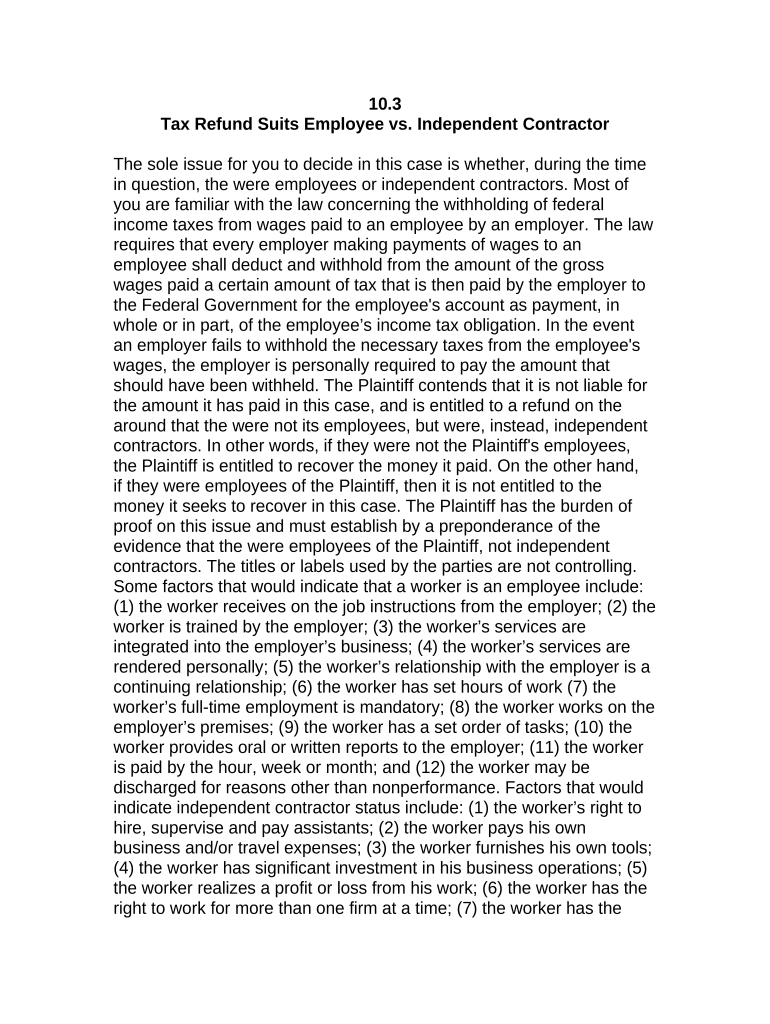

Employee Contractor Tax Form

What is the Employee Contractor Tax

The Employee Contractor Tax pertains to the tax obligations of individuals classified as independent contractors or self-employed individuals. This tax is essential for those who earn income outside of traditional employment, such as freelancers or gig workers. The Employee Contractor Tax includes various components, such as income tax and self-employment tax, which are crucial for reporting earnings accurately to the IRS. Understanding this tax helps individuals comply with federal regulations and avoid potential penalties.

Steps to Complete the Employee Contractor Tax

Completing the Employee Contractor Tax involves several key steps to ensure accurate reporting and compliance. Here are the main steps:

- Gather necessary documents: Collect all relevant financial documents, including 1099 forms, invoices, and records of expenses.

- Calculate total income: Sum all income earned as an independent contractor for the tax year.

- Deduct eligible expenses: Identify and deduct business-related expenses to lower taxable income.

- Complete the appropriate tax forms: Fill out the necessary IRS forms, such as Schedule C for reporting income and expenses.

- File your taxes: Submit your completed forms electronically or by mail before the tax deadline.

Legal Use of the Employee Contractor Tax

The legal use of the Employee Contractor Tax is governed by IRS regulations that outline how independent contractors should report their income and pay taxes. Compliance with these regulations is crucial to avoid audits and penalties. Independent contractors must ensure they are accurately classifying their income and expenses, maintaining proper documentation, and filing their taxes on time. This legal framework provides protection for both the taxpayer and the government, ensuring fair tax practices.

IRS Guidelines

The IRS provides specific guidelines for independent contractors regarding the Employee Contractor Tax. These guidelines include information on how to classify income, what constitutes deductible expenses, and the filing process. Independent contractors must familiarize themselves with these guidelines to ensure compliance. The IRS also offers resources, such as publications and online tools, to assist in understanding tax obligations and responsibilities.

Filing Deadlines / Important Dates

Filing deadlines for the Employee Contractor Tax are critical for compliance. Typically, independent contractors must file their taxes by April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may shift. It is essential for independent contractors to be aware of these dates to avoid late penalties. Additionally, estimated tax payments may be required quarterly, with specific deadlines for each payment.

Required Documents

To complete the Employee Contractor Tax accurately, certain documents are necessary. These include:

- Form 1099-MISC or 1099-NEC, which reports non-employee compensation.

- Receipts and invoices for business expenses.

- Bank statements and financial records to verify income.

- Previous year’s tax return for reference.

Having these documents organized and readily available will streamline the tax filing process and help ensure accuracy.

Quick guide on how to complete employee contractor tax

Effortlessly Prepare Employee Contractor Tax on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your files swiftly without delays. Manage Employee Contractor Tax on any platform utilizing airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and eSign Employee Contractor Tax with Ease

- Obtain Employee Contractor Tax and click on Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Employee Contractor Tax to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the significance of the 10 103 3 form in airSlate SignNow?

The 10 103 3 form is essential for businesses that require a streamlined process for document signing. airSlate SignNow simplifies the eSigning of this form, ensuring compliance and efficiency in handling official documents. Our platform allows users to manage the 10 103 3 form effortlessly and securely.

-

How does airSlate SignNow help businesses with the 10 103 3 form?

airSlate SignNow provides a user-friendly interface for sending, signing, and managing the 10 103 3 form. This solution reduces paperwork, saves time, and enhances productivity by automating the signing process. With our platform, businesses can handle the 10 103 3 with ease and confidence.

-

What are the pricing options for using airSlate SignNow with the 10 103 3 form?

airSlate SignNow offers various pricing plans tailored to the needs of different businesses, including options for handling the 10 103 3 form. We focus on providing a cost-effective solution that scales with your business requirements while ensuring that you have the features necessary to manage your documents efficiently.

-

Are there any integrations available for managing the 10 103 3 form?

Yes, airSlate SignNow integrates seamlessly with numerous applications to facilitate the management of the 10 103 3 form. Whether you use CRM systems, cloud storage, or workflow automation tools, our platform connects with them to enhance your document management process. This integration provides flexibility and boosts overall efficiency.

-

What features does airSlate SignNow offer for signing the 10 103 3 form?

airSlate SignNow includes a range of features specifically designed for signing the 10 103 3 form, such as customizable templates, secure cloud storage, and real-time tracking of document status. Additionally, our solution supports multiple signing options, including in-person and electronic signatures, making it versatile for various business needs.

-

How does airSlate SignNow ensure security for the 10 103 3 form?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like the 10 103 3 form. We employ industry-leading encryption methods and compliance protocols to protect your data. Our platform ensures that all transactions involving the 10 103 3 form are secure and trustworthy.

-

Can I customize the 10 103 3 form within airSlate SignNow?

Absolutely! airSlate SignNow allows users to create customizable templates for the 10 103 3 form, tailored to your specific business needs. This flexibility ensures that every document aligns with your branding and operational requirements while streamlining the signing process.

Get more for Employee Contractor Tax

Find out other Employee Contractor Tax

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later