Form ET 85 New York State Estate Tax Certification Revised 2

What is the Form ET 85 New York State Estate Tax Certification Revised 2

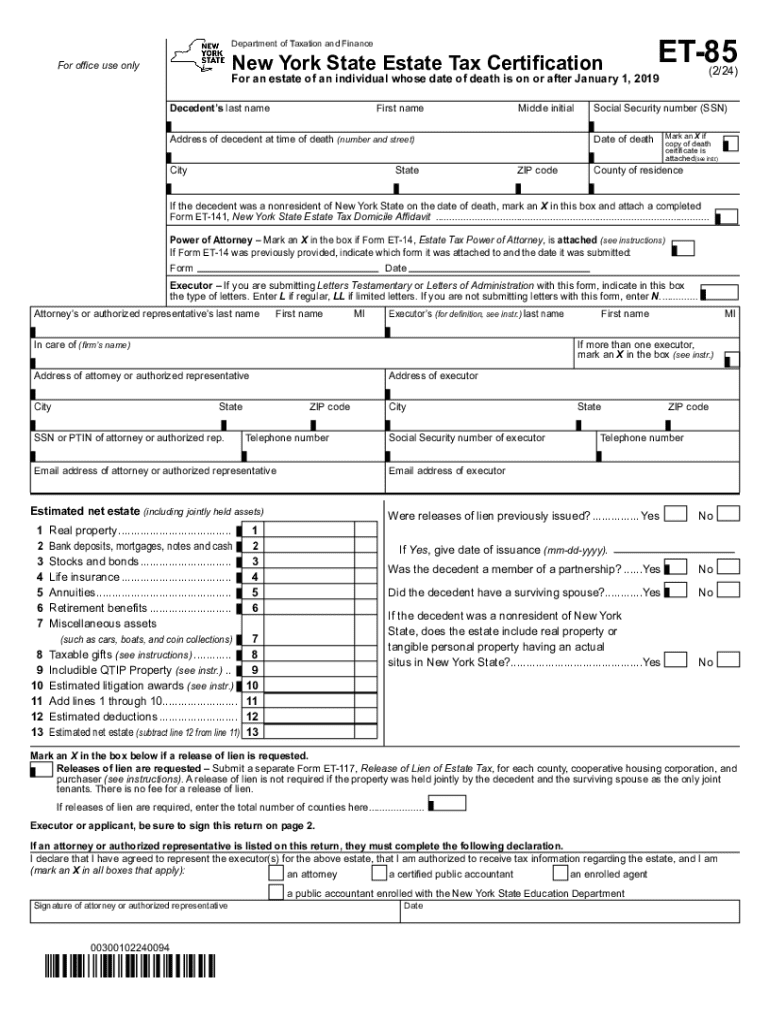

The Form ET 85 is a crucial document used in New York State for estate tax certification. This form is specifically designed to certify that the estate has met all tax obligations under New York State law. It is typically required when transferring property or assets from a deceased individual to their heirs or beneficiaries. The form ensures compliance with state tax regulations and helps facilitate the smooth transfer of assets.

Steps to complete the Form ET 85 New York State Estate Tax Certification Revised 2

Completing the Form ET 85 involves several key steps:

- Gather necessary information: Collect all relevant details about the deceased, including their full name, date of death, and the estate's total value.

- Complete the form: Fill out the required fields accurately, ensuring all information is correct and complete.

- Attach supporting documents: Include any necessary documentation that supports the information provided on the form, such as tax returns or financial statements.

- Review the form: Carefully check for any errors or omissions before submission.

- Submit the form: Send the completed form to the appropriate New York State tax authority by the specified deadline.

Legal use of the Form ET 85 New York State Estate Tax Certification Revised 2

The Form ET 85 serves a legal purpose in the estate settlement process. By certifying that all estate tax obligations have been fulfilled, this form protects the interests of both the estate and the beneficiaries. It is essential for legal compliance and helps prevent future disputes regarding the estate's tax status. Failure to submit this form may result in penalties or delays in the distribution of assets.

Key elements of the Form ET 85 New York State Estate Tax Certification Revised 2

Understanding the key elements of the Form ET 85 is vital for accurate completion. The form typically includes:

- Decedent's information: Full name and date of death.

- Estate details: Total value of the estate and any relevant tax identification numbers.

- Certification statement: A declaration confirming that all estate taxes have been paid or are not applicable.

- Signature: The form must be signed by the executor or administrator of the estate, affirming the accuracy of the information provided.

Filing Deadlines / Important Dates

Timely submission of the Form ET 85 is critical. The filing deadline typically coincides with the estate tax return due date, which is nine months after the decedent's date of death. It is essential to be aware of any specific dates or extensions that may apply. Missing the deadline can lead to penalties and complications in the estate settlement process.

Who Issues the Form

The Form ET 85 is issued by the New York State Department of Taxation and Finance. This agency oversees the collection of state taxes and ensures compliance with tax laws. It is important to obtain the most current version of the form directly from the department to ensure compliance with any updates or changes in regulations.

Quick guide on how to complete form et 85 new york state estate tax certification revised 2

Effortlessly Prepare Form ET 85 New York State Estate Tax Certification Revised 2 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Manage Form ET 85 New York State Estate Tax Certification Revised 2 on any platform using the airSlate SignNow Android or iOS applications and simplify your document-based tasks today.

The Simplest Way to Edit and eSign Form ET 85 New York State Estate Tax Certification Revised 2 with Ease

- Locate Form ET 85 New York State Estate Tax Certification Revised 2 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to finalize your changes.

- Select how you wish to share your form: via email, SMS, an invitation link, or download it to your computer.

Eliminate concerns of lost or misplaced documents, tedious searching for forms, or errors that require printing additional copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Form ET 85 New York State Estate Tax Certification Revised 2 while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form et 85 new york state estate tax certification revised 2

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the et 85 feature in airSlate SignNow?

The et 85 feature in airSlate SignNow allows users to easily send and eSign documents securely. This feature streamlines the signing process, making it efficient for businesses of all sizes. With et 85, you can manage your documents from anywhere, ensuring a seamless workflow.

-

How much does airSlate SignNow cost with the et 85 feature?

Pricing for airSlate SignNow with the et 85 feature is competitive and designed to fit various budgets. We offer different plans that cater to individual users and teams, ensuring you get the best value for your investment. For specific pricing details, please visit our pricing page.

-

What are the benefits of using airSlate SignNow's et 85?

Using the et 85 feature in airSlate SignNow provides numerous benefits, including enhanced security, ease of use, and improved document management. It helps businesses reduce turnaround time for signatures, which can lead to faster transactions and improved customer satisfaction. Overall, et 85 is a powerful tool for modern businesses.

-

Can I integrate airSlate SignNow with other applications using et 85?

Yes, airSlate SignNow's et 85 feature supports integration with various applications, enhancing your workflow. You can connect it with popular tools like Google Drive, Salesforce, and more. This flexibility allows you to streamline your processes and improve productivity.

-

Is the et 85 feature user-friendly for beginners?

Absolutely! The et 85 feature in airSlate SignNow is designed with user-friendliness in mind. Even beginners can navigate the platform easily, thanks to its intuitive interface and helpful resources. You'll be able to send and eSign documents without any technical expertise.

-

What types of documents can I eSign using et 85?

With the et 85 feature, you can eSign a wide variety of documents, including contracts, agreements, and forms. This versatility makes it suitable for different industries and use cases. Whether you're in real estate, finance, or healthcare, et 85 can handle your document needs.

-

How secure is the et 85 feature in airSlate SignNow?

The et 85 feature in airSlate SignNow prioritizes security, employing advanced encryption and authentication measures. Your documents are protected throughout the signing process, ensuring confidentiality and compliance with legal standards. You can trust that your sensitive information is safe with us.

Get more for Form ET 85 New York State Estate Tax Certification Revised 2

Find out other Form ET 85 New York State Estate Tax Certification Revised 2

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free