IA 8453 IND Iowa Individual Income Tax Declaration for an E File Return Form

What is the IA 8453 IND Iowa Individual Income Tax Declaration For An E File Return

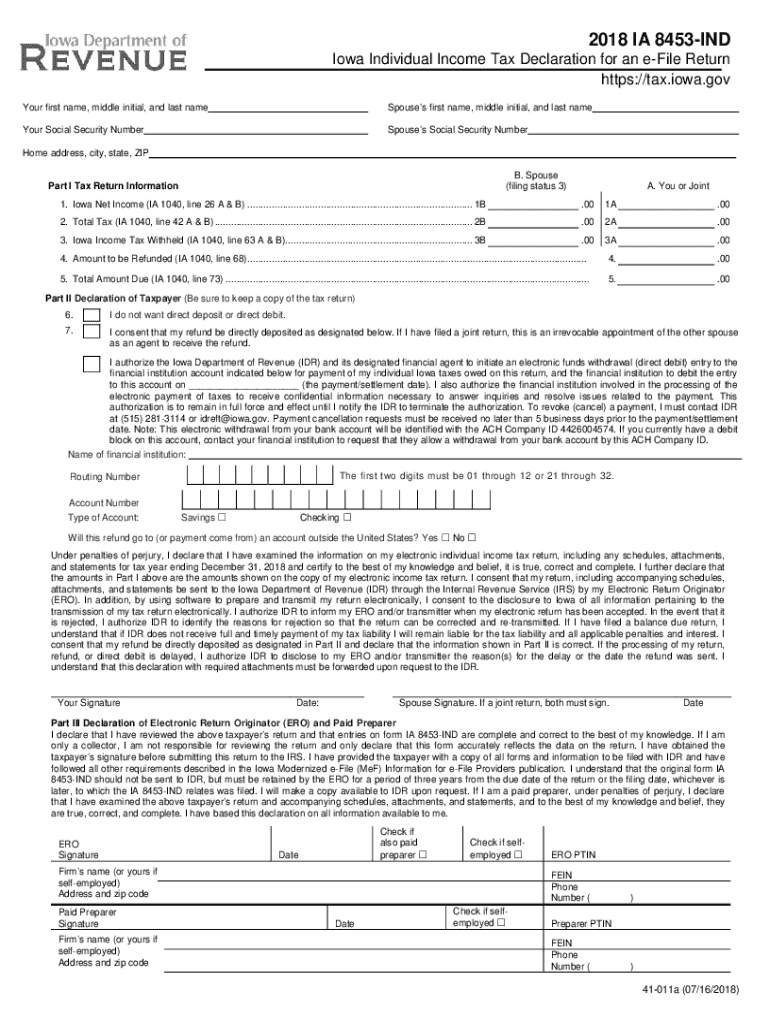

The IA 8453 IND is an essential form used by individuals filing their Iowa income tax returns electronically. This declaration serves as a verification document, confirming that the taxpayer has reviewed their e-filed return and that all information provided is accurate. It is particularly important for those who are submitting their tax returns through electronic means, as it ensures compliance with state regulations.

This form includes key details such as the taxpayer's name, Social Security number, and signature, which are necessary for the Iowa Department of Revenue to process the return. By signing the IA 8453 IND, taxpayers affirm that they understand their tax obligations and the information they have submitted.

Steps to complete the IA 8453 IND Iowa Individual Income Tax Declaration For An E File Return

Completing the IA 8453 IND involves several straightforward steps:

- Gather necessary information, including your Social Security number, filing status, and income details.

- Access the IA 8453 IND form, either through a tax preparation software or by downloading it from the Iowa Department of Revenue website.

- Fill out the form with accurate information, ensuring all fields are completed as required.

- Review the completed form for any errors or omissions.

- Sign and date the form to certify that the information is correct.

- Submit the IA 8453 IND along with your e-filed return, ensuring that you retain a copy for your records.

Key elements of the IA 8453 IND Iowa Individual Income Tax Declaration For An E File Return

The IA 8453 IND includes several critical elements that taxpayers must be aware of:

- Taxpayer Information: This section requires the taxpayer's name, address, and Social Security number.

- Filing Status: Taxpayers must indicate their filing status, such as single, married filing jointly, or head of household.

- Signature: A handwritten or electronic signature is required to validate the declaration.

- Tax Year: The form must specify the tax year for which the declaration is being filed.

- Declaration Statement: This statement affirms that the taxpayer has reviewed the return and that the information is correct.

Legal use of the IA 8453 IND Iowa Individual Income Tax Declaration For An E File Return

The IA 8453 IND is legally binding, serving as a declaration that the information provided in the e-filed return is true and complete. By signing this form, taxpayers are agreeing to comply with Iowa tax laws and regulations. It is important to understand that any inaccuracies or fraudulent information can lead to penalties or legal repercussions.

Additionally, the form acts as a safeguard for both the taxpayer and the Iowa Department of Revenue, ensuring that all electronic filings are verified and authenticated. This legal framework helps maintain the integrity of the tax filing process in Iowa.

How to obtain the IA 8453 IND Iowa Individual Income Tax Declaration For An E File Return

Taxpayers can obtain the IA 8453 IND form through various means:

- Tax Preparation Software: Most tax preparation software will automatically generate the IA 8453 IND when you prepare your Iowa tax return.

- Iowa Department of Revenue Website: The form can be downloaded directly from the Iowa Department of Revenue’s official website in a fillable PDF format.

- Tax Professionals: Tax advisors and accountants can provide the form as part of their services, ensuring it is completed correctly.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ia 8453 ind iowa individual income tax declaration for an e file return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ia ind 8453 and how does it relate to airSlate SignNow?

ia ind 8453 is a form used for electronic signatures in tax-related documents. With airSlate SignNow, you can easily eSign this form, ensuring compliance and security. Our platform simplifies the process, making it efficient for businesses to manage their tax documentation.

-

How much does airSlate SignNow cost for using ia ind 8453?

airSlate SignNow offers flexible pricing plans that cater to different business needs. The cost for using ia ind 8453 is included in our subscription plans, which provide unlimited eSigning capabilities. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing ia ind 8453?

airSlate SignNow provides a range of features for managing ia ind 8453, including customizable templates, secure storage, and real-time tracking. These features enhance the efficiency of document handling and ensure that your forms are signed promptly and securely.

-

Can I integrate airSlate SignNow with other applications for ia ind 8453?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing you to manage ia ind 8453 alongside your existing workflows. Whether you use CRM systems or cloud storage solutions, our platform can connect with them to streamline your document processes.

-

What are the benefits of using airSlate SignNow for ia ind 8453?

Using airSlate SignNow for ia ind 8453 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed quickly and stored securely, helping you save time and resources.

-

Is airSlate SignNow compliant with regulations for ia ind 8453?

Absolutely! airSlate SignNow is designed to comply with all relevant regulations for electronic signatures, including those applicable to ia ind 8453. This compliance ensures that your signed documents are legally binding and recognized by authorities.

-

How can I get started with airSlate SignNow for ia ind 8453?

Getting started with airSlate SignNow for ia ind 8453 is easy. Simply sign up for an account, choose a pricing plan, and start uploading your documents. Our user-friendly interface will guide you through the process of eSigning your forms efficiently.

Get more for IA 8453 IND Iowa Individual Income Tax Declaration For An E File Return

- Notice to lessor exercising option to purchase washington form

- Assignment of lease and rent from borrower to lender washington form

- Assignment of lease from lessor with notice of assignment washington form

- Tenant abandoned property form

- Guaranty or guarantee of payment of rent washington form

- Letter from landlord to tenant as notice of default on commercial lease washington form

- Rental lease extension form

- Commercial rental lease application questionnaire washington form

Find out other IA 8453 IND Iowa Individual Income Tax Declaration For An E File Return

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now