TC 90CB Renter Refund Application Circuit Breaker Application Forms & Publications

Understanding the TC 90CB Renter Refund Application

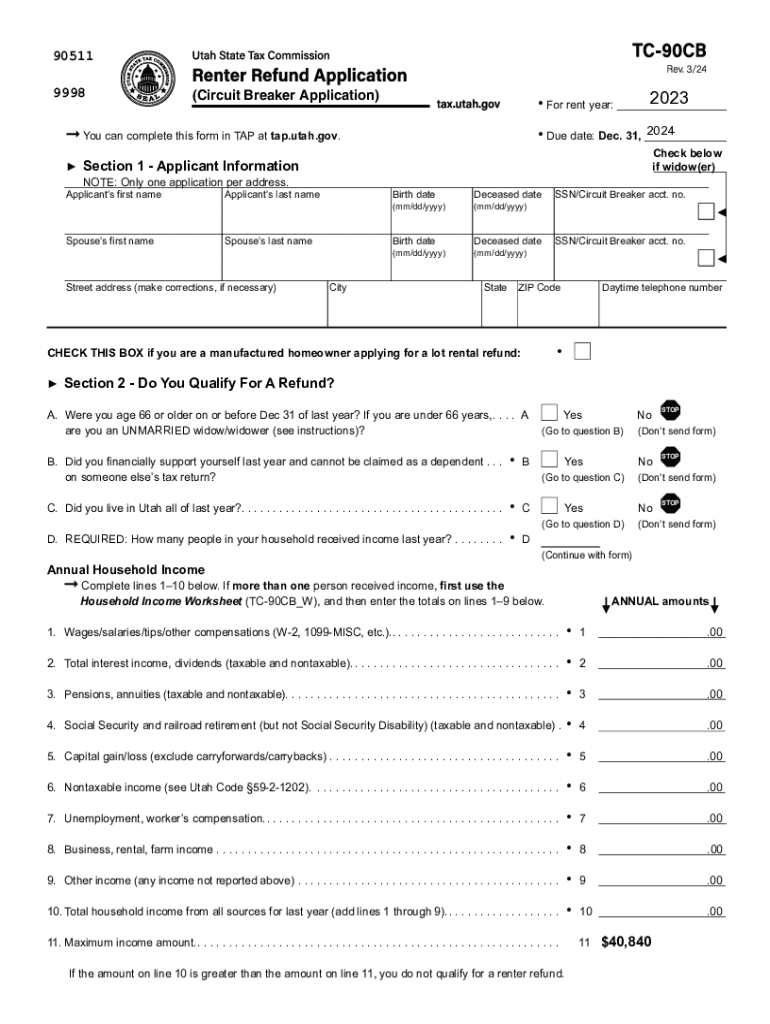

The TC 90CB Renter Refund Application, also known as the Utah renter refund application, is designed to provide financial relief to eligible renters in Utah. This program is part of the Circuit Breaker program, which aims to assist those who may struggle with housing costs. The application allows qualifying individuals to receive a refund on a portion of their rent based on income and other criteria.

Eligibility Criteria for the TC 90CB Renter Refund

To qualify for the TC 90CB renter refund, applicants must meet specific eligibility requirements. Generally, applicants need to be Utah residents, have a valid rental agreement, and meet income thresholds set by the state. Additionally, applicants must be at least 18 years old and not be claimed as a dependent on someone else's tax return. Understanding these criteria is crucial for ensuring a successful application process.

Steps to Complete the TC 90CB Renter Refund Application

Completing the TC 90CB renter refund application involves several steps. First, gather necessary documentation, including proof of residency and income. Next, fill out the application form accurately, ensuring all information is complete. After completing the form, review it for any errors before submitting it. Applications can be submitted either online or by mail, depending on preference. Following these steps carefully can help streamline the process and reduce the chance of delays.

Required Documents for the TC 90CB Renter Refund

When applying for the TC 90CB renter refund, certain documents are required to verify eligibility. Commonly required documents include:

- Proof of income, such as pay stubs or tax returns

- A copy of the rental agreement

- Identification, such as a driver's license or state ID

- Any additional documentation requested by the state

Having these documents ready can facilitate a smoother application process and ensure that all necessary information is provided.

Form Submission Methods for the TC 90CB Renter Refund

The TC 90CB renter refund application can be submitted through various methods. Applicants have the option to submit their forms online via the state’s official website, which may offer a more convenient and faster processing time. Alternatively, forms can be mailed to the designated state office or submitted in person at local government offices. Each method has its own advantages, so applicants should choose the one that best fits their needs.

Filing Deadlines for the TC 90CB Renter Refund

It is essential to be aware of the filing deadlines for the TC 90CB renter refund application to ensure timely submission. Typically, applications must be submitted by a specific date each year, often aligned with the tax filing season. Missing the deadline may result in disqualification from receiving the refund. Staying informed about these important dates can help applicants avoid potential issues.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tc 90cb renter refund application circuit breaker application forms ampamp publications

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Utah renter refund?

The Utah renter refund is a program designed to provide financial assistance to eligible renters in Utah. This refund helps alleviate the burden of housing costs for low-income individuals and families. By understanding the requirements and application process, renters can benefit from this valuable financial support.

-

How can I apply for the Utah renter refund?

To apply for the Utah renter refund, you need to complete the application form available on the Utah State Tax Commission website. Ensure you have all necessary documentation, such as proof of income and residency. Submitting your application on time is crucial to receiving your refund promptly.

-

What are the eligibility requirements for the Utah renter refund?

Eligibility for the Utah renter refund typically includes being a resident of Utah, meeting specific income limits, and having paid rent during the tax year. It's important to review the detailed criteria on the Utah State Tax Commission's website to ensure you qualify for the refund.

-

How much can I receive from the Utah renter refund?

The amount you can receive from the Utah renter refund varies based on your income and the amount of rent you paid. Generally, the refund can provide signNow financial relief, helping you manage your housing expenses more effectively. Check the latest guidelines for specific refund amounts.

-

When is the deadline to apply for the Utah renter refund?

The deadline to apply for the Utah renter refund is typically set for the end of the tax season, usually around mid-October. It's essential to submit your application before this deadline to ensure you receive your refund. Keep an eye on the Utah State Tax Commission's announcements for any updates.

-

Can I track the status of my Utah renter refund application?

Yes, you can track the status of your Utah renter refund application through the Utah State Tax Commission's online portal. By entering your information, you can see if your application is being processed and when you can expect your refund. This feature helps keep you informed throughout the process.

-

What documents do I need to provide for the Utah renter refund?

When applying for the Utah renter refund, you will need to provide documents such as proof of income, rental agreements, and any other relevant financial information. Having these documents ready will streamline your application process. Make sure to check the specific requirements on the Utah State Tax Commission's website.

Get more for TC 90CB Renter Refund Application Circuit Breaker Application Forms & Publications

- Hunting forms package virginia

- Identity theft recovery package virginia form

- Aging parent package virginia form

- Sale of a business package virginia form

- Virginia guardian 497428426 form

- New state resident package virginia form

- Health care directive advance medical directive includes living will and health care decisions virginia form

- Commercial property sales package virginia form

Find out other TC 90CB Renter Refund Application Circuit Breaker Application Forms & Publications

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online

- How To eSign Connecticut Quitclaim Deed

- How To eSign Florida Quitclaim Deed

- Can I eSign Kentucky Quitclaim Deed

- eSign Maine Quitclaim Deed Free

- How Do I eSign New York Quitclaim Deed

- eSign New Hampshire Warranty Deed Fast

- eSign Hawaii Postnuptial Agreement Template Later

- eSign Kentucky Postnuptial Agreement Template Online

- eSign Maryland Postnuptial Agreement Template Mobile

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure