Schedule B Form

What is the Schedule B

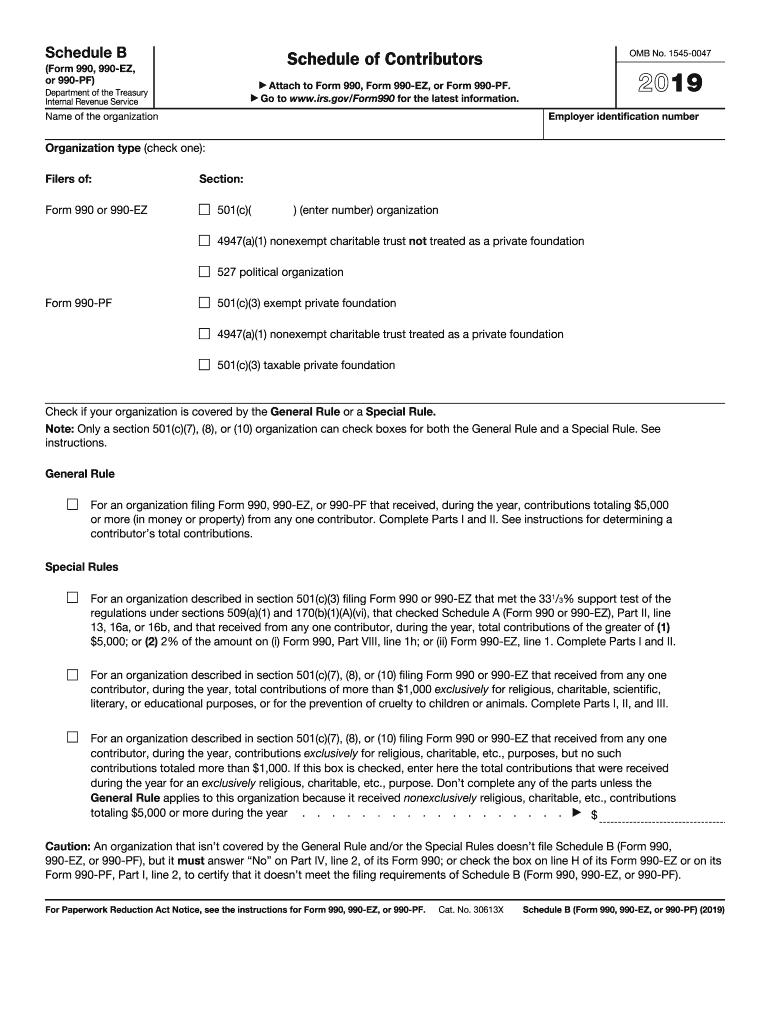

The 2019 Form 990 Schedule B is a supplementary form required by the Internal Revenue Service (IRS) for organizations that file Form 990, the annual information return for tax-exempt organizations. This schedule details the contributors who donated more than a specified amount during the tax year. The purpose of Schedule B is to provide transparency regarding the funding sources of tax-exempt entities, ensuring compliance with federal regulations. Organizations must accurately report this information to maintain their tax-exempt status and fulfill their obligations to the IRS.

How to use the Schedule B

To effectively use the 2019 Form 990 Schedule B, organizations should first gather all necessary information about their contributors. This includes names, addresses, and the amounts donated. The form requires details for any individual or entity that contributed more than $5,000 during the year. Organizations must complete the form accurately and ensure that it is submitted along with their main Form 990. It is essential to follow IRS guidelines to avoid penalties and ensure that the organization remains in good standing.

Steps to complete the Schedule B

Completing the 2019 Form 990 Schedule B involves several key steps:

- Gather contributor information: Collect names, addresses, and donation amounts for all contributors exceeding the $5,000 threshold.

- Fill out the form: Accurately enter the required information in the designated fields on Schedule B.

- Review for accuracy: Double-check all entries to ensure compliance with IRS regulations.

- Attach to Form 990: Include the completed Schedule B with the main Form 990 submission.

- Submit by the deadline: Ensure that the form is filed by the appropriate deadline to avoid penalties.

Legal use of the Schedule B

The legal use of the 2019 Form 990 Schedule B is crucial for maintaining compliance with IRS regulations. Organizations must ensure that they report all required information accurately and completely. Failure to comply can result in penalties, including the loss of tax-exempt status. It is also important for organizations to understand the confidentiality of contributor information, as certain details may need to be disclosed while others are protected under privacy laws.

IRS Guidelines

The IRS provides specific guidelines for completing the 2019 Form 990 Schedule B. Organizations should refer to these guidelines to understand the reporting requirements and thresholds for contributions. The IRS emphasizes the importance of transparency and accuracy in reporting, as well as the need for organizations to maintain detailed records of contributions. Adhering to these guidelines helps ensure that organizations remain compliant and avoid potential legal issues.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for the 2019 Form 990 Schedule B. The standard deadline for filing Form 990 is the fifteenth day of the fifth month after the end of the organization's fiscal year. This means that for organizations with a calendar year-end, the deadline is May 15. It is crucial to file on time to avoid penalties and maintain compliance with IRS regulations. Organizations may file for an extension if needed, but they must still comply with the extended deadlines.

Quick guide on how to complete fillable online 5000 or 2 2 of the amount on i

Complete Schedule B effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow gives you all the resources you need to generate, modify, and electronically sign your documents swiftly without delays. Manage Schedule B on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Schedule B with ease

- Obtain Schedule B and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or errors that necessitate printing out new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Schedule B and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable online 5000 or 2 2 of the amount on i

How to create an electronic signature for the Fillable Online 5000 Or 2 2 Of The Amount On I online

How to make an eSignature for the Fillable Online 5000 Or 2 2 Of The Amount On I in Chrome

How to make an electronic signature for signing the Fillable Online 5000 Or 2 2 Of The Amount On I in Gmail

How to make an eSignature for the Fillable Online 5000 Or 2 2 Of The Amount On I right from your smart phone

How to create an eSignature for the Fillable Online 5000 Or 2 2 Of The Amount On I on iOS

How to create an eSignature for the Fillable Online 5000 Or 2 2 Of The Amount On I on Android

People also ask

-

What are 990 2019 contributors and why are they important?

990 2019 contributors refer to individuals or organizations that have contributed to the making or filing of Form 990 for the tax year 2019. Understanding the role of these contributors is crucial for non-profits as it provides insight into funding sources and compliance with IRS reporting requirements. Tracking 990 2019 contributors can help ensure transparency and accountability.

-

How can airSlate SignNow help with managing 990 2019 contributors?

airSlate SignNow offers a streamlined platform for sending and eSigning documents related to 990 2019 contributors. With features like document templates and real-time tracking, organizations can manage contributor agreements efficiently. This simplifies the documentation process and ensures that all contributors can sign important forms from anywhere.

-

What features does airSlate SignNow provide that benefit non-profits dealing with 990 2019 contributors?

airSlate SignNow includes customizable templates, bulk sending, and integration with popular CRMs, which are essential for non-profits managing 990 2019 contributors. These features facilitate easier communication and document flow, allowing organizations to focus on their mission rather than administrative burdens. Moreover, the platform’s user-friendly interface promotes enhanced collaboration.

-

Is airSlate SignNow cost-effective for organizations managing 990 2019 contributors?

Yes, airSlate SignNow is a cost-effective solution for organizations that need to manage 990 2019 contributors. With flexible pricing plans, non-profits can choose an option that fits their budget while accessing essential eSigning features. This helps organizations reduce operational costs while maintaining compliance and transparency.

-

How does airSlate SignNow ensure the security of documents for 990 2019 contributors?

airSlate SignNow prioritizes security, using encryption and secure data storage to protect documents related to 990 2019 contributors. This level of security ensures that all sensitive information remains confidential and complies with industry standards. Users can confidently store and share documents without risk of unauthorized access.

-

Can airSlate SignNow integrate with other tools for managing 990 2019 contributors?

Absolutely! airSlate SignNow seamlessly integrates with a variety of CRM systems and cloud storage platforms, simplifying the process of managing 990 2019 contributors. This connectivity allows organizations to consolidate their workflows, making it easier to track contributions and document revisions. Integrations enhance productivity and ensure that all your tools work in harmony.

-

How does airSlate SignNow enhance communication with 990 2019 contributors?

airSlate SignNow enhances communication with 990 2019 contributors by providing real-time notifications and status updates on document signing progress. This keeps all parties informed and engaged, reducing delays and misunderstandings. The platform enables direct communication through comment features, fostering collaboration.

Get more for Schedule B

Find out other Schedule B

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure