Instructions for Form ET 706 New York State Estate Tax Return for an Estate of an Individual Who Died on or After January 1, Rev

Understanding the ET 706 Instructions

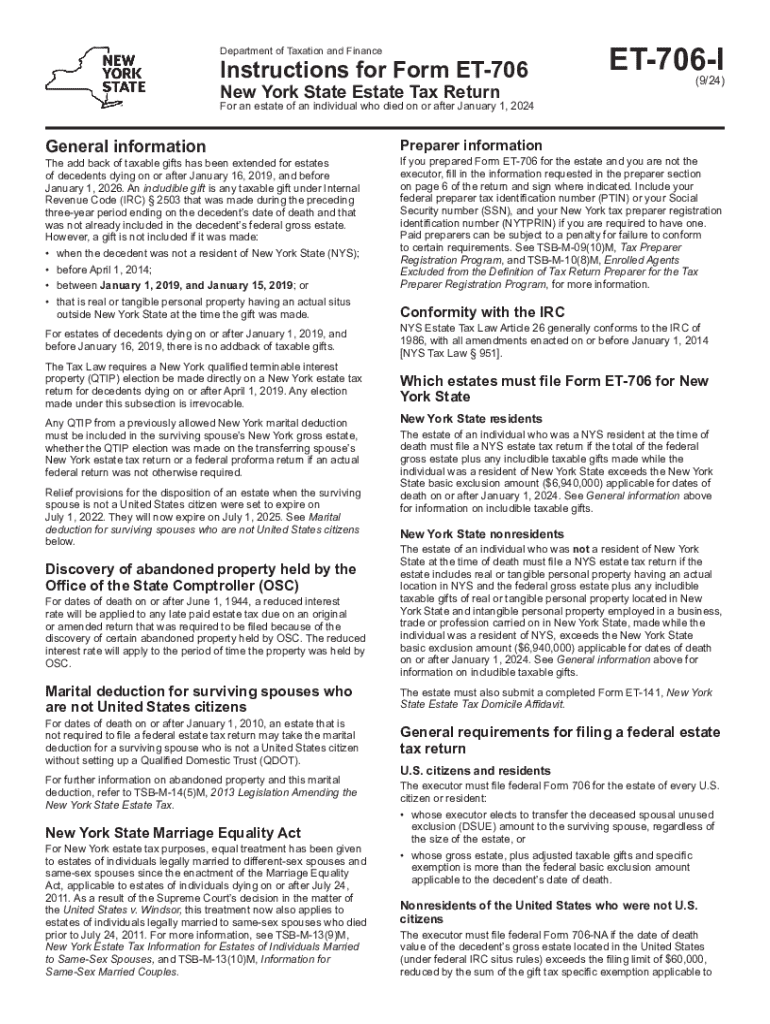

The ET 706 form is the New York State Estate Tax Return, specifically designed for estates of individuals who passed away on or after January 1, 2019. This form is essential for reporting the estate's value and calculating any estate taxes owed. The instructions provide guidance on how to complete the form accurately, ensuring compliance with state tax laws. It is crucial for executors and administrators to understand the requirements outlined in these instructions to avoid potential penalties.

Steps to Complete the ET 706 Form

Completing the ET 706 form involves several key steps:

- Gather Required Information: Collect all necessary documents related to the deceased's assets, liabilities, and any previous tax returns.

- Complete the Form: Fill out the form accurately, ensuring all sections are completed as per the instructions.

- Calculate the Estate Tax: Use the provided tables and guidelines to determine the estate tax liability.

- Review for Accuracy: Double-check all entries for correctness to prevent errors that could lead to delays or penalties.

- Submit the Form: File the completed ET 706 form by the specified deadline, either online or via mail.

Key Elements of the ET 706 Instructions

The instructions for the ET 706 form include several critical components:

- Filing Requirements: Details on who must file the form and under what circumstances.

- Documentation Needed: A list of documents required to support the information reported on the form.

- Tax Calculation Guidelines: Instructions for calculating the estate tax based on the estate's value.

- Submission Methods: Information on how to file the form, including options for online submission and mailing addresses.

Legal Use of the ET 706 Form

The ET 706 form is legally binding, and accurate completion is essential for compliance with New York State tax laws. Executors and administrators must ensure that the form is filed on time to avoid penalties. Understanding the legal implications of the information reported on the form is vital, as inaccuracies can lead to audits or additional taxes owed.

Filing Deadlines and Important Dates

Filing deadlines for the ET 706 form are critical to avoid late fees and penalties. Generally, the form must be filed within nine months of the date of death. However, extensions may be available under certain circumstances. It is important to be aware of these dates to ensure timely submission.

Obtaining the ET 706 Instructions

The ET 706 instructions can be obtained directly from the New York State Department of Taxation and Finance website or through authorized tax professionals. It is advisable to access the most current version of the instructions to ensure compliance with any recent changes in tax laws or filing requirements.

Quick guide on how to complete instructions for form et 706 new york state estate tax return for an estate of an individual who died on or after january 1 769879895

Complete Instructions For Form ET 706 New York State Estate Tax Return For An Estate Of An Individual Who Died On Or After January 1, Rev effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Instructions For Form ET 706 New York State Estate Tax Return For An Estate Of An Individual Who Died On Or After January 1, Rev on any platform using airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to edit and eSign Instructions For Form ET 706 New York State Estate Tax Return For An Estate Of An Individual Who Died On Or After January 1, Rev without any hassle

- Locate Instructions For Form ET 706 New York State Estate Tax Return For An Estate Of An Individual Who Died On Or After January 1, Rev and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to finalize your changes.

- Select your preferred method to send your form: via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device of your choice. Edit and eSign Instructions For Form ET 706 New York State Estate Tax Return For An Estate Of An Individual Who Died On Or After January 1, Rev and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form et 706 new york state estate tax return for an estate of an individual who died on or after january 1 769879895

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the et 706 instructions for using airSlate SignNow?

The et 706 instructions for airSlate SignNow guide users on how to effectively utilize the platform for electronic signatures and document management. These instructions provide step-by-step details on setting up your account, uploading documents, and sending them for eSignature. Following these guidelines ensures a smooth experience while maximizing the platform's features.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow varies based on the plan you choose, with options designed to fit different business needs. Each plan includes access to essential features, including the ability to follow et 706 instructions for document signing. For detailed pricing information, visit our pricing page to find the best option for your organization.

-

What features does airSlate SignNow offer?

airSlate SignNow offers a range of features including document templates, customizable workflows, and secure eSigning capabilities. These features are designed to streamline your document management process and ensure compliance with et 706 instructions. Users can easily create, send, and track documents, enhancing productivity and efficiency.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, businesses can signNowly reduce the time and resources spent on document management. The platform simplifies the signing process, allowing users to follow et 706 instructions seamlessly. This leads to faster turnaround times, improved customer satisfaction, and a more organized workflow.

-

Does airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers integrations with various software applications, enhancing its functionality. Users can connect with popular tools like CRM systems and cloud storage services, making it easier to manage documents while adhering to et 706 instructions. These integrations help streamline processes and improve overall efficiency.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely, airSlate SignNow prioritizes the security of your documents with advanced encryption and compliance measures. This ensures that all transactions, including those following et 706 instructions, are protected. Users can confidently send and sign sensitive documents knowing that their information is secure.

-

Can I customize my documents in airSlate SignNow?

Yes, airSlate SignNow allows users to customize documents to fit their specific needs. You can add fields, logos, and other elements to your documents while following et 706 instructions. This customization ensures that your documents reflect your brand and meet your business requirements.

Get more for Instructions For Form ET 706 New York State Estate Tax Return For An Estate Of An Individual Who Died On Or After January 1, Rev

Find out other Instructions For Form ET 706 New York State Estate Tax Return For An Estate Of An Individual Who Died On Or After January 1, Rev

- Sign Montana Banking Quitclaim Deed Secure

- Sign Montana Banking Quitclaim Deed Safe

- Sign Missouri Banking Rental Lease Agreement Now

- Sign Nebraska Banking Last Will And Testament Online

- Sign Nebraska Banking LLC Operating Agreement Easy

- Sign Missouri Banking Lease Agreement Form Simple

- Sign Nebraska Banking Lease Termination Letter Myself

- Sign Nevada Banking Promissory Note Template Easy

- Sign Nevada Banking Limited Power Of Attorney Secure

- Sign New Jersey Banking Business Plan Template Free

- Sign New Jersey Banking Separation Agreement Myself

- Sign New Jersey Banking Separation Agreement Simple

- Sign Banking Word New York Fast

- Sign New Mexico Banking Contract Easy

- Sign New York Banking Moving Checklist Free

- Sign New Mexico Banking Cease And Desist Letter Now

- Sign North Carolina Banking Notice To Quit Free

- Sign Banking PPT Ohio Fast

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast