M1R, Age 65 or OlderDisabled Subtraction M1R, Age 65 or OlderDisabled Subtraction Form

Understanding the Schedule M1R

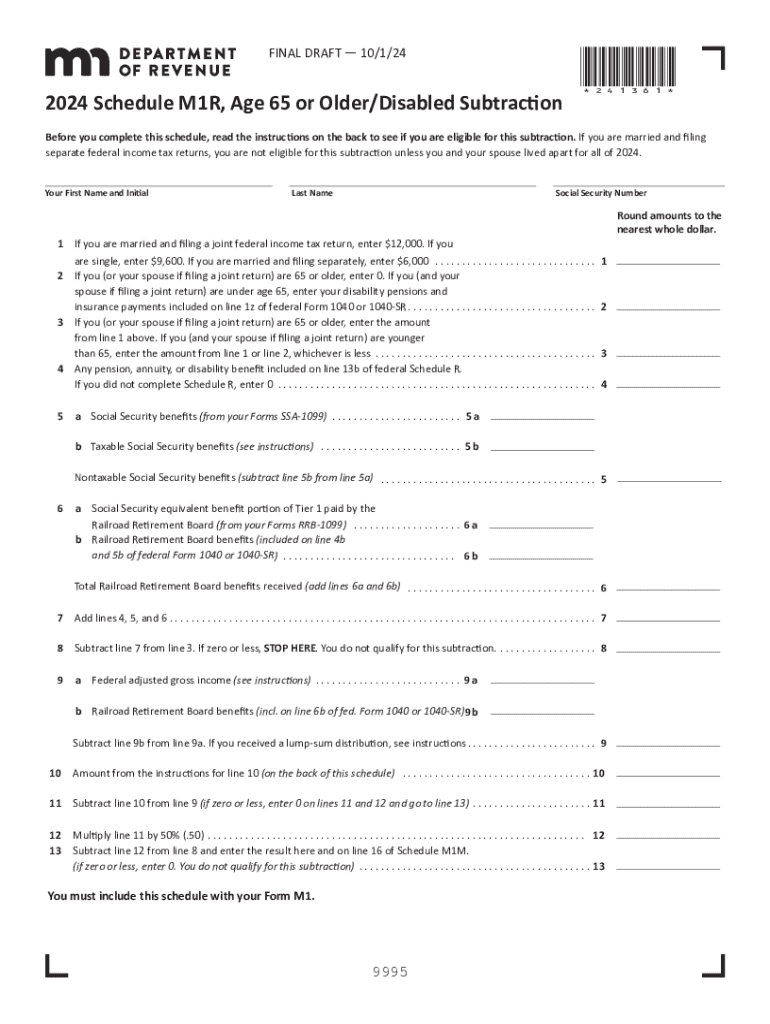

The Schedule M1R is a form used by residents of Minnesota to claim the older adult or disabled subtraction from their taxable income. This subtraction is available to individuals who are age sixty-five or older, or those who are permanently disabled. The purpose of the M1R is to provide tax relief to eligible taxpayers, thereby reducing their overall tax burden. It is essential for individuals who meet these criteria to understand the form's requirements and benefits to ensure they maximize their potential tax savings.

Eligibility Criteria for the M1R

To qualify for the Schedule M1R, taxpayers must meet specific eligibility criteria. Individuals must be at least sixty-five years old or classified as permanently disabled. Additionally, the income limits for claiming this subtraction may vary, so it is crucial to review the current guidelines provided by the Minnesota Department of Revenue. Taxpayers should also ensure they have the necessary documentation to support their claim, such as proof of age or disability status.

Steps to Complete the Schedule M1R

Completing the Schedule M1R involves several straightforward steps. First, gather all relevant financial documents, including income statements and proof of age or disability. Next, fill out the form accurately, ensuring that all required sections are completed. Pay attention to the income limits and specific calculations needed to determine the amount of subtraction. After completing the form, review it for accuracy before submission. Finally, attach the M1R to your Minnesota tax return when filing.

Required Documents for the M1R

When preparing to file the Schedule M1R, taxpayers need to have specific documents on hand. These documents may include:

- Proof of age, such as a birth certificate or government-issued ID.

- Documentation of disability, if applicable, such as a letter from a healthcare provider.

- Income statements, including W-2 forms or 1099s, to verify total income.

Having these documents ready will streamline the filing process and help ensure that the claim is processed without delays.

Form Submission Methods for the M1R

Taxpayers can submit the Schedule M1R through various methods. The form can be filed electronically along with the Minnesota tax return using approved tax software. Alternatively, individuals may choose to mail a paper version of the form to the Minnesota Department of Revenue. It is important to check the submission deadlines to avoid any penalties or issues with processing.

Common Questions About the M1R

Many taxpayers have questions regarding the Schedule M1R. Common inquiries include:

- What happens if I miss the filing deadline?

- Can I amend my M1R after submission?

- How will the subtraction affect my overall tax refund?

Addressing these questions can help taxpayers navigate the process more effectively and ensure they understand the implications of their filings.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m1r age 65 or olderdisabled subtraction m1r age 65 or olderdisabled subtraction

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 schedule m1r for airSlate SignNow?

The 2024 schedule m1r outlines the key features and updates that airSlate SignNow will introduce throughout the year. This schedule ensures that users are aware of new functionalities and enhancements that will improve their eSigning experience. Staying updated with the 2024 schedule m1r allows businesses to leverage the latest tools for efficiency.

-

How much does airSlate SignNow cost in 2024?

Pricing for airSlate SignNow in 2024 varies based on the plan you choose. The 2024 schedule m1r includes competitive pricing options that cater to different business sizes and needs. You can find detailed pricing information on our website to select the best plan for your organization.

-

What features are included in the 2024 schedule m1r?

The 2024 schedule m1r includes a variety of features such as advanced document management, customizable templates, and enhanced security protocols. These features are designed to streamline the eSigning process and improve overall user experience. By utilizing the 2024 schedule m1r, businesses can maximize their productivity.

-

How does airSlate SignNow benefit my business in 2024?

In 2024, airSlate SignNow offers numerous benefits, including increased efficiency, reduced turnaround times, and improved document security. The 2024 schedule m1r highlights how these advantages can help businesses save time and resources. Adopting airSlate SignNow can lead to a more streamlined workflow and better customer satisfaction.

-

Can I integrate airSlate SignNow with other applications in 2024?

Yes, airSlate SignNow supports integrations with various applications in 2024. The 2024 schedule m1r details the compatible platforms, allowing users to connect their existing tools seamlessly. This integration capability enhances productivity by enabling users to manage documents across different systems.

-

Is airSlate SignNow secure for sensitive documents in 2024?

Absolutely, airSlate SignNow prioritizes security, especially for sensitive documents in 2024. The 2024 schedule m1r includes updates on security features such as encryption and compliance with industry standards. Businesses can trust that their documents are protected while using airSlate SignNow.

-

What support options are available for airSlate SignNow users in 2024?

In 2024, airSlate SignNow offers various support options, including live chat, email support, and a comprehensive knowledge base. The 2024 schedule m1r ensures that users have access to resources that can help them troubleshoot issues and maximize their use of the platform. Our dedicated support team is always ready to assist.

Get more for M1R, Age 65 Or OlderDisabled Subtraction M1R, Age 65 Or OlderDisabled Subtraction

Find out other M1R, Age 65 Or OlderDisabled Subtraction M1R, Age 65 Or OlderDisabled Subtraction

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment