FINAL DRAFT 10124 *241661* Schedule M1C, Non Form

What is the FINAL DRAFT 10124 *241661* Schedule M1C, Non

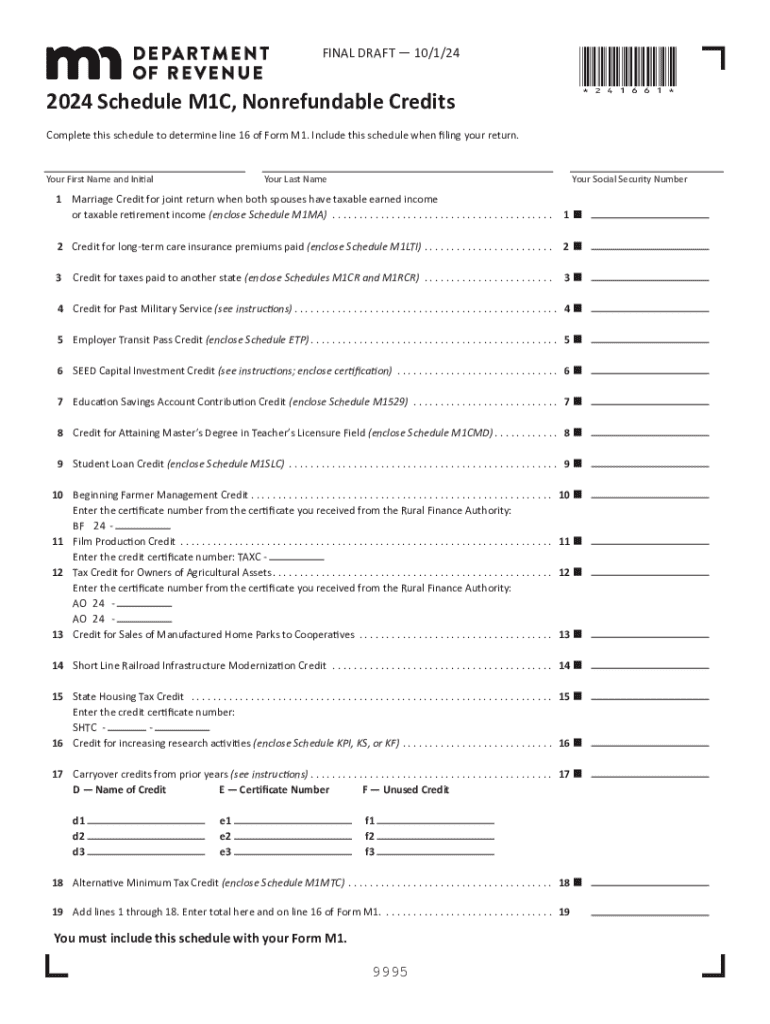

The FINAL DRAFT 10124 *241661* Schedule M1C, Non is a specific tax form used in the United States. This form is typically associated with reporting certain types of income or deductions that are not included in the standard tax return. It is essential for individuals or businesses that need to provide additional information to the IRS regarding their financial activities. Understanding the purpose of this form is crucial for accurate tax filing and compliance with federal regulations.

How to use the FINAL DRAFT 10124 *241661* Schedule M1C, Non

Using the FINAL DRAFT 10124 *241661* Schedule M1C, Non involves several steps to ensure proper completion and submission. First, gather all necessary financial documents and information relevant to the specific income or deductions you are reporting. Next, carefully fill out the form, ensuring that all entries are accurate and complete. After completing the form, review it for any errors before submitting it to the IRS. It is advisable to keep a copy of the completed form for your records.

Steps to complete the FINAL DRAFT 10124 *241661* Schedule M1C, Non

To complete the FINAL DRAFT 10124 *241661* Schedule M1C, Non, follow these steps:

- Gather all relevant financial documents, including income statements and previous tax returns.

- Begin filling out the form by entering your personal information, such as your name and Social Security number.

- Provide details about the specific income or deductions you are reporting in the designated sections of the form.

- Double-check all entries for accuracy, ensuring that calculations are correct.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the FINAL DRAFT 10124 *241661* Schedule M1C, Non. Typically, this form must be submitted by the same deadline as your federal tax return. For most taxpayers, this date is April fifteenth of each year. However, if you are granted an extension for your tax return, the deadline for submitting this form may also be extended. Always verify the current year's deadlines to avoid penalties.

Legal use of the FINAL DRAFT 10124 *241661* Schedule M1C, Non

The legal use of the FINAL DRAFT 10124 *241661* Schedule M1C, Non is primarily to ensure compliance with federal tax laws. This form allows taxpayers to accurately report additional income or deductions that are not captured in their main tax return. Failing to use this form when required can lead to legal repercussions, including fines or audits by the IRS. Therefore, it is essential to understand when and how to use this form to maintain compliance with tax regulations.

Required Documents

When preparing to complete the FINAL DRAFT 10124 *241661* Schedule M1C, Non, certain documents are required for accurate reporting. These may include:

- W-2 forms from employers, if applicable.

- 1099 forms for any freelance or contract work.

- Receipts or documentation for deductions being claimed.

- Previous tax returns for reference.

Having these documents on hand will facilitate a smoother completion process.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the final draft 10124 241661 schedule m1c non

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FINAL DRAFT 10124 *241661* Schedule M1C, Non?

The FINAL DRAFT 10124 *241661* Schedule M1C, Non is a specific document used for tax reporting purposes. It helps businesses accurately report their financial information to comply with regulatory requirements. Understanding this document is crucial for ensuring proper tax filings.

-

How can airSlate SignNow help with the FINAL DRAFT 10124 *241661* Schedule M1C, Non?

airSlate SignNow provides an efficient platform for businesses to create, send, and eSign the FINAL DRAFT 10124 *241661* Schedule M1C, Non. Our user-friendly interface simplifies the document management process, ensuring that your tax documents are handled securely and efficiently.

-

What are the pricing options for using airSlate SignNow for the FINAL DRAFT 10124 *241661* Schedule M1C, Non?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various businesses. Whether you are a small business or a large enterprise, you can find a plan that fits your budget while providing the necessary features for managing the FINAL DRAFT 10124 *241661* Schedule M1C, Non.

-

What features does airSlate SignNow offer for document management?

With airSlate SignNow, you can enjoy features such as customizable templates, secure eSigning, and real-time tracking for the FINAL DRAFT 10124 *241661* Schedule M1C, Non. These features enhance your document workflow, making it easier to manage and complete important tax documents.

-

Is airSlate SignNow compliant with legal standards for the FINAL DRAFT 10124 *241661* Schedule M1C, Non?

Yes, airSlate SignNow is fully compliant with legal standards for electronic signatures and document management. This ensures that your FINAL DRAFT 10124 *241661* Schedule M1C, Non is legally binding and meets all regulatory requirements.

-

Can I integrate airSlate SignNow with other software for managing the FINAL DRAFT 10124 *241661* Schedule M1C, Non?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to streamline your workflow for the FINAL DRAFT 10124 *241661* Schedule M1C, Non. This integration capability enhances productivity and ensures that all your tools work together efficiently.

-

What are the benefits of using airSlate SignNow for the FINAL DRAFT 10124 *241661* Schedule M1C, Non?

Using airSlate SignNow for the FINAL DRAFT 10124 *241661* Schedule M1C, Non provides numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform simplifies the eSigning process, allowing you to focus on your business while ensuring compliance with tax regulations.

Get more for FINAL DRAFT 10124 *241661* Schedule M1C, Non

- Written request by contractor to provide list mechanic liens individual new jersey form

- New jersey mechanic form

- File lien form

- Nj husband wife 497319190 form

- Warranty deed from husband and wife to corporation new jersey form

- Divorce worksheet and law summary for contested or uncontested case of over 25 pages ideal client interview form new jersey

- Limited liability company 497319193 form

- New jersey lien 497319194 form

Find out other FINAL DRAFT 10124 *241661* Schedule M1C, Non

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application