FINAL DRAFT 101242024 Schedule M1ED, K12 Educati Form

Understanding the M1ED Form for K-12 Education

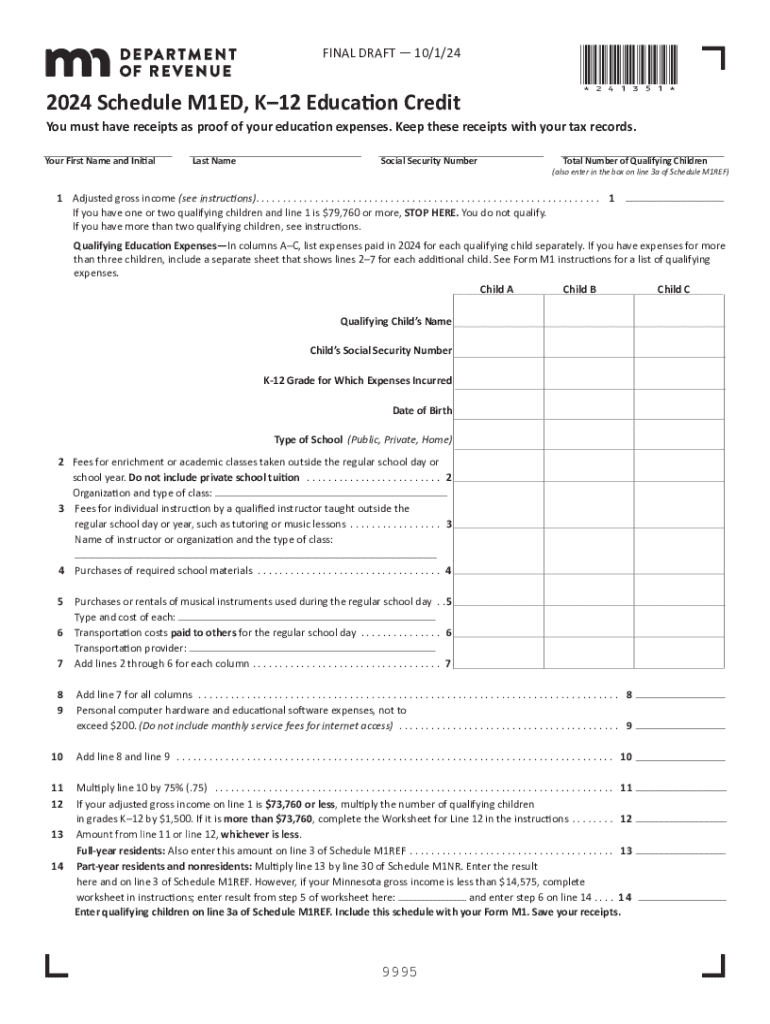

The M1ED form, specifically the FINAL DRAFT 101242024 Schedule M1ED, is designed for K-12 education funding in Minnesota. This form allows eligible taxpayers to claim a credit for qualifying educational expenses. It is essential for educators and parents to understand the purpose of this form as it can significantly impact funding for educational initiatives.

Steps to Complete the M1ED Form

Completing the M1ED form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including receipts for educational expenses. Next, fill out the form with accurate information regarding the taxpayer's details and the educational expenses incurred. It is crucial to double-check all entries for correctness before submission.

Eligibility Criteria for the M1ED Form

To qualify for the M1ED form, taxpayers must meet specific eligibility criteria. This includes being a resident of Minnesota and having incurred educational expenses related to K-12 education. The expenses must be for items such as books, supplies, and other necessary materials for students enrolled in qualifying schools. Understanding these criteria helps ensure that applicants can successfully claim their credits.

Required Documents for Submission

When submitting the M1ED form, certain documents are required to support the claim. These typically include receipts for educational expenses, proof of residency, and any relevant identification numbers. Having these documents ready can streamline the submission process and reduce the likelihood of delays or issues with the claim.

Filing Deadlines for the M1ED Form

It is important to be aware of the filing deadlines associated with the M1ED form. Typically, the form must be submitted by the tax filing deadline for the year in which the educational expenses were incurred. Keeping track of these dates ensures that taxpayers do not miss out on potential credits that could benefit their educational funding.

Submission Methods for the M1ED Form

The M1ED form can be submitted through various methods, including online filing, mail, or in-person submission at designated locations. Each method has its own advantages, such as the convenience of online submission or the personal touch of in-person filing. Taxpayers should choose the method that best suits their needs and preferences.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the final draft 101242024 schedule m1ed k12 educati

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an m1ed form and how does it work?

An m1ed form is a digital document that allows users to collect information and signatures electronically. With airSlate SignNow, you can create, send, and manage m1ed forms seamlessly, ensuring a smooth workflow for your business. This solution simplifies the process of document management and enhances efficiency.

-

How much does it cost to use airSlate SignNow for m1ed forms?

Pricing for airSlate SignNow varies based on the plan you choose, but it is designed to be cost-effective for businesses of all sizes. You can start with a free trial to explore the features related to m1ed forms before committing to a subscription. Our plans offer great value for the capabilities provided.

-

What features are included with m1ed forms in airSlate SignNow?

AirSlate SignNow offers a range of features for m1ed forms, including customizable templates, automated workflows, and real-time tracking of document status. Additionally, you can integrate m1ed forms with other applications to streamline your processes further. These features enhance productivity and ensure compliance.

-

What are the benefits of using m1ed forms for my business?

Using m1ed forms can signNowly improve your business operations by reducing paperwork and speeding up the document signing process. AirSlate SignNow allows for easy collaboration and ensures that all signatures are legally binding. This leads to faster transactions and improved customer satisfaction.

-

Can I integrate m1ed forms with other software?

Yes, airSlate SignNow allows for seamless integration of m1ed forms with various software applications, including CRM systems, cloud storage, and productivity tools. This integration helps centralize your document management and enhances overall workflow efficiency. You can connect with popular platforms like Salesforce and Google Drive.

-

Is it secure to use m1ed forms with airSlate SignNow?

Absolutely! AirSlate SignNow prioritizes security and compliance, ensuring that your m1ed forms are protected with advanced encryption and authentication measures. We adhere to industry standards to safeguard your data, giving you peace of mind while managing sensitive documents.

-

How can I track the status of my m1ed forms?

With airSlate SignNow, you can easily track the status of your m1ed forms in real-time. The platform provides notifications and updates on when documents are viewed, signed, or completed. This feature helps you stay informed and manage your document workflow effectively.

Get more for FINAL DRAFT 101242024 Schedule M1ED, K12 Educati

- Annual minutes new mexico new mexico form

- Notices resolutions simple stock ledger and certificate new mexico form

- Minutes for organizational meeting new mexico new mexico form

- Sample transmittal letter to secretary of states office to file articles of incorporation new mexico new mexico form

- Lead based paint disclosure for sales transaction new mexico form

- Lead based paint disclosure for rental transaction new mexico form

- Notice of lease for recording new mexico form

- Sample cover letter for filing of llc articles or certificate with secretary of state new mexico form

Find out other FINAL DRAFT 101242024 Schedule M1ED, K12 Educati

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation