FINAL DRAFT 11824 *241331* Schedule M1NR, No Form

Understanding the Minnesota Schedule M1NR

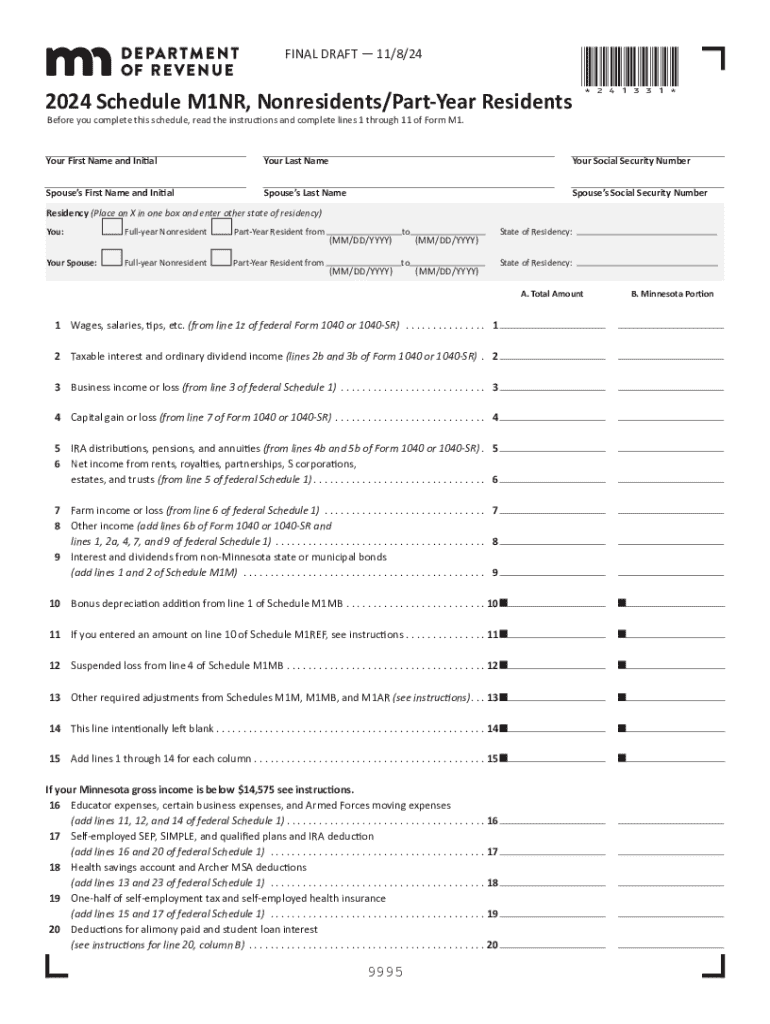

The Minnesota Schedule M1NR is a crucial tax form used by nonresidents to report income earned in Minnesota. This form is essential for individuals who do not reside in Minnesota but have taxable income sourced from the state. It allows taxpayers to accurately calculate their tax liability based on Minnesota's tax laws.

Nonresidents must complete the Schedule M1NR to determine their tax obligations, ensuring compliance with state regulations. The form includes various sections that require detailed information about income, deductions, and credits applicable to nonresidents.

Steps to Complete the Minnesota Schedule M1NR

Completing the Minnesota Schedule M1NR involves several key steps:

- Gather Required Information: Collect all necessary documents, including W-2s, 1099s, and any other income statements relevant to your Minnesota earnings.

- Fill Out Personal Information: Provide your name, address, and Social Security number at the top of the form.

- Report Income: List all income earned in Minnesota, including wages, salaries, and other sources of income.

- Calculate Deductions: Identify any deductions you may qualify for, such as those for business expenses or certain credits.

- Review and Submit: Double-check all entries for accuracy before submitting the form either online or by mail.

Eligibility Criteria for Filing the Schedule M1NR

To be eligible to file the Minnesota Schedule M1NR, you must meet specific criteria:

- You must be a nonresident of Minnesota.

- You must have earned income from Minnesota sources during the tax year.

- You need to have a valid Social Security number or Individual Taxpayer Identification Number (ITIN).

Meeting these criteria ensures that you can accurately report your income and fulfill your tax obligations in Minnesota.

Filing Deadlines for the Minnesota Schedule M1NR

Filing deadlines for the Minnesota Schedule M1NR are typically aligned with federal tax deadlines. For most taxpayers, the due date is April 15 of the year following the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to be aware of these deadlines to avoid penalties and interest on unpaid taxes.

How to Obtain the Minnesota Schedule M1NR

The Minnesota Schedule M1NR can be obtained through the Minnesota Department of Revenue website. It is available as a downloadable PDF form that can be printed and filled out by hand or completed electronically if preferred. Additionally, tax preparation software often includes the Schedule M1NR, simplifying the process for users.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the final draft 11824 241331 schedule m1nr no

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Minnesota schedule interest feature in airSlate SignNow?

The Minnesota schedule interest feature in airSlate SignNow allows users to efficiently manage and track interest calculations on scheduled payments. This feature is particularly beneficial for businesses that need to ensure compliance with Minnesota's financial regulations. By automating these calculations, users can save time and reduce errors in their documentation.

-

How does airSlate SignNow handle pricing for Minnesota schedule interest?

airSlate SignNow offers competitive pricing plans that include features like Minnesota schedule interest. Users can choose from various subscription options based on their business needs, ensuring they only pay for what they use. Additionally, the platform provides a free trial, allowing potential customers to explore the Minnesota schedule interest feature before committing.

-

What are the benefits of using airSlate SignNow for Minnesota schedule interest?

Using airSlate SignNow for Minnesota schedule interest streamlines the document signing process while ensuring accurate interest calculations. This not only enhances efficiency but also improves compliance with state regulations. Businesses can benefit from reduced administrative burdens and faster turnaround times on important documents.

-

Can I integrate airSlate SignNow with other tools for managing Minnesota schedule interest?

Yes, airSlate SignNow offers seamless integrations with various tools and platforms that can help manage Minnesota schedule interest. This includes popular CRM systems, accounting software, and document management solutions. These integrations enhance workflow efficiency and ensure that all aspects of document management are covered.

-

Is airSlate SignNow user-friendly for managing Minnesota schedule interest?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to manage Minnesota schedule interest. The intuitive interface allows users to navigate through features effortlessly, ensuring that even those with minimal technical skills can utilize the platform effectively.

-

What types of documents can I eSign related to Minnesota schedule interest?

With airSlate SignNow, you can eSign a variety of documents related to Minnesota schedule interest, including contracts, agreements, and financial statements. The platform supports multiple document formats, ensuring that you can handle all your signing needs in one place. This versatility is crucial for businesses operating in Minnesota.

-

How secure is airSlate SignNow when handling Minnesota schedule interest documents?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive documents related to Minnesota schedule interest. The platform employs advanced encryption and security protocols to protect your data. Additionally, it complies with industry standards to ensure that your documents remain confidential and secure.

Get more for FINAL DRAFT 11824 *241331* Schedule M1NR, No

- Framing contractor package new jersey form

- Foundation contractor package new jersey form

- Plumbing contractor package new jersey form

- Brick mason contractor package new jersey form

- Roofing contractor package new jersey form

- Electrical contractor package new jersey form

- Sheetrock drywall contractor package new jersey form

- Flooring contractor package new jersey form

Find out other FINAL DRAFT 11824 *241331* Schedule M1NR, No

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template