Form Grt 1Fill Out and Use This PDF

Understanding the Guam Gross Receipts Tax Form GRT-1

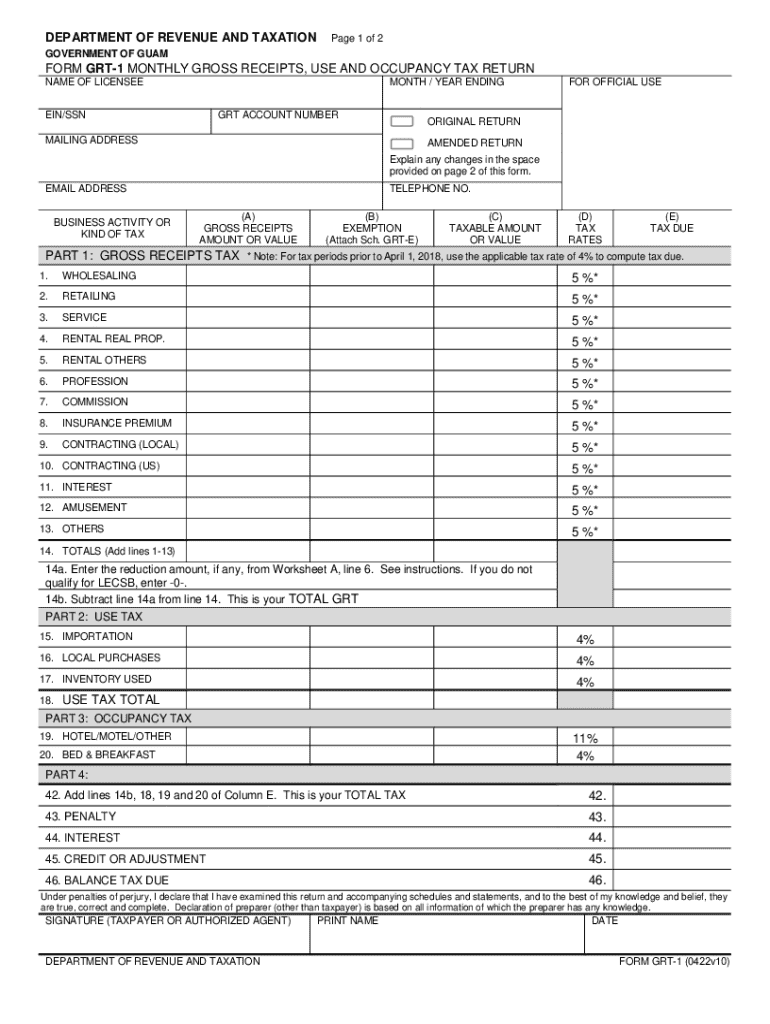

The Guam Gross Receipts Tax (GRT) Form GRT-1 is a crucial document for businesses operating in Guam. This form is used to report gross receipts and calculate the amount of tax owed to the government. Businesses must complete this form accurately to ensure compliance with local tax laws. The GRT-1 captures essential information about the business's income, including sales and service receipts, and is vital for maintaining proper financial records.

Steps to Complete the Guam GRT-1 Form

Filling out the Guam GRT-1 form involves several key steps:

- Gather all necessary financial documents, including sales records and receipts.

- Enter your business information, including the name, address, and tax identification number.

- Report total gross receipts for the reporting period, ensuring accuracy in calculations.

- Calculate the GRT owed based on the applicable tax rate.

- Review the completed form for any errors or omissions before submission.

Filing Deadlines for the Guam GRT-1 Form

Timely filing of the Guam GRT-1 form is essential to avoid penalties. The filing deadlines typically fall on the 20th of the month following the end of each reporting period. Businesses must adhere to these deadlines to ensure compliance with Guam tax regulations and avoid late fees.

Form Submission Methods for the Guam GRT-1

Businesses can submit the Guam GRT-1 form through various methods:

- Online: Submit the form electronically through the designated government portal.

- Mail: Send a printed copy of the completed form to the appropriate tax office address.

- In-Person: Deliver the form directly to the local tax office for immediate processing.

Key Elements of the Guam GRT-1 Form

The Guam GRT-1 form includes several important sections that must be completed:

- Business Information: Name, address, and tax identification number of the business.

- Gross Receipts: Total gross receipts for the reporting period.

- Tax Calculation: Calculation of the GRT owed based on reported receipts.

- Signature: Authorized signature of the business owner or representative.

Penalties for Non-Compliance with the Guam GRT-1

Failure to file the Guam GRT-1 form on time or inaccuracies in reporting can lead to significant penalties. Businesses may face fines, interest on unpaid taxes, and potential legal action. It is crucial to ensure that the form is completed accurately and submitted by the deadline to avoid these consequences.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form grt 1fill out and use this pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the guam gross receipts tax?

The Guam gross receipts tax is a tax imposed on businesses for the privilege of doing business in Guam. It is calculated based on the gross revenue generated by the business, and understanding this tax is crucial for compliance. airSlate SignNow can help streamline document management related to tax filings.

-

How does airSlate SignNow assist with guam gross receipts tax documentation?

airSlate SignNow simplifies the process of preparing and signing documents related to the guam gross receipts tax. With our eSignature solution, you can easily send, sign, and store tax-related documents securely. This ensures that your business remains compliant and organized.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including those dealing with guam gross receipts tax. Our plans are designed to be cost-effective while providing essential features for document management and eSigning. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing guam gross receipts tax documents?

Our platform includes features such as customizable templates, automated workflows, and secure storage, all of which are beneficial for managing guam gross receipts tax documents. These features help streamline the process, reduce errors, and ensure that your documents are always accessible when needed.

-

Can airSlate SignNow integrate with accounting software for guam gross receipts tax?

Yes, airSlate SignNow can integrate with various accounting software solutions, making it easier to manage guam gross receipts tax filings. This integration allows for seamless data transfer and ensures that your financial records are up-to-date. You can focus on your business while we handle the paperwork.

-

What are the benefits of using airSlate SignNow for guam gross receipts tax compliance?

Using airSlate SignNow for guam gross receipts tax compliance offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to manage all your tax-related documents in one place, making it easier to stay compliant and organized. Additionally, eSigning speeds up the approval process.

-

Is airSlate SignNow suitable for small businesses dealing with guam gross receipts tax?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses managing guam gross receipts tax. Our user-friendly interface and affordable pricing make it an ideal solution for small business owners looking to simplify their document management and eSigning processes.

Get more for Form Grt 1Fill Out And Use This PDF

Find out other Form Grt 1Fill Out And Use This PDF

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter