Canara Bank Account Opening Form

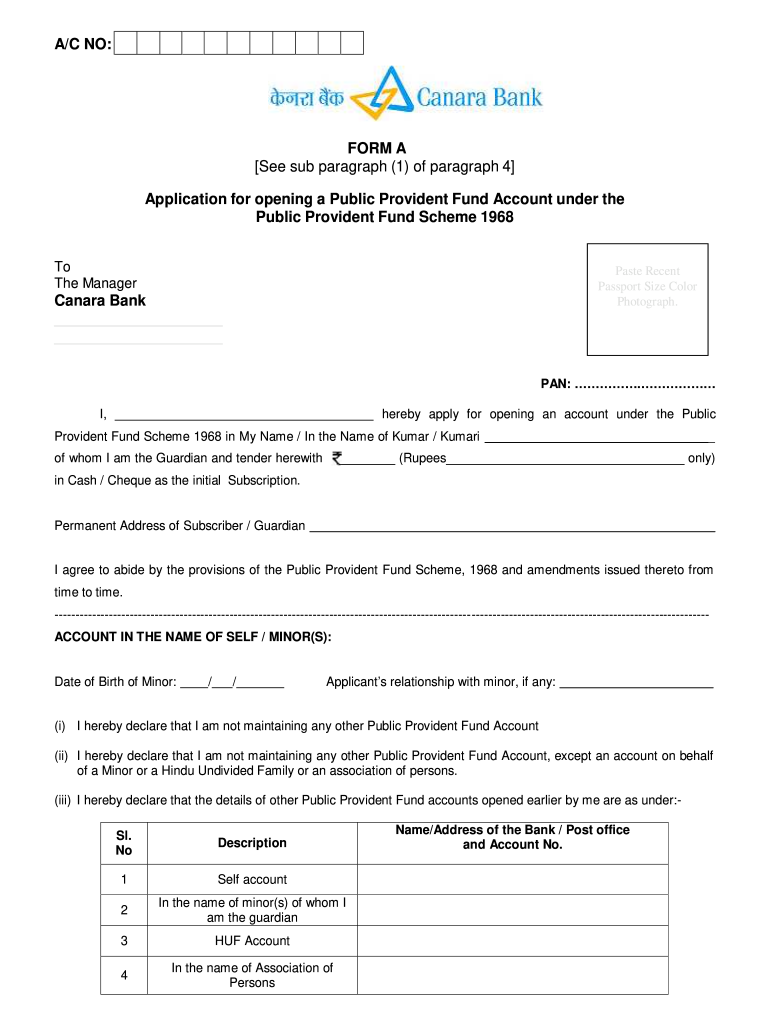

What is the Canara Bank Account Opening Form

The Canara Bank Account Opening Form is a crucial document required for individuals seeking to open a new bank account with Canara Bank. This form collects essential information from the applicant, including personal details such as name, address, date of birth, and identification proof. It also outlines the type of account being opened, whether it's a savings account, current account, or fixed deposit account. Understanding the purpose of this form is vital for ensuring a smooth account opening process.

Steps to complete the Canara Bank Account Opening Form

Completing the Canara Bank Account Opening Form involves several straightforward steps:

- Gather Required Documents: Collect necessary identification documents, such as a government-issued ID, proof of address, and a recent passport-sized photograph.

- Fill Out Personal Information: Accurately provide your personal details in the designated sections of the form, ensuring that all information matches your identification documents.

- Select Account Type: Indicate the type of account you wish to open by checking the appropriate box on the form.

- Sign and Date: Review the completed form for accuracy, then sign and date it to confirm your application.

Legal use of the Canara Bank Account Opening Form

The Canara Bank Account Opening Form serves as a legally binding document once completed and submitted. It is essential for establishing a formal banking relationship between you and the bank. The information provided in this form is used to verify your identity and assess your eligibility for the requested account type. Compliance with all legal requirements ensures that your application is processed without delays or complications.

Required Documents

When filling out the Canara Bank Account Opening Form, you must provide several supporting documents to verify your identity and address. Commonly required documents include:

- Government-issued photo ID (e.g., passport, driver's license)

- Proof of address (e.g., utility bill, lease agreement)

- Passport-sized photographs

Having these documents ready will facilitate a smoother application process and help avoid any potential issues during verification.

How to obtain the Canara Bank Account Opening Form

The Canara Bank Account Opening Form can be obtained through various channels. You can visit your nearest Canara Bank branch to request a physical copy of the form. Additionally, the form may be available for download from the official Canara Bank website, allowing you to fill it out at your convenience. Ensure you are using the most current version of the form to avoid any discrepancies during your application process.

Form Submission Methods (Online / Mail / In-Person)

Once you have completed the Canara Bank Account Opening Form, you can submit it through various methods:

- In-Person: Visit your local Canara Bank branch and submit the form directly to a bank representative.

- Online: If available, you may submit the form electronically through the bank's online banking portal.

- Mail: Some branches may allow you to send the completed form via postal mail. Check with your local branch for specific instructions.

Choosing the right submission method can enhance convenience and ensure timely processing of your application.

Quick guide on how to complete canara bank account opening form

Easily Create Canara Bank Account Opening Form on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally-friendly substitute to conventional printed and signed forms, as you can easily locate the appropriate template and securely store it online. airSlate SignNow equips you with all the necessary tools to design, alter, and electronically sign your documents quickly and without hindrances. Manage Canara Bank Account Opening Form on any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

Steps to Alter and Electronically Sign Canara Bank Account Opening Form with Ease

- Obtain Canara Bank Account Opening Form and click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Canara Bank Account Opening Form and ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the canara bank account opening form

How to generate an eSignature for a PDF file online

How to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

How to make an eSignature for a PDF on Android devices

People also ask

-

What is the application public provident fund and how does it work?

The application public provident fund is a government-backed savings scheme designed to encourage long-term savings among individuals. Users can open an account to contribute regularly, which earns interest over time, helping to build a secure financial future. This application is accessible through various banks and financial institutions.

-

How do I apply for the public provident fund?

To apply for the application public provident fund, you need to visit your chosen bank or financial institution and fill out the required application form. You will also need to submit identification and other necessary documents. Once your application is processed, you'll be able to start making contributions and earning interest.

-

What are the benefits of using the application public provident fund?

Using the application public provident fund offers numerous benefits, such as tax deductions under Section 80C of the Income Tax Act and a fixed interest rate that is often higher than traditional savings accounts. The scheme encourages long-term savings and provides a secure way to build a retirement corpus. Additionally, the investment is safe as it is backed by the government.

-

What is the minimum contribution required for the public provident fund application?

The application public provident fund requires a minimum contribution of Rs. 500 annually. However, there is no maximum limit, allowing individuals to invest as much as they desire. This flexibility can help individuals save according to their financial capabilities.

-

Are there any penalties for early withdrawal from the public provident fund?

Yes, the application public provident fund has restrictions regarding withdrawals. You can make partial withdrawals after a certain period, but early withdrawals before the completion of 15 years may incur penalties. It's essential to plan your withdrawals carefully to avoid any financial penalties.

-

What features does the application public provident fund offer?

The application public provident fund offers key features such as a government-backed interest rate, partial withdrawal options, and tax benefits. Additionally, it provides a secure platform for long-term savings, allowing individuals to contribute regularly without any hassles. These features make it an attractive option for risk-averse investors.

-

Can I integrate my public provident fund application with digital banking services?

Many banks offer seamless integration for the application public provident fund with their digital banking services. This allows users to monitor their contributions, check balances, and manage their accounts online or via mobile apps. Always check with your bank for specific features related to digital integration.

Get more for Canara Bank Account Opening Form

- Assignment of mortgage by individual mortgage holder illinois form

- Assignment of mortgage by corporate mortgage holder illinois form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for residential property illinois form

- Notice of default in payment of rent as warning prior to demand to pay or terminate for nonresidential or commercial property 497306193 form

- Notice of intent to vacate at end of specified lease term from tenant to landlord for residential property illinois form

- Notice of intent to vacate at end of specified lease term from tenant to landlord nonresidential illinois form

- Notice of intent not to renew at end of specified term from landlord to tenant for residential property illinois form

- Notice of intent not to renew at end of specified term from landlord to tenant for nonresidential or commercial property 497306197 form

Find out other Canara Bank Account Opening Form

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word