All Tax FormsDepartment of Revenue Georgia Gov

What is the Georgia State Withholding Form?

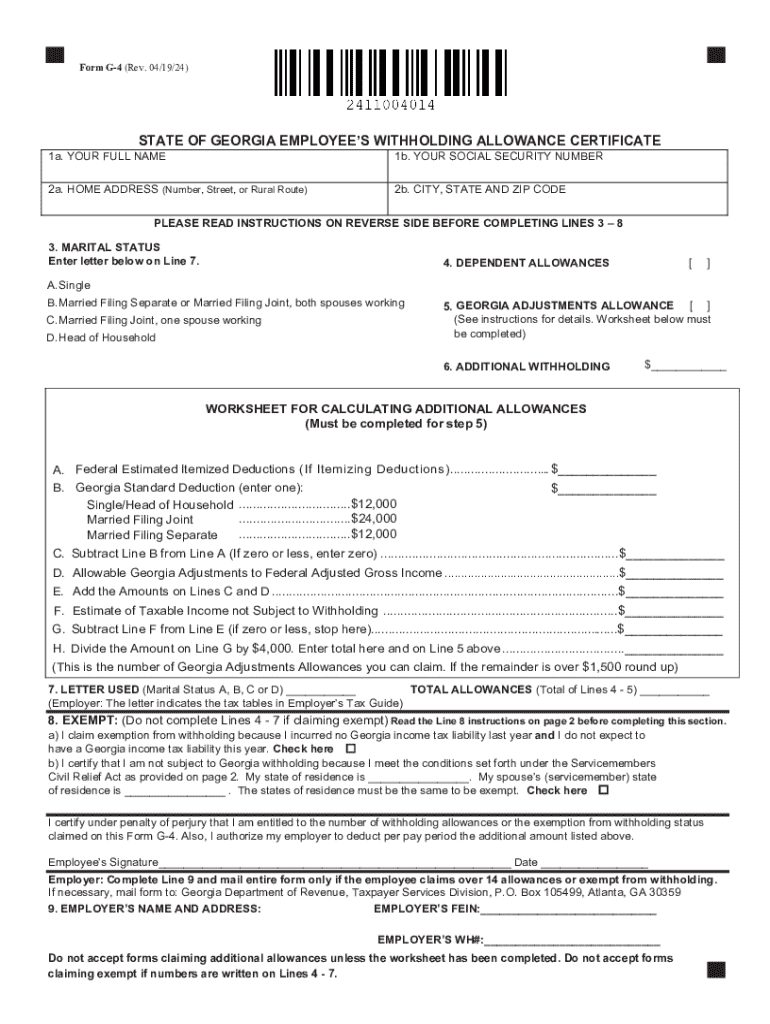

The Georgia State Withholding Form, commonly referred to as the G-4 form, is a crucial document used by employers to determine the amount of state income tax to withhold from employees' paychecks. This form is essential for ensuring compliance with Georgia tax laws and helps employees manage their tax obligations effectively. The G-4 form allows employees to specify their withholding preferences based on personal circumstances, such as marital status and number of allowances claimed.

Steps to Complete the Georgia G-4 Form

Completing the Georgia G-4 form involves several straightforward steps:

- Obtain the G-4 form from the Georgia Department of Revenue website or from your employer.

- Fill out personal information, including your name, address, and Social Security number.

- Indicate your filing status, such as single, married, or head of household.

- Claim the number of allowances you wish to take, which affects your withholding amount.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to your employer for processing.

Required Documents for Filing

When completing the Georgia G-4 form, you may need the following documents:

- Your Social Security number.

- Personal identification, such as a driver's license or state ID.

- Information about your spouse and dependents, if applicable.

- Previous tax returns or W-2 forms for reference.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines for the Georgia G-4 form to avoid penalties. Generally, employees should submit their G-4 forms to their employers at the start of employment or whenever there is a change in their withholding preferences. Employers are responsible for withholding the appropriate amount from each paycheck based on the information provided on the G-4 form.

Legal Use of the Georgia G-4 Form

The Georgia G-4 form is legally required for all employers operating in the state of Georgia. Employers must ensure that they withhold the correct amount of state income tax from employees' wages based on the information provided in the G-4 form. Failure to comply with these regulations can result in penalties for both employers and employees.

Examples of Using the Georgia G-4 Form

There are various scenarios in which the Georgia G-4 form is utilized:

- A new employee fills out the G-4 form upon hiring to establish their tax withholding preferences.

- An employee who gets married may need to update their G-4 form to reflect their new marital status and adjust their allowances.

- A worker who has a child may claim additional allowances on their G-4 form to reduce their tax withholding.

Penalties for Non-Compliance

Failure to submit the Georgia G-4 form or to withhold the correct amount of state income tax can lead to significant penalties. Employers may face fines from the Georgia Department of Revenue, and employees may owe back taxes plus interest if insufficient withholding occurs. It is crucial for both parties to ensure compliance with state tax laws to avoid these consequences.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the all tax formsdepartment of revenue georgia gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to the Georgia?

airSlate SignNow is a powerful eSignature solution that enables businesses in Georgia to send and sign documents electronically. It streamlines the signing process, making it faster and more efficient. With its user-friendly interface, companies in Georgia can easily manage their document workflows.

-

What are the pricing options for airSlate SignNow in Georgia?

airSlate SignNow offers flexible pricing plans tailored for businesses in Georgia. Whether you are a small startup or a large enterprise, there is a plan that fits your needs. You can choose from monthly or annual subscriptions, ensuring you get the best value for your investment.

-

What features does airSlate SignNow provide for users in Georgia?

airSlate SignNow includes a variety of features designed to enhance document management for users in Georgia. Key features include customizable templates, real-time tracking, and secure cloud storage. These tools help businesses streamline their operations and improve productivity.

-

How can airSlate SignNow benefit businesses in Georgia?

Businesses in Georgia can benefit from airSlate SignNow by reducing the time and costs associated with traditional document signing. The platform enhances efficiency, allowing teams to focus on core activities rather than paperwork. Additionally, it ensures compliance with legal standards, providing peace of mind.

-

Does airSlate SignNow integrate with other software commonly used in Georgia?

Yes, airSlate SignNow seamlessly integrates with various software applications that are popular among businesses in Georgia. This includes CRM systems, cloud storage services, and productivity tools. These integrations help create a cohesive workflow, enhancing overall efficiency.

-

Is airSlate SignNow secure for businesses operating in Georgia?

Absolutely, airSlate SignNow prioritizes security for its users in Georgia. The platform employs advanced encryption and complies with industry standards to protect sensitive information. Businesses can confidently use airSlate SignNow knowing their data is secure.

-

Can airSlate SignNow help with compliance in Georgia?

Yes, airSlate SignNow assists businesses in Georgia with compliance by providing legally binding eSignatures that meet state and federal regulations. The platform keeps detailed audit trails and timestamps for every document, ensuring that businesses can easily demonstrate compliance when needed.

Get more for All Tax FormsDepartment Of Revenue Georgia gov

- Subsidiary corporation form

- Jury instruction 10102 debt vs equity form

- Employee contractor tax form

- Jury instruction 10106 section 6672 penalty form

- Jury instruction 11111 general instruction form

- Gml 239 referral notice onondaga county form

- 1form 20gsee rule 613 2licence to sell stoc

- Usps form 3996

Find out other All Tax FormsDepartment Of Revenue Georgia gov

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online