Wt 7 Form

What is the W-7 Form?

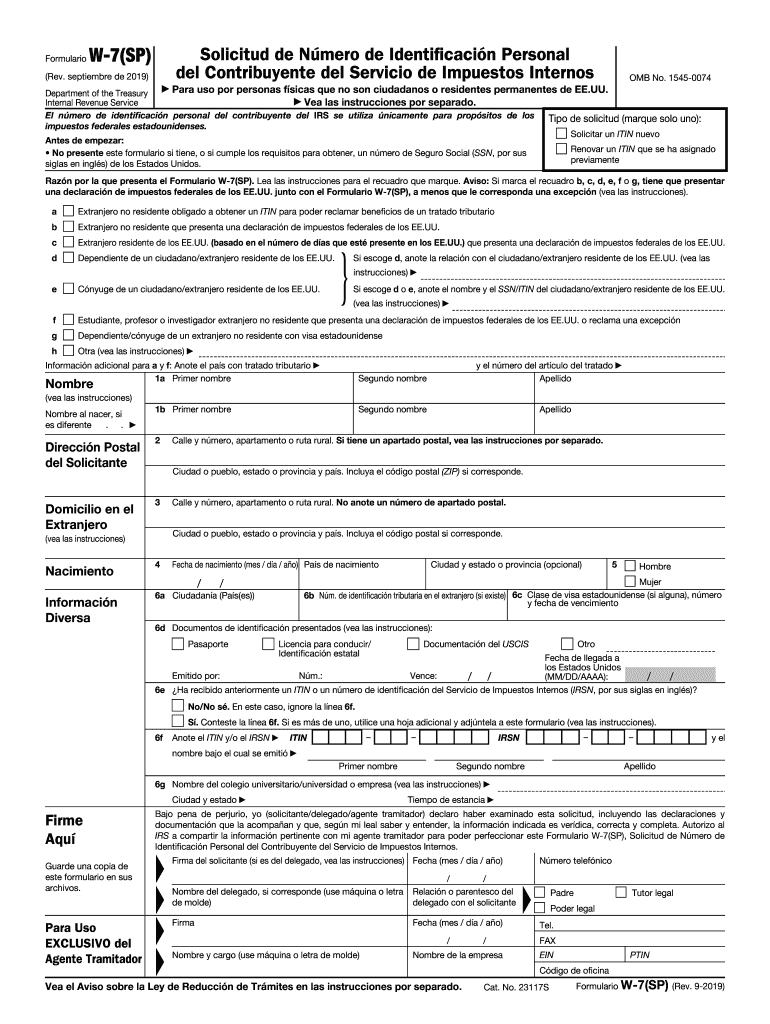

The W-7 form, also known as the Application for IRS Individual Taxpayer Identification Number (ITIN), is used by individuals who are not eligible for a Social Security number but need to file a U.S. tax return. This form is essential for non-resident aliens, their spouses, and dependents who require an ITIN for tax purposes. The W-7 form allows these individuals to comply with U.S. tax laws while ensuring they can report their income accurately.

Steps to Complete the W-7 Form

Completing the W-7 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including proof of identity and foreign status. Next, fill out the W-7 form, providing personal information such as your name, mailing address, and the reason for needing an ITIN. After completing the form, review it for any errors. Finally, submit the W-7 form along with your tax return or as a standalone application, depending on your situation.

Legal Use of the W-7 Form

The W-7 form is legally recognized by the IRS for obtaining an ITIN, which is crucial for fulfilling tax obligations. It is important to use the W-7 form correctly to avoid delays or issues with tax filings. The form must be submitted with valid documentation that proves both identity and foreign status, ensuring compliance with IRS regulations. Understanding the legal requirements surrounding the W-7 form can help individuals navigate the application process more effectively.

Required Documents for the W-7 Form

When applying for an ITIN using the W-7 form, specific documents must be submitted to verify identity and foreign status. Acceptable documents include a valid passport, national identification card, or birth certificate, among others. Each document must be current and contain your name and photograph. It is essential to provide original documents or certified copies, as the IRS requires verification to process your application.

Form Submission Methods

The W-7 form can be submitted through various methods, including online, by mail, or in person at designated IRS offices. When submitting by mail, ensure that all required documents are included to avoid processing delays. If you choose to submit the form in person, it is advisable to schedule an appointment at an IRS Taxpayer Assistance Center. Understanding these submission methods can help streamline the application process.

IRS Guidelines for the W-7 Form

The IRS provides specific guidelines for completing and submitting the W-7 form. These guidelines outline eligibility criteria, acceptable documentation, and the process for obtaining an ITIN. It is crucial to adhere to these guidelines to ensure that your application is processed efficiently. Familiarizing yourself with the IRS's requirements can help prevent common mistakes that may lead to application rejection.

Quick guide on how to complete form w 7 sp

Effortlessly Prepare Wt 7 Form on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an excellent environmentally friendly option compared to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents quickly and efficiently. Handle Wt 7 Form seamlessly on any platform with the airSlate SignNow Android or iOS applications and simplify your document-centric processes today.

The Easiest Way to Edit and eSign Wt 7 Form

- Locate Wt 7 Form and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with the specific tools that airSlate SignNow provides for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review the information and select the Done button to save your changes.

- Choose your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Wt 7 Form to ensure excellent communication at every step of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 7 sp

How to make an eSignature for your Form W 7 Sp online

How to generate an electronic signature for the Form W 7 Sp in Chrome

How to generate an eSignature for putting it on the Form W 7 Sp in Gmail

How to create an eSignature for the Form W 7 Sp straight from your smart phone

How to create an eSignature for the Form W 7 Sp on iOS

How to make an electronic signature for the Form W 7 Sp on Android OS

People also ask

-

What is the Wt 7 Form and how can it be used with airSlate SignNow?

The Wt 7 Form is designed for businesses to easily manage their tax-related documentation. With airSlate SignNow, you can seamlessly eSign and send the Wt 7 Form, ensuring compliance and security in your document handling process. This integration simplifies tax documentation, making it more efficient for your business.

-

How does airSlate SignNow ensure the security of the Wt 7 Form?

airSlate SignNow prioritizes security by employing advanced encryption technologies to protect your Wt 7 Form and other sensitive documents. All data is securely stored and transmitted, ensuring that your information remains confidential. With our platform, you can confidently manage your Wt 7 Form without worrying about data bsignNowes.

-

Can I customize the Wt 7 Form within airSlate SignNow?

Yes, airSlate SignNow allows you to customize the Wt 7 Form to meet your specific business needs. You can add fields, adjust layouts, and incorporate your branding to make the form uniquely yours. This flexibility ensures that your Wt 7 Form aligns with your processes and enhances user experience.

-

What pricing plans are available for using airSlate SignNow with the Wt 7 Form?

airSlate SignNow offers various pricing plans tailored to fit different business needs, including options for those primarily using the Wt 7 Form. Each plan provides access to essential features for eSigning and document management, allowing you to choose the best fit for your budget. Explore our plans to find the right solution for your Wt 7 Form needs.

-

Is it possible to integrate the Wt 7 Form with other software using airSlate SignNow?

Absolutely! airSlate SignNow supports integrations with numerous applications, allowing you to connect the Wt 7 Form with your preferred software. This functionality streamlines your workflow and enhances productivity by enabling your team to manage documents effortlessly across platforms.

-

What are the key benefits of using airSlate SignNow for the Wt 7 Form?

Using airSlate SignNow for the Wt 7 Form provides numerous benefits, including increased efficiency through eSigning, enhanced security for sensitive information, and improved compliance with tax regulations. Additionally, the user-friendly interface simplifies the document management process, making it accessible for all team members.

-

How can I track the status of my Wt 7 Form sent through airSlate SignNow?

With airSlate SignNow, you can easily track the status of your Wt 7 Form in real-time. The platform provides updates on when your document is viewed, signed, or completed, allowing you to stay informed and manage your documentation process effectively. This feature ensures transparency and accountability in your transactions.

Get more for Wt 7 Form

- Adult dnr form nevada

- Application for extension of time water nv form

- How to apply varaince nevada health form

- Acd 31015 2007 form

- Form rpd 41096 2011

- Formula to state crs tax nm 2011

- Rpd 41284 2011 form

- Form h c 1 health care contributions worksheet and form w h t 4 36 quarterly withholding reconciliation and required

Find out other Wt 7 Form

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement