Form M1

What is the Form M1

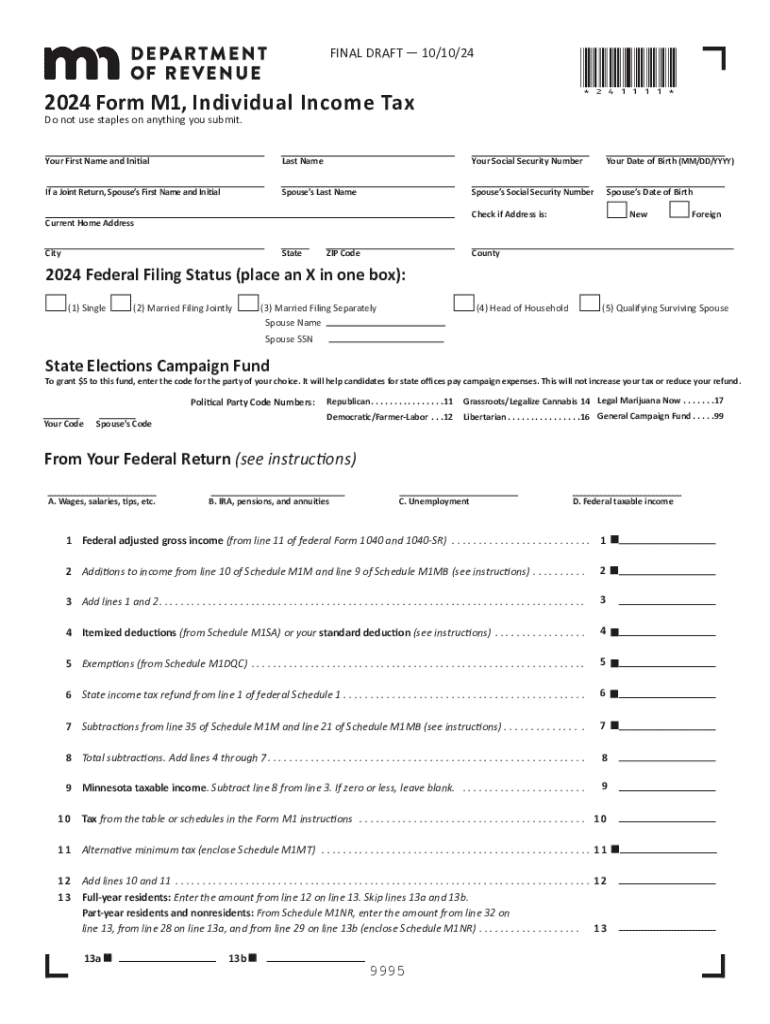

The Form M1 is the Minnesota Individual Income Tax Return, used by residents to report their income and calculate their state tax liability. This form is essential for individuals who earn income within Minnesota, as it allows taxpayers to detail their earnings, claim deductions, and determine any taxes owed or refunds due. The Form M1 is specifically designed for individual taxpayers and is a key component of the state’s tax filing process for the year 2024.

How to obtain the Form M1

The Form M1 can be easily obtained through the Minnesota Department of Revenue's official website. Taxpayers can download the form directly in a printable format. Additionally, physical copies may be available at local government offices, libraries, and post offices throughout Minnesota. It is advisable to ensure that you are using the correct version for the 2024 tax year to avoid any filing issues.

Steps to complete the Form M1

Completing the Form M1 involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring accuracy to avoid discrepancies.

- Claim any eligible deductions and credits to reduce your taxable income.

- Calculate your total tax liability based on the provided tax tables.

- Sign and date the form before submission.

Filing Deadlines / Important Dates

The deadline for filing the Form M1 for the 2024 tax year typically aligns with the federal tax filing deadline. For most taxpayers, this means the form must be submitted by April 15, 2025. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about these dates to ensure timely submission and avoid penalties.

Required Documents

To successfully complete the Form M1, taxpayers should prepare the following documents:

- W-2 forms from employers, detailing wages and tax withheld.

- 1099 forms for any freelance or independent contractor income.

- Records of any other income sources, such as rental income or investment earnings.

- Documentation for deductions, including receipts for medical expenses, charitable contributions, and mortgage interest.

Form Submission Methods

Taxpayers have multiple options for submitting the Form M1:

- Online submission through the Minnesota Department of Revenue’s e-filing system.

- Mailing a completed paper form to the designated address provided in the form instructions.

- In-person submission at local tax offices, if available.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form m1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow for handling mn tax forms 2024?

airSlate SignNow offers a user-friendly platform that simplifies the process of managing mn tax forms 2024. Key features include customizable templates, secure eSignature capabilities, and real-time tracking of document status. These tools ensure that you can efficiently prepare and submit your tax forms without hassle.

-

How does airSlate SignNow ensure the security of my mn tax forms 2024?

Security is a top priority for airSlate SignNow when handling mn tax forms 2024. The platform employs advanced encryption protocols and complies with industry standards to protect your sensitive information. Additionally, you can set access controls and audit trails to monitor who views or edits your documents.

-

Is airSlate SignNow cost-effective for managing mn tax forms 2024?

Yes, airSlate SignNow is a cost-effective solution for managing mn tax forms 2024. With flexible pricing plans, you can choose the option that best fits your business needs without overspending. The value provided by its features often outweighs the costs, making it a smart investment.

-

Can I integrate airSlate SignNow with other tools for mn tax forms 2024?

Absolutely! airSlate SignNow offers seamless integrations with various applications, making it easy to manage mn tax forms 2024 alongside your existing tools. Whether you use CRM systems, cloud storage, or accounting software, you can streamline your workflow and enhance productivity.

-

What benefits does airSlate SignNow provide for small businesses dealing with mn tax forms 2024?

For small businesses, airSlate SignNow simplifies the process of handling mn tax forms 2024, saving time and reducing errors. The platform's intuitive interface allows users to quickly create, send, and sign documents, which is crucial during tax season. Additionally, the cost savings from reduced paper usage and storage can signNowly benefit small operations.

-

How can I get started with airSlate SignNow for mn tax forms 2024?

Getting started with airSlate SignNow for mn tax forms 2024 is easy. Simply sign up for an account on our website, choose a pricing plan that suits your needs, and start creating your tax forms. Our user-friendly interface and helpful resources will guide you through the process.

-

What support options are available for users of airSlate SignNow managing mn tax forms 2024?

airSlate SignNow provides comprehensive support options for users managing mn tax forms 2024. You can access a detailed knowledge base, video tutorials, and customer support via chat or email. Our team is dedicated to helping you resolve any issues quickly and efficiently.

Get more for Form M1

Find out other Form M1

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile