Michigan Law Changes Form W 2 Filing Due Date to January 31

Understanding the Michigan Form 5081 for 2024

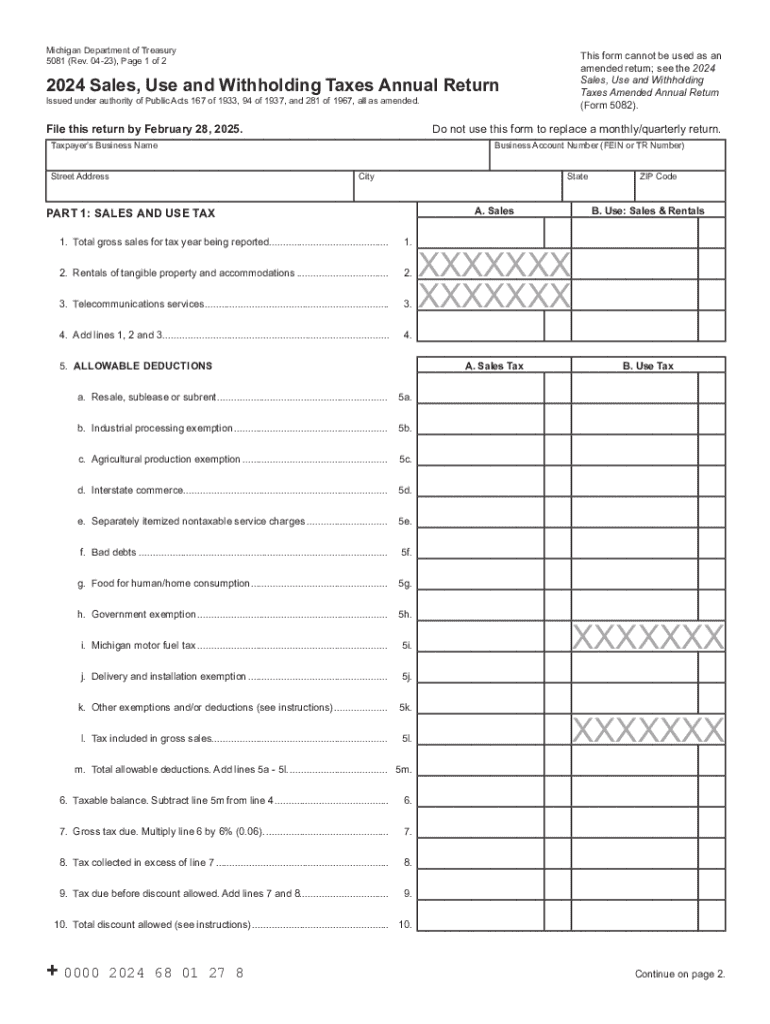

The Michigan Form 5081, also known as the Michigan Sales and Use Tax Annual Return, is a crucial document for businesses operating within the state. This form is used to report sales and use tax liabilities and is essential for compliance with state tax regulations. The 2024 version of this form reflects any updates or changes in tax laws that may affect businesses. It is important for taxpayers to familiarize themselves with the details of this form to ensure accurate reporting and timely submission.

Steps to Complete the Michigan Form 5081 for 2024

Completing the Michigan Form 5081 involves several key steps:

- Gather Required Information: Collect all necessary data, including total sales, taxable sales, and any exemptions.

- Fill Out the Form: Accurately input the gathered information into the designated fields of the form.

- Calculate Tax Liability: Use the provided formulas to determine the total sales tax owed based on your reported figures.

- Review the Form: Double-check all entries for accuracy to avoid potential penalties.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person.

Filing Deadlines for the Michigan Form 5081 in 2024

Timely filing of the Michigan Form 5081 is essential to avoid penalties. The due date for the 2024 form is typically set for January 31 of the following year. However, businesses should verify any specific deadlines that may apply to their situation. Staying informed about these dates helps ensure compliance and avoids unnecessary fees.

Form Submission Methods for the Michigan Form 5081

Taxpayers have several options for submitting the Michigan Form 5081:

- Online Submission: Many businesses prefer to file electronically through the Michigan Department of Treasury's online portal.

- Mail Submission: The completed form can be printed and sent via postal service to the appropriate address provided by the state.

- In-Person Submission: Taxpayers may also choose to deliver the form directly to a local treasury office.

Penalties for Non-Compliance with the Michigan Form 5081

Failure to file the Michigan Form 5081 on time can result in significant penalties. These penalties may include fines based on the amount of tax owed and could escalate if the form remains unfiled. It is vital for businesses to adhere to filing deadlines and ensure that all information is accurate to avoid these consequences.

Eligibility Criteria for Filing the Michigan Form 5081

Eligibility to file the Michigan Form 5081 typically applies to businesses that are registered to collect sales and use taxes in Michigan. This includes retailers, wholesalers, and service providers who meet certain sales thresholds. Understanding the eligibility requirements is essential for compliance and proper tax reporting.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan law changes form w 2 filing due date to january 31

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 5081 Michigan 2024?

The form 5081 Michigan 2024 is a document required for specific administrative processes in Michigan. It is essential for businesses and individuals to understand its requirements to ensure compliance. Using airSlate SignNow can simplify the process of filling and submitting this form electronically.

-

How can airSlate SignNow help with the form 5081 Michigan 2024?

airSlate SignNow provides an easy-to-use platform for completing and eSigning the form 5081 Michigan 2024. Our solution streamlines the document workflow, allowing users to fill out the form quickly and securely. This ensures that you can submit your form efficiently without any hassle.

-

What are the pricing options for using airSlate SignNow for form 5081 Michigan 2024?

airSlate SignNow offers flexible pricing plans to accommodate various business needs when handling the form 5081 Michigan 2024. Our plans are designed to be cost-effective, ensuring that you get the best value for your investment. You can choose from monthly or annual subscriptions based on your usage requirements.

-

Are there any features specifically for the form 5081 Michigan 2024?

Yes, airSlate SignNow includes features tailored for the form 5081 Michigan 2024, such as customizable templates and automated workflows. These features help users efficiently manage their document processes. Additionally, you can track the status of your submissions in real-time.

-

What benefits does airSlate SignNow offer for managing the form 5081 Michigan 2024?

Using airSlate SignNow for the form 5081 Michigan 2024 offers numerous benefits, including increased efficiency and reduced paperwork. Our platform enhances collaboration by allowing multiple users to work on the document simultaneously. This leads to faster processing times and improved accuracy.

-

Can I integrate airSlate SignNow with other tools for the form 5081 Michigan 2024?

Absolutely! airSlate SignNow supports integrations with various applications, making it easier to manage the form 5081 Michigan 2024 alongside your existing tools. This seamless integration helps streamline your workflow and enhances productivity by connecting all your essential applications.

-

Is airSlate SignNow secure for handling the form 5081 Michigan 2024?

Yes, airSlate SignNow prioritizes security when handling the form 5081 Michigan 2024. Our platform employs advanced encryption and compliance measures to protect your sensitive information. You can trust that your documents are safe and secure throughout the signing process.

Get more for Michigan Law Changes Form W 2 Filing Due Date To January 31

Find out other Michigan Law Changes Form W 2 Filing Due Date To January 31

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document