online ic 046 form 4h wisconsin

Find out other Wv It 141

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe