Form TR 579 1 CT New York State Authorization for Electronic

What is the Form TR 579 1 CT New York State Authorization For Electronic

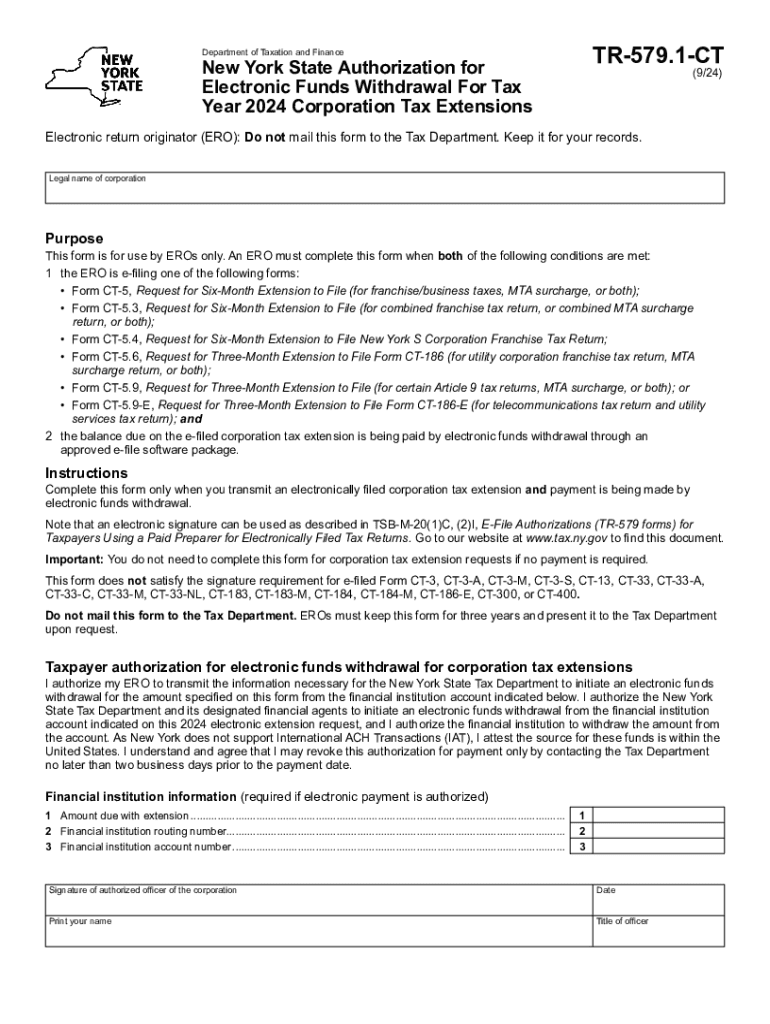

The Form TR 579 1 CT is a crucial document used in New York State for authorizing electronic transactions related to tax matters. This form allows taxpayers to grant permission for their tax information to be accessed and processed electronically. It is essential for ensuring compliance with state tax regulations while facilitating a more efficient filing process. Understanding this form is vital for anyone looking to manage their tax obligations digitally.

Steps to complete the Form TR 579 1 CT New York State Authorization For Electronic

Completing the Form TR 579 1 CT involves several straightforward steps:

- Begin by downloading the form from the official New York State Department of Taxation and Finance website.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about the tax year for which you are authorizing electronic access.

- Sign and date the form to validate your authorization.

- Submit the completed form as directed, either electronically or via mail.

How to use the Form TR 579 1 CT New York State Authorization For Electronic

The Form TR 579 1 CT is used primarily to authorize electronic access to your tax records. Once completed, this form allows tax professionals or software providers to file your tax returns on your behalf. It is particularly useful for those who prefer a digital filing process, as it streamlines communication with the New York State tax authorities. Ensure that you retain a copy of the form for your records after submission.

Legal use of the Form TR 579 1 CT New York State Authorization For Electronic

This form is legally binding and must be filled out accurately to ensure compliance with New York State tax laws. By signing the form, you grant permission for authorized parties to access your tax information electronically. Misuse of this authorization can lead to penalties, so it is important to only authorize trusted individuals or entities. Always review the form carefully before submission to avoid any legal complications.

Required Documents

When completing the Form TR 579 1 CT, you may need to provide additional documentation to support your authorization. This can include:

- A copy of your most recent tax return.

- Identification documents, such as a driver's license or Social Security card.

- Any relevant notices or correspondence from the New York State Department of Taxation and Finance.

Having these documents ready can help expedite the processing of your authorization request.

Filing Deadlines / Important Dates

It is essential to be aware of filing deadlines when submitting the Form TR 579 1 CT. Generally, the form should be submitted before the tax filing deadline for the year in question. For most taxpayers, this is typically April fifteenth. However, if you are applying for an extension, ensure that you submit the form in accordance with the extension deadlines set by the New York State tax authorities. Staying informed about these dates can help you avoid late penalties.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form tr 579 1 ct new york state authorization for electronic

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are ct authorization funds and how do they work with airSlate SignNow?

CT authorization funds refer to the financial resources allocated for specific transactions or services. With airSlate SignNow, you can easily manage and authorize these funds through secure eSigning processes, ensuring that all financial agreements are legally binding and efficiently handled.

-

How does airSlate SignNow ensure the security of ct authorization funds?

AirSlate SignNow employs advanced encryption and security protocols to protect ct authorization funds during the eSigning process. This ensures that sensitive financial information remains confidential and secure, giving users peace of mind when managing their transactions.

-

What features does airSlate SignNow offer for managing ct authorization funds?

AirSlate SignNow provides a range of features for managing ct authorization funds, including customizable templates, automated workflows, and real-time tracking of document status. These tools streamline the process of obtaining signatures and authorizations, making it easier for businesses to handle their financial agreements.

-

Is there a cost associated with using airSlate SignNow for ct authorization funds?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan includes features that facilitate the management of ct authorization funds, ensuring that you get the best value for your investment while streamlining your document workflows.

-

Can airSlate SignNow integrate with other financial software for ct authorization funds?

Absolutely! AirSlate SignNow integrates seamlessly with various financial software solutions, allowing you to manage ct authorization funds alongside your existing systems. This integration enhances efficiency by automating data transfer and reducing manual entry errors.

-

What are the benefits of using airSlate SignNow for ct authorization funds?

Using airSlate SignNow for ct authorization funds offers numerous benefits, including increased efficiency, reduced turnaround times, and enhanced compliance. The platform simplifies the eSigning process, allowing businesses to focus on their core operations while ensuring that financial agreements are handled promptly.

-

How can I get started with airSlate SignNow for ct authorization funds?

Getting started with airSlate SignNow for ct authorization funds is easy! Simply sign up for an account, choose a pricing plan that suits your needs, and start creating and sending documents for eSigning. Our user-friendly interface makes it simple to manage your financial agreements.

Get more for Form TR 579 1 CT New York State Authorization For Electronic

Find out other Form TR 579 1 CT New York State Authorization For Electronic

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF