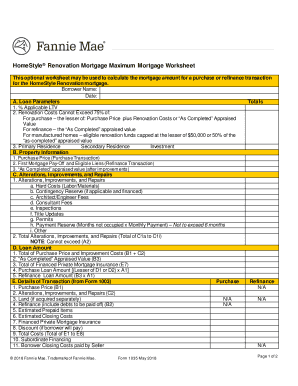

HomeStyle Renovation Mortgage Maximum Mortgage Worksheet 2018-2026

What is the 1035 form?

The 1035 form refers to a tax form used for the exchange of life insurance policies or annuities. This form is essential for policyholders who wish to transfer their existing life insurance or annuity contracts to another provider without incurring immediate tax liabilities. The 1035 exchange allows for a seamless transition, preserving the tax-deferred status of the funds involved.

Key elements of the 1035 form

Understanding the key elements of the 1035 form is crucial for ensuring a smooth exchange process. The form typically includes:

- Policyholder Information: Details about the individual or entity initiating the exchange.

- Current Policy Information: Information about the existing life insurance or annuity, including policy numbers and issuing companies.

- New Policy Information: Details about the new policy or annuity being purchased, including the type and coverage amount.

- Signature Section: A section for the policyholder to authorize the exchange and confirm their understanding of the process.

Steps to complete the 1035 form

Completing the 1035 form involves several important steps to ensure accuracy and compliance:

- Gather all necessary documentation related to the existing policy and the new policy.

- Fill out the policyholder information accurately, ensuring that names and addresses match official records.

- Provide the required details about the current policy, including the issuing company and policy number.

- Enter the information for the new policy, ensuring that it meets the criteria for a 1035 exchange.

- Review the completed form for any errors or omissions before signing.

- Submit the form to the new insurance provider to initiate the exchange process.

Who issues the 1035 form?

The 1035 form is not a standard form issued by the IRS but is instead provided by insurance companies and financial institutions involved in the exchange process. Each provider may have its own version of the form, but all must comply with IRS regulations regarding tax-deferred exchanges. It is essential to use the form provided by the new insurance company to ensure proper processing.

Legal use of the 1035 form

The legal use of the 1035 form is governed by IRS regulations, which stipulate that the exchange must be made directly between the two insurance companies involved. This ensures that the transaction qualifies for tax deferral. Policyholders should be aware of the specific conditions that must be met, including the requirement that the new policy must be of the same or greater value as the existing policy.

Required documents for the 1035 form

When completing the 1035 form, several documents are typically required to facilitate the exchange:

- Current policy documents, including the policy number and terms.

- New policy application or information from the new insurance provider.

- Identification documents to verify the policyholder's identity.

- Any additional forms required by the new insurance company.

Create this form in 5 minutes or less

Find and fill out the correct homestyle renovation mortgage maximum mortgage worksheet

Create this form in 5 minutes!

How to create an eSignature for the homestyle renovation mortgage maximum mortgage worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1035 form and why is it important?

A 1035 form is a tax-free transfer document used to exchange one life insurance policy or annuity for another. It is important because it allows policyholders to switch products without incurring tax liabilities, ensuring they can optimize their financial strategies.

-

How can airSlate SignNow help with the 1035 form process?

airSlate SignNow simplifies the 1035 form process by allowing users to easily create, send, and eSign documents online. This streamlines the workflow, reduces paperwork, and ensures that all necessary signatures are collected efficiently.

-

Is there a cost associated with using airSlate SignNow for the 1035 form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that facilitate the completion of the 1035 form, making it a cost-effective solution for document management.

-

What features does airSlate SignNow offer for managing the 1035 form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for the 1035 form. These tools enhance efficiency and ensure that all parties can complete the document accurately and promptly.

-

Can I integrate airSlate SignNow with other software for the 1035 form?

Absolutely! airSlate SignNow offers integrations with various CRM and document management systems, allowing you to seamlessly manage the 1035 form alongside your existing tools. This integration enhances productivity and ensures a smooth workflow.

-

What are the benefits of using airSlate SignNow for the 1035 form?

Using airSlate SignNow for the 1035 form provides numerous benefits, including reduced turnaround time, enhanced security, and improved compliance. These advantages help businesses manage their documents more effectively and maintain a professional image.

-

How secure is the information on the 1035 form when using airSlate SignNow?

airSlate SignNow prioritizes security by employing advanced encryption and compliance measures to protect your information on the 1035 form. This ensures that sensitive data remains confidential and secure throughout the signing process.

Get more for HomeStyle Renovation Mortgage Maximum Mortgage Worksheet

- Vermont prenuptial premarital agreement with financial statements vermont form

- Vt premarital agreement form

- Amendment to prenuptial or premarital agreement vermont form

- Financial statements only in connection with prenuptial premarital agreement vermont form

- Revocation of premarital or prenuptial agreement vermont form

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children vermont form

- Petition to open an estate under foreign will vermont form

- Vermont foreign form

Find out other HomeStyle Renovation Mortgage Maximum Mortgage Worksheet

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract