Irs Tax Form 8868

What is the IRS Tax Form 8868

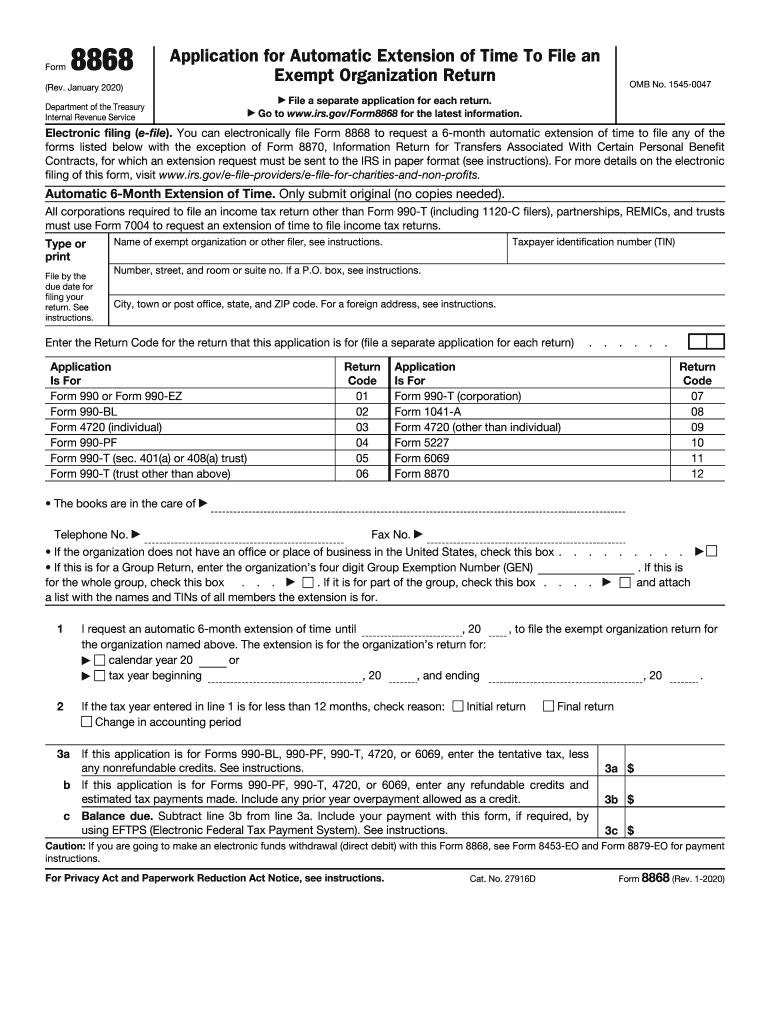

The IRS Tax Form 8868 is an application for an extension of time to file an exempt organization return. This form is primarily used by tax-exempt organizations, such as charities and non-profits, to request an automatic extension of up to six months for filing their annual returns. The form is essential for organizations that need additional time to prepare their financial statements or gather necessary documentation for compliance with IRS regulations.

How to use the IRS Tax Form 8868

To use the IRS Tax Form 8868, organizations must complete the form accurately and submit it to the IRS by the original due date of their return. The form can be filed electronically or by mail. When filling out the form, organizations should provide their name, address, and Employer Identification Number (EIN), along with details regarding the return for which they are requesting an extension. It is important to ensure that all information is correct to avoid delays or issues with processing.

Steps to complete the IRS Tax Form 8868

Completing the IRS Tax Form 8868 involves several key steps:

- Obtain the latest version of the form, which can be downloaded from the IRS website.

- Fill in the organization's name, address, and EIN at the top of the form.

- Indicate the type of return for which you are requesting an extension.

- Provide the original due date of the return and the requested extension period.

- Sign and date the form to certify that the information is accurate.

- Submit the completed form to the IRS by the due date, either electronically or via mail.

Legal use of the IRS Tax Form 8868

The legal use of the IRS Tax Form 8868 is governed by IRS regulations, which allow tax-exempt organizations to request an extension for filing their returns. To be considered legally valid, the form must be submitted on time and contain accurate information. Organizations should retain a copy of the submitted form for their records, as it serves as proof of the extension request. Compliance with IRS guidelines ensures that organizations maintain their tax-exempt status and avoid potential penalties.

Filing Deadlines / Important Dates

The filing deadlines for the IRS Tax Form 8868 coincide with the due dates of the respective annual returns for tax-exempt organizations. Typically, the original due date for these returns is the fifteenth day of the fifth month after the end of the organization's accounting period. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. It is crucial for organizations to be aware of these dates to ensure timely submission of the form and avoid late filing penalties.

Penalties for Non-Compliance

Failure to file the IRS Tax Form 8868 on time can result in penalties for tax-exempt organizations. The IRS imposes a penalty for each month the return is late, which can accumulate quickly. Additionally, if the organization does not file its annual return, it may risk losing its tax-exempt status. Therefore, it is essential for organizations to adhere to filing deadlines and maintain compliance with IRS regulations to avoid financial repercussions.

Quick guide on how to complete form 8868 rev january 2020 application for automatic extension of time to file an exempt organization return

Prepare Irs Tax Form 8868 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any delays. Manage Irs Tax Form 8868 on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Irs Tax Form 8868 effortlessly

- Obtain Irs Tax Form 8868 and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact confidential information with tools that airSlate SignNow supplies specifically for this purpose.

- Create your signature using the Sign feature, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors necessitating the printing of new copies. airSlate SignNow fulfills your document management needs with just a few clicks from your preferred device. Modify and eSign Irs Tax Form 8868 and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8868 rev january 2020 application for automatic extension of time to file an exempt organization return

How to create an electronic signature for the Form 8868 Rev January 2020 Application For Automatic Extension Of Time To File An Exempt Organization Return in the online mode

How to make an eSignature for your Form 8868 Rev January 2020 Application For Automatic Extension Of Time To File An Exempt Organization Return in Google Chrome

How to create an electronic signature for signing the Form 8868 Rev January 2020 Application For Automatic Extension Of Time To File An Exempt Organization Return in Gmail

How to generate an eSignature for the Form 8868 Rev January 2020 Application For Automatic Extension Of Time To File An Exempt Organization Return right from your mobile device

How to create an eSignature for the Form 8868 Rev January 2020 Application For Automatic Extension Of Time To File An Exempt Organization Return on iOS

How to generate an eSignature for the Form 8868 Rev January 2020 Application For Automatic Extension Of Time To File An Exempt Organization Return on Android

People also ask

-

What is the significance of 8868 2020 for businesses?

The 8868 2020 form is essential for businesses seeking to apply for an extension of time to file their tax returns. Understanding how to manage this process efficiently can save companies from potential penalties, especially during tax season. Utilizing airSlate SignNow can help streamline the eSigning of the 8868 2020 document, making compliance hassle-free.

-

How does airSlate SignNow facilitate the signing of the 8868 2020 form?

AirSlate SignNow allows users to easily upload, sign, and send the 8868 2020 form online. With its user-friendly interface, even those unfamiliar with digital signing can complete their documents quickly. This means reduced wait times and improved efficiency for your business’s tax processes.

-

What are the pricing options for using airSlate SignNow?

AirSlate SignNow offers flexible pricing plans to cater to various business needs, starting with a free trial and competitive monthly subscriptions. Whether your business is small or large, you can find a plan that suits your requirement for handling the 8868 2020 form and other documents. The cost-effectiveness of SignNow makes it a smart choice for budget-conscious businesses.

-

What features does airSlate SignNow provide that support the 8868 2020 filing?

AirSlate SignNow comes with various features that simplify the process of filing the 8868 2020 form, including document templates, real-time tracking, and automated reminders. These features ensure that your paperwork is completed promptly and efficiently. With SignNow, you can manage all your document needs in one centralized platform.

-

Can airSlate SignNow integrate with other software for tax management?

Yes, airSlate SignNow seamlessly integrates with a wide range of software applications that businesses use for tax management and accounting. This compatibility allows you to link your systems, making it easier to manage the 8868 2020 form along with your other financial documents. Integration enhances workflow efficiency and reduces the chances of errors.

-

How does airSlate SignNow ensure the security of the 8868 2020 form?

Security is a top priority for airSlate SignNow; the platform uses advanced encryption and secure hosting to protect all documents, including the 8868 2020 form. Client data and signatures are safeguarded against unauthorized access, providing peace of mind when handling sensitive information. This commitment to security is crucial for maintaining compliance and trust.

-

What are the benefits of using airSlate SignNow over traditional methods for 8868 2020 submission?

Using airSlate SignNow to submit the 8868 2020 form offers numerous benefits over traditional methods, including faster turnaround times and a paperless process. Digital signatures eliminate the need for printing, scanning, and mailing, making the entire process more eco-friendly. Furthermore, the ability to track document status in real-time is a signNow advantage.

Get more for Irs Tax Form 8868

Find out other Irs Tax Form 8868

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document