Fillable Form 50 129 Use Appraisal Application for 1

Understanding the Fillable Form 50-129 for Agricultural Exemption

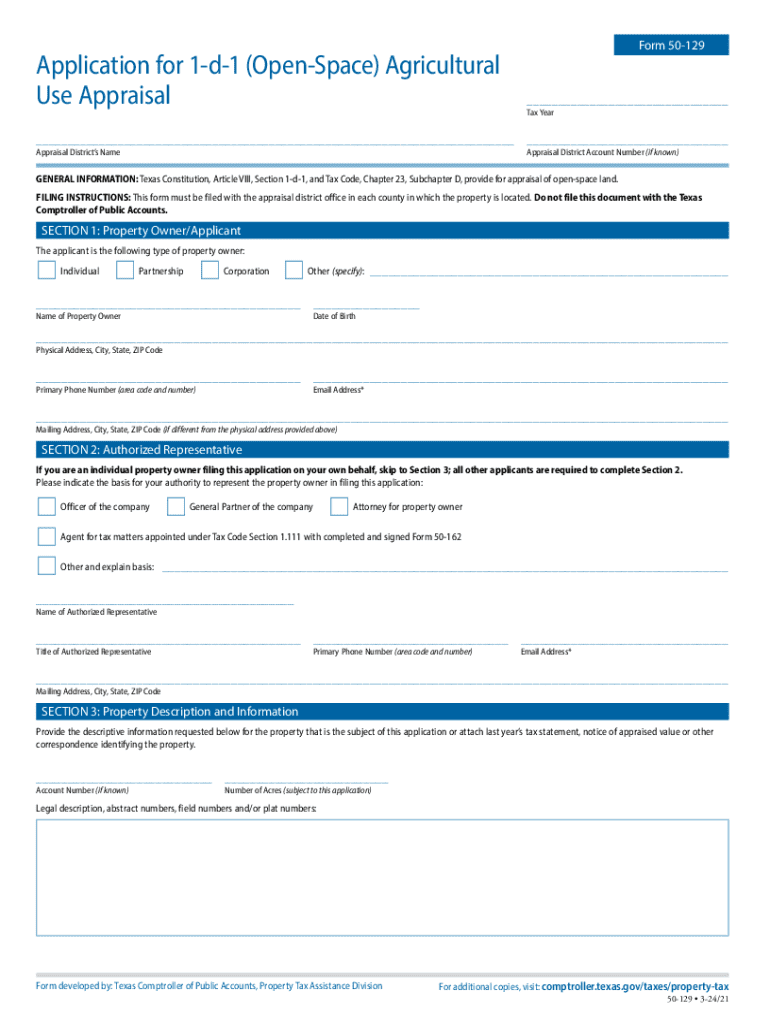

The Fillable Form 50-129, also known as the Application for 1-D-1 Open Space Agricultural Valuation, is a crucial document for Texas property owners seeking agricultural exemptions. This form allows landowners to apply for a special appraisal that reduces property taxes based on the land's agricultural use. The 1-D-1 appraisal is designed to encourage the preservation of agricultural land and support farmers and ranchers in Texas.

Steps to Complete the Fillable Form 50-129

Completing the Fillable Form 50-129 requires careful attention to detail. Here are the essential steps:

- Gather necessary information, including property details, ownership information, and agricultural use specifics.

- Access the Fillable Form 50-129 through the Texas Comptroller's website or authorized platforms.

- Fill out the form accurately, ensuring all sections are completed, including the description of agricultural activities.

- Attach any required documentation that supports your application, such as proof of agricultural production.

- Review the completed form for accuracy before submission.

Eligibility Criteria for the Fillable Form 50-129

To qualify for the agricultural exemption using the Fillable Form 50-129, applicants must meet specific eligibility criteria:

- The property must be used primarily for agricultural purposes, such as farming or ranching.

- The land must have been in agricultural use for at least five of the previous seven years.

- The applicant must demonstrate a genuine intent to produce agricultural products for sale.

Required Documents for Submission of Form 50-129

When submitting the Fillable Form 50-129, certain documents are essential to support your application:

- Proof of agricultural production, such as receipts or sales records.

- Maps or surveys detailing the property boundaries and land use.

- Any previous appraisal documents related to the property.

Form Submission Methods for Form 50-129

The Fillable Form 50-129 can be submitted through various methods, providing flexibility for applicants:

- Online submission via the Texas Comptroller’s website, where you can upload your completed form and required documents.

- Mailing the completed form to the local appraisal district office.

- In-person submission at your local appraisal district office for immediate assistance.

Legal Use of the Fillable Form 50-129

The Fillable Form 50-129 is legally recognized in Texas for obtaining agricultural exemptions. Proper completion and submission of this form can lead to significant tax savings for landowners engaged in agricultural activities. It is essential to ensure that all information provided is truthful and accurate to avoid penalties or denial of the application.

Handy tips for filling out Fillable Form 50 129 Use Appraisal Application For 1 online

Quick steps to complete and e-sign Fillable Form 50 129 Use Appraisal Application For 1 online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Get access to a HIPAA and GDPR compliant solution for maximum efficiency. Use signNow to e-sign and share Fillable Form 50 129 Use Appraisal Application For 1 for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable form 50 129 use appraisal application for 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Texas 1D1 agricultural exemption form?

The Texas 1D1 agricultural exemption form is a document used by landowners in Texas to apply for agricultural tax exemptions. This form helps to reduce property taxes for land used for agricultural purposes, ensuring that farmers and ranchers can maintain their operations more affordably.

-

How can airSlate SignNow help with the Texas 1D1 agricultural exemption form?

airSlate SignNow provides an efficient platform for completing and eSigning the Texas 1D1 agricultural exemption form. With our user-friendly interface, you can easily fill out the form, gather necessary signatures, and submit it electronically, streamlining the entire process.

-

Is there a cost associated with using airSlate SignNow for the Texas 1D1 agricultural exemption form?

Yes, airSlate SignNow offers various pricing plans to suit different needs. Our cost-effective solution allows you to manage documents, including the Texas 1D1 agricultural exemption form, without breaking the bank, making it accessible for all users.

-

What features does airSlate SignNow offer for managing the Texas 1D1 agricultural exemption form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These tools make it easy to manage the Texas 1D1 agricultural exemption form efficiently, ensuring that you can focus on your agricultural business.

-

Can I integrate airSlate SignNow with other software for the Texas 1D1 agricultural exemption form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling the Texas 1D1 agricultural exemption form. This ensures that you can connect with your existing tools for a seamless experience.

-

What are the benefits of using airSlate SignNow for the Texas 1D1 agricultural exemption form?

Using airSlate SignNow for the Texas 1D1 agricultural exemption form provides numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform simplifies the eSigning process, allowing you to focus on your agricultural activities rather than paperwork.

-

How secure is airSlate SignNow when handling the Texas 1D1 agricultural exemption form?

Security is a top priority at airSlate SignNow. When handling the Texas 1D1 agricultural exemption form, your data is protected with advanced encryption and secure storage, ensuring that your sensitive information remains confidential and safe from unauthorized access.

Get more for Fillable Form 50 129 Use Appraisal Application For 1

- Limited power of attorney for stock transactions and corporate powers virginia form

- Special durable power of attorney for bank account matters virginia form

- Virginia small business startup package virginia form

- Virginia property management package virginia form

- Virginia annual 497428502 form

- Va corporation 497428503 form

- Sample corporate records for a virginia professional corporation virginia form

- Virginia professional form

Find out other Fillable Form 50 129 Use Appraisal Application For 1

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement