Omb 1545 0008 Form

What is the OMB ?

The OMB is a form issued by the Internal Revenue Service (IRS) that is crucial for various tax-related processes. This form is primarily associated with the reporting of tax information, ensuring compliance with federal regulations. It is essential for individuals and businesses to understand the purpose of this form, as it impacts their tax obligations and reporting accuracy.

How to use the OMB

Using the OMB involves several steps that ensure the correct information is reported to the IRS. Taxpayers must first gather all necessary financial documents, such as income statements and deductions. Once the required information is collected, individuals can fill out the form accurately, ensuring that all entries are complete and correct. It is advisable to review the form for any errors before submission to avoid potential penalties.

Steps to complete the OMB

Completing the OMB requires a systematic approach:

- Gather all relevant financial documents, including W-2s and 1099s.

- Carefully fill out the form, ensuring all sections are completed accurately.

- Double-check for any errors or omissions.

- Sign and date the form as required.

- Submit the form to the IRS by the specified deadline.

Legal use of the OMB

The legal use of the OMB is governed by IRS regulations. It is important for taxpayers to use the form in accordance with these guidelines to ensure compliance. Failure to do so may result in penalties or legal repercussions. Understanding the legal implications of this form can help individuals and businesses avoid potential issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the OMB are critical for taxpayers to keep in mind. Typically, the IRS requires that this form be submitted by April 15 of each year, unless an extension is granted. It is essential to stay informed about any changes to these dates, as missing a deadline can lead to penalties and interest on unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the OMB . The form can be filed online through the IRS e-file system, which is often the fastest method. Alternatively, individuals may choose to mail the completed form to the appropriate IRS address or submit it in person at designated IRS offices. Each method has its own advantages, and taxpayers should select the one that best suits their needs.

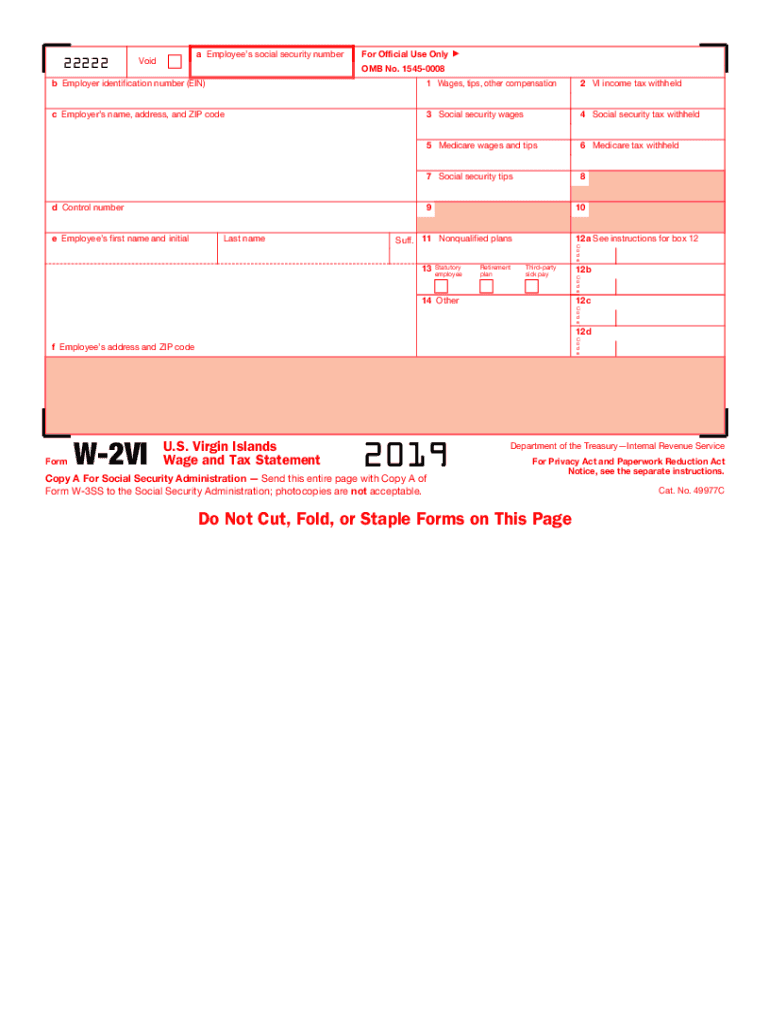

Quick guide on how to complete 2019 form w 2 vi us virgin islands wage and tax statement

Prepare Omb 1545 0008 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your papers quickly without delays. Manage Omb 1545 0008 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Omb 1545 0008 without hassle

- Locate Omb 1545 0008 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Omb 1545 0008 to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form w 2 vi us virgin islands wage and tax statement

How to generate an electronic signature for the 2019 Form W 2 Vi Us Virgin Islands Wage And Tax Statement online

How to make an electronic signature for the 2019 Form W 2 Vi Us Virgin Islands Wage And Tax Statement in Chrome

How to create an electronic signature for signing the 2019 Form W 2 Vi Us Virgin Islands Wage And Tax Statement in Gmail

How to create an eSignature for the 2019 Form W 2 Vi Us Virgin Islands Wage And Tax Statement straight from your smart phone

How to make an eSignature for the 2019 Form W 2 Vi Us Virgin Islands Wage And Tax Statement on iOS devices

How to generate an eSignature for the 2019 Form W 2 Vi Us Virgin Islands Wage And Tax Statement on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to 2vi 2019?

airSlate SignNow is a powerful eSignature solution that enables businesses to send and electronically sign documents quickly and securely. By optimizing your document workflow with airSlate SignNow, you can experience the benefits of efficiency and reliability, particularly important for managing deadlines related to 2vi 2019.

-

What are the pricing options for airSlate SignNow in 2vi 2019?

airSlate SignNow offers a variety of pricing plans tailored to different business needs, making it a cost-effective choice for 2vi 2019. Whether you're a small business or part of a large organization, you can select a plan that suits your budget while still enjoying all essential features.

-

What features does airSlate SignNow offer for 2vi 2019?

The features of airSlate SignNow include customizable templates, real-time tracking of document statuses, and secure storage solutions. These tools help streamline your signing processes, ensuring that tasks related to 2vi 2019 are completed efficiently and without any hassles.

-

How can airSlate SignNow benefit my business in 2vi 2019?

By utilizing airSlate SignNow, businesses can accelerate their document processes, save on printing costs, and reduce errors associated with manual signing. The benefits you gain through improved efficiency directly translate to better performance in your initiatives for 2vi 2019.

-

Does airSlate SignNow integrate with other software for 2vi 2019?

Yes, airSlate SignNow seamlessly integrates with various business tools and software, including CRM systems and cloud storage services. This integration capability allows you to enhance the functionality of your existing tools while addressing the specific requirements for 2vi 2019.

-

Is airSlate SignNow compliant with industry regulations for 2vi 2019?

Absolutely! airSlate SignNow is designed to meet industry standards and compliance requirements, including those related to ESIGN and UETA. This focus on compliance ensures that your documents are legally binding and secure, making it the ideal choice for your needs in 2vi 2019.

-

Can I access airSlate SignNow from mobile devices for 2vi 2019?

Yes, airSlate SignNow is fully functional on mobile devices, allowing you to manage and sign documents on the go. This convenience is especially useful during 2vi 2019 when timely responses and document processing can make a signNow impact on your operations.

Get more for Omb 1545 0008

- Appleton wi non profit food permit 2011 form

- Learning life outing permit form

- West warwick pretreatment form

- Alabama mvt 20 1 form

- How to fill out a 1099 misc form for al 2010 2019

- Form 2g guidelines for completing offer to purchase

- Ic 004 form pw 1 wisconsin nonresident income or franchise tax withholding on pass through entity income 794874054

- Dd form 626 motor vehicle inspection transporting hazardous sensitive materials

Find out other Omb 1545 0008

- Sign Oklahoma Life-Insurance Quote Form Later

- Can I Sign Texas Life-Insurance Quote Form

- Sign Texas Life-Insurance Quote Form Fast

- How To Sign Washington Life-Insurance Quote Form

- Can I Sign Wisconsin Life-Insurance Quote Form

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online