Mi Tax 5081 Form Fill Out and Sign Printable

Understanding the Michigan Form 5081

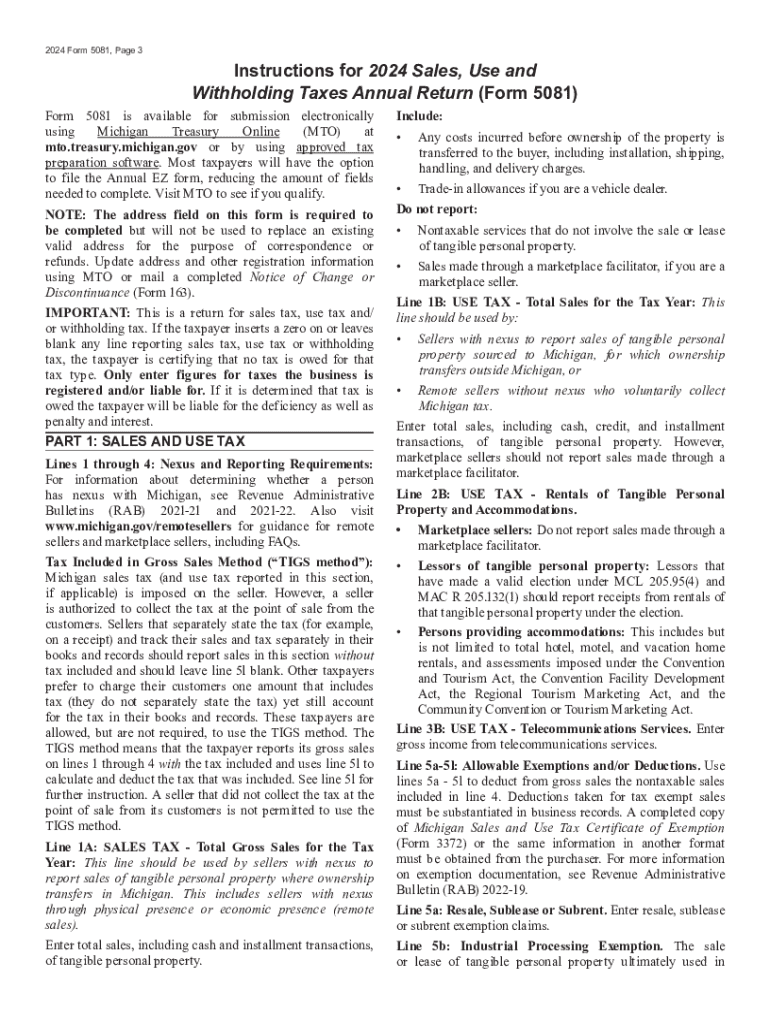

The Michigan Form 5081, also known as the MI Form 5081 tax annual, is a crucial document for taxpayers in Michigan. This form is primarily used for reporting and remitting use tax, which is applicable to purchases made outside of Michigan that are brought into the state for use. It is essential for individuals and businesses who have made taxable purchases without paying Michigan sales tax at the time of purchase.

This form is particularly relevant for those who may have purchased items online or from out-of-state vendors. By filing the MI Form 5081, taxpayers ensure compliance with state tax laws and avoid potential penalties for non-compliance.

Steps to Complete the Michigan Form 5081

Filling out the Michigan Form 5081 involves several straightforward steps. Begin by gathering all necessary information regarding your purchases, including receipts and invoices that detail the items bought, their costs, and the sales tax that was not paid. Follow these steps to complete the form:

- Provide your personal information, including name, address, and taxpayer identification number.

- List the items purchased that are subject to use tax, along with their purchase prices.

- Calculate the total use tax due based on the applicable tax rate.

- Sign and date the form to certify that the information is accurate.

Once the form is completed, it can be submitted either online or via mail, depending on your preference.

Obtaining the Michigan Form 5081

The MI Form 5081 can be easily obtained through the Michigan Department of Treasury's official website. It is available as a printable document, allowing taxpayers to fill it out manually or digitally. For those who prefer a digital format, the form is also available in a fillable PDF format, which can simplify the process of completing and signing the document.

Additionally, many tax preparation software programs may include the MI Form 5081, enabling users to complete their tax filings electronically.

Filing Deadlines for the Michigan Form 5081

It is important to be aware of the filing deadlines associated with the MI Form 5081 to avoid penalties. Typically, the form must be filed by April 15 of the year following the tax year in which the purchases were made. If April 15 falls on a weekend or holiday, the due date may be extended to the next business day. Taxpayers should keep this timeline in mind to ensure timely compliance.

Legal Use of the Michigan Form 5081

The MI Form 5081 is legally mandated for reporting use tax in Michigan. Failure to file this form can result in penalties and interest on unpaid taxes. It is essential for individuals and businesses to understand their obligations under Michigan tax law, particularly if they have made significant purchases that may be subject to use tax. Filing the form accurately and on time helps maintain compliance with state regulations.

Key Elements of the Michigan Form 5081

When filling out the MI Form 5081, several key elements must be included:

- Taxpayer Information: Name, address, and taxpayer identification number.

- Purchase Details: A description of the items purchased, including the date of purchase and the total cost.

- Tax Calculation: The total amount of use tax owed based on the purchase price.

- Signature: A declaration that the information provided is true and accurate.

Ensuring that all these elements are correctly filled out is vital for the processing of the form.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mi tax 5081 form fill out and sign printable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MI Form 5081 tax annual and why is it important?

The MI Form 5081 tax annual is a crucial document for Michigan taxpayers, as it summarizes annual tax information. Completing this form accurately ensures compliance with state tax regulations and helps avoid penalties. Understanding its requirements can simplify your tax filing process.

-

How can airSlate SignNow help with the MI Form 5081 tax annual?

airSlate SignNow provides an efficient platform for electronically signing and sending the MI Form 5081 tax annual. With its user-friendly interface, you can easily manage your documents and ensure they are securely signed and submitted on time. This streamlines your tax preparation process.

-

What features does airSlate SignNow offer for handling tax documents like the MI Form 5081?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like the MI Form 5081 tax annual. These features enhance efficiency and ensure that all necessary signatures are obtained promptly.

-

Is airSlate SignNow cost-effective for small businesses needing to file the MI Form 5081 tax annual?

Yes, airSlate SignNow is a cost-effective solution for small businesses that need to file the MI Form 5081 tax annual. With flexible pricing plans, businesses can choose a package that fits their budget while still accessing essential features for document management and eSigning.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, making it easier to manage the MI Form 5081 tax annual alongside your other financial documents. This integration helps streamline your workflow and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for the MI Form 5081 tax annual?

Using airSlate SignNow for the MI Form 5081 tax annual offers numerous benefits, including increased efficiency, enhanced security, and reduced paper usage. The platform allows for quick document turnaround, ensuring that your tax filings are completed on time and with minimal hassle.

-

How secure is airSlate SignNow when handling sensitive tax documents like the MI Form 5081?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax documents like the MI Form 5081 tax annual. You can trust that your information is safe and secure while using our platform for eSigning and document management.

Get more for Mi Tax 5081 Form Fill Out And Sign Printable

- Sample letter for review of answers and objections to plaintiffs 2nd set of interrogatories form

- Sample letter audit form

- Trial list exhibits form

- Draft proposed order form

- Sample letter settlement 497333969 form

- How to write in a letter form

- Sample letter tax 497333971 form

- Letter settlement offer 497333972 form

Find out other Mi Tax 5081 Form Fill Out And Sign Printable

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later