Get Get MN Form MWR Reciprocity ExemptionAffidavit of

Understanding the Minnesota MWR Reciprocity Exemption Affidavit

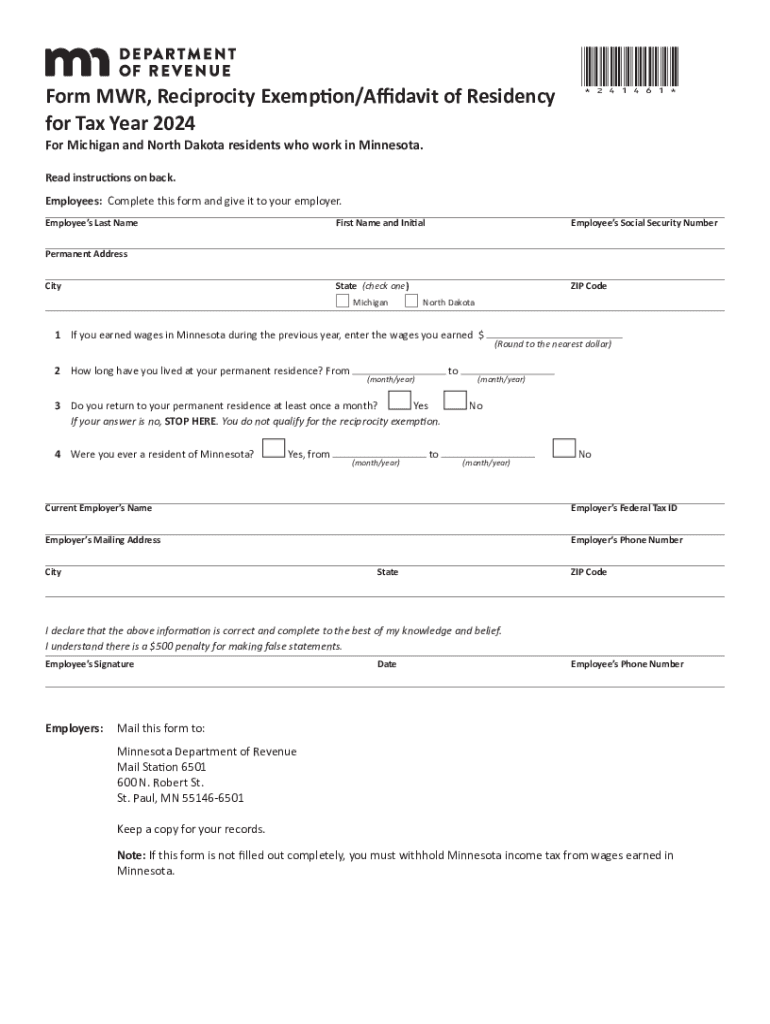

The Minnesota MWR Reciprocity Exemption Affidavit is a crucial document for individuals who work in Minnesota but reside in a neighboring state. This form allows eligible taxpayers to claim an exemption from Minnesota income tax withholding. Understanding the purpose of this affidavit is essential for ensuring compliance and maximizing tax benefits.

Individuals who qualify for this exemption typically reside in states that have reciprocity agreements with Minnesota. These agreements prevent double taxation on income earned in Minnesota by residents of those states. By submitting the MWR form, taxpayers can ensure that only their home state taxes their income, simplifying their tax obligations.

Steps to Complete the Minnesota MWR Reciprocity Exemption Affidavit

Completing the Minnesota MWR Reciprocity Exemption Affidavit involves several straightforward steps. First, gather the necessary personal information, including your name, address, and Social Security number. Next, indicate your residency status and the state where you reside.

After filling out the required fields, ensure that you sign and date the form. It's important to review the completed affidavit for accuracy before submission. Any errors could delay processing or result in withholding issues. Once finalized, submit the form to your employer, who will then adjust your tax withholding accordingly.

Eligibility Criteria for the MWR Reciprocity Exemption

To qualify for the Minnesota MWR Reciprocity Exemption, taxpayers must meet specific eligibility criteria. Primarily, the individual must be a resident of a state that has a reciprocity agreement with Minnesota, such as Wisconsin, Iowa, or North Dakota.

Additionally, the taxpayer must not have any Minnesota source income that is subject to withholding. This means that if you work in Minnesota but live in a reciprocating state, you can apply for this exemption to avoid unnecessary tax deductions from your paycheck.

Required Documents for the MWR Reciprocity Exemption

When applying for the Minnesota MWR Reciprocity Exemption, you will need to provide certain documents to support your claim. These typically include proof of residency in your home state, such as a driver's license or utility bill, which verifies your address.

Additionally, your employer may require identification or other personal information to process the affidavit correctly. Having these documents ready can streamline the submission process and ensure that your exemption is granted without delay.

Filing Deadlines for the MWR Reciprocity Exemption

It is essential to be aware of the filing deadlines associated with the Minnesota MWR Reciprocity Exemption. Generally, the affidavit should be submitted to your employer as soon as you begin working in Minnesota or when your residency status changes.

Employers typically require the form to be submitted before the first paycheck to ensure that the correct amount of tax is withheld. Missing this deadline could result in unnecessary tax deductions, so timely submission is crucial.

Form Submission Methods for the MWR Reciprocity Exemption

The Minnesota MWR Reciprocity Exemption Affidavit can be submitted through various methods. The most common method is to provide a printed copy of the completed form directly to your employer. This ensures they have the necessary information to adjust your tax withholding.

Some employers may also allow electronic submission of the affidavit, depending on their payroll systems. It's advisable to check with your employer regarding their preferred submission method to ensure compliance and proper processing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the get get mn form mwr reciprocity exemptionaffidavit of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 MN form printable?

The 2024 MN form printable refers to the official forms required for various state processes in Minnesota for the year 2024. These forms can be easily downloaded, printed, and filled out for tax filings, applications, and other official purposes. Using airSlate SignNow, you can quickly access and manage these forms digitally.

-

How can I access the 2024 MN form printable through airSlate SignNow?

You can access the 2024 MN form printable by visiting the airSlate SignNow platform and searching for the specific form you need. Our user-friendly interface allows you to find, download, and print the forms with ease. Additionally, you can eSign them directly on the platform.

-

Is there a cost associated with using the 2024 MN form printable on airSlate SignNow?

While accessing the 2024 MN form printable is free, using airSlate SignNow's eSigning features may require a subscription. We offer various pricing plans to suit different business needs, ensuring you get the best value for your document management solutions.

-

What features does airSlate SignNow offer for the 2024 MN form printable?

airSlate SignNow provides a range of features for the 2024 MN form printable, including easy document editing, eSigning, and secure storage. You can also collaborate with team members in real-time, ensuring that all necessary signatures are collected efficiently.

-

Can I integrate airSlate SignNow with other applications for the 2024 MN form printable?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing you to streamline your workflow when handling the 2024 MN form printable. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the 2024 MN form printable?

Using airSlate SignNow for the 2024 MN form printable offers numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform simplifies the signing process, reduces paperwork, and ensures that your documents are stored safely and accessed easily.

-

Is it easy to eSign the 2024 MN form printable with airSlate SignNow?

Absolutely! airSlate SignNow makes it incredibly easy to eSign the 2024 MN form printable. With just a few clicks, you can add your signature, date, and any necessary information, making the process quick and efficient.

Get more for Get Get MN Form MWR Reciprocity ExemptionAffidavit Of

- Nj rental agreement form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants new jersey form

- Nj shut off form

- Nj letter tenant 497319257 form

- New jersey waiver form

- New jersey waiver form

- Notice pay rent 497319262 form

- Notice to pay rent or lease terminates for nonresidential or commercial property days of advance notice variable new jersey form

Find out other Get Get MN Form MWR Reciprocity ExemptionAffidavit Of

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile