Franchise and Excise Tax Return Form

Understanding the Franchise and Excise Tax Return

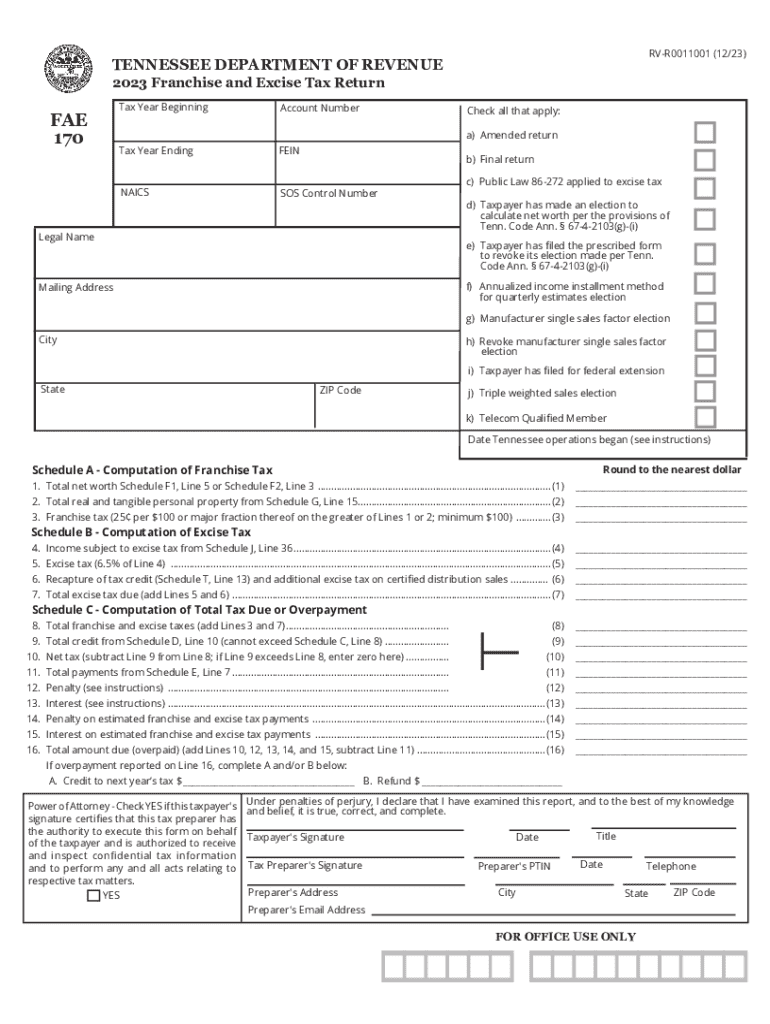

The Franchise and Excise Tax Return is a crucial document for businesses operating in Tennessee. This tax return is required for corporations and limited liability companies (LLCs) that do business in the state. The tax is based on the net worth of the business and its gross receipts. Understanding the purpose of this form is essential for compliance with state tax laws and avoiding penalties.

Steps to Complete the Franchise and Excise Tax Return

Completing the Franchise and Excise Tax Return involves several key steps. First, gather all necessary financial documents, including income statements and balance sheets. Next, determine your taxable income and calculate the excise tax based on the applicable rate. After that, fill out the form accurately, ensuring that all figures are correct. Finally, review the completed form for any errors before submission.

Filing Deadlines and Important Dates

It is important to be aware of the filing deadlines for the Franchise and Excise Tax Return to avoid late fees. Typically, the return is due on the fifteenth day of the fourth month following the end of the tax year. For most businesses operating on a calendar year, this means the return is due by April 15. Keeping track of these dates is essential for maintaining compliance.

Required Documents for Filing

When preparing to file the Franchise and Excise Tax Return, certain documents are required. These include financial statements, previous tax returns, and any supporting documentation that verifies income and expenses. Having these documents ready can streamline the filing process and ensure that all necessary information is included.

Form Submission Methods

The Franchise and Excise Tax Return can be submitted in several ways. Businesses can file the form online through the Tennessee Department of Revenue’s website, which offers a convenient and efficient method. Alternatively, the form can be mailed to the appropriate address or submitted in person at designated locations. Understanding these submission methods can help businesses choose the best option for their needs.

Penalties for Non-Compliance

Failing to file the Franchise and Excise Tax Return on time can result in significant penalties. The Tennessee Department of Revenue imposes late fees and interest on unpaid taxes. In some cases, businesses may also face additional legal consequences. Being aware of these penalties can motivate timely and accurate filing.

Key Elements of the Franchise and Excise Tax Return

The Franchise and Excise Tax Return includes several key elements that must be completed accurately. These elements typically consist of business identification information, income calculations, and deductions. Understanding each component of the form is crucial for ensuring compliance and minimizing tax liability.

Quick guide on how to complete franchise and excise tax return

Complete Franchise And Excise Tax Return effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Franchise And Excise Tax Return on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

The optimal method to modify and eSign Franchise And Excise Tax Return with ease

- Locate Franchise And Excise Tax Return and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method for delivering your form, via email, text (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow fulfills all your requirements in document management in just a few clicks from your preferred device. Modify and eSign Franchise And Excise Tax Return and guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the franchise and excise tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the fae 170 form and why is it important?

The fae 170 form is a crucial document used for various administrative purposes, particularly in financial and legal contexts. Understanding its requirements and proper usage can streamline your processes and ensure compliance with regulations.

-

How can airSlate SignNow help with the fae 170 form?

airSlate SignNow simplifies the process of completing and signing the fae 170 form by providing an intuitive platform for electronic signatures. This ensures that your documents are signed quickly and securely, enhancing efficiency in your workflow.

-

Is there a cost associated with using airSlate SignNow for the fae 170 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that facilitate the signing and management of documents like the fae 170 form, ensuring you find a solution that fits your budget.

-

What features does airSlate SignNow offer for managing the fae 170 form?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage, all of which enhance the management of the fae 170 form. These tools help you streamline document handling and improve collaboration among team members.

-

Can I integrate airSlate SignNow with other applications for the fae 170 form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to seamlessly manage the fae 170 form alongside your existing tools. This integration capability enhances productivity and ensures a smooth workflow.

-

What are the benefits of using airSlate SignNow for the fae 170 form?

Using airSlate SignNow for the fae 170 form provides numerous benefits, including faster turnaround times, reduced paper usage, and enhanced security. These advantages not only save time but also contribute to a more sustainable business practice.

-

Is airSlate SignNow user-friendly for completing the fae 170 form?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the fae 170 form. The platform's intuitive interface ensures that users can navigate the signing process without any technical difficulties.

Get more for Franchise And Excise Tax Return

- Mn odometer 497311823 form

- Promissory note in connection with sale of vehicle or automobile minnesota form

- Mn bill sale boat form

- Bill of sale of automobile and odometer statement for as is sale minnesota form

- Construction contract cost plus or fixed fee minnesota form

- Painting contract for contractor minnesota form

- Trim carpenter contract for contractor minnesota form

- Fencing contract for contractor minnesota form

Find out other Franchise And Excise Tax Return

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement