Form R 1 Virginia Department of Taxation Business Registration Form

Understanding the Form R-1 Virginia Department Of Taxation Business Registration Form

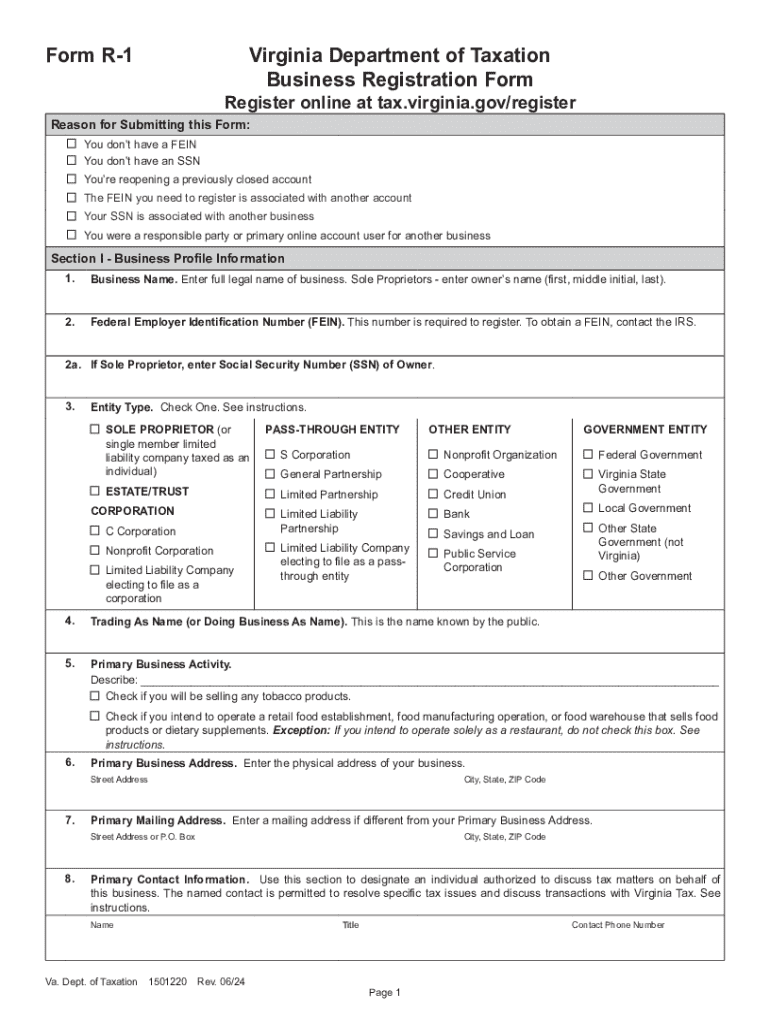

The Form R-1 is a crucial document used by businesses in Virginia to register for state taxes. This form is essential for any entity that plans to operate in Virginia and is required to comply with state tax regulations. It collects vital information about the business, including its name, address, and type of entity, which helps the Virginia Department of Taxation identify and manage tax obligations effectively.

Steps to Complete the Form R-1 Virginia Department Of Taxation Business Registration Form

Completing the Form R-1 involves several key steps. First, gather all necessary information about your business, including the legal name, address, and federal Employer Identification Number (EIN). Next, accurately fill out each section of the form, ensuring that all details align with your business records. Pay special attention to the type of business entity you are registering, as this will affect your tax obligations. After completing the form, review it for accuracy before submission.

How to Obtain the Form R-1 Virginia Department Of Taxation Business Registration Form

The Form R-1 can be obtained directly from the Virginia Department of Taxation's official website. It is available as a downloadable PDF, which you can print and fill out manually. Additionally, businesses may also request the form through the mail or visit a local tax office for assistance. Ensuring you have the correct and most current version of the form is essential for compliance.

Key Elements of the Form R-1 Virginia Department Of Taxation Business Registration Form

The Form R-1 includes several key elements that must be completed for successful registration. These elements include:

- Business Name: The legal name of your business as registered with the state.

- Business Address: The physical location where the business operates.

- Type of Business Entity: Options include sole proprietorship, partnership, corporation, or limited liability company (LLC).

- Federal Employer Identification Number (EIN): Required for tax identification purposes.

- Contact Information: Details for the primary contact person for the business.

Form Submission Methods for the R-1 Virginia Department Of Taxation Business Registration Form

Once the Form R-1 is completed, it can be submitted through various methods. Businesses have the option to file online through the Virginia Department of Taxation's e-services portal, which is the most efficient method. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at a local office. Each method has specific processing times, so it is beneficial to choose the one that best fits your timeline.

Legal Use of the Form R-1 Virginia Department Of Taxation Business Registration Form

The Form R-1 is legally required for any business entity operating in Virginia that needs to register for state taxes. Failing to submit this form can lead to penalties and complications with tax compliance. It is important to ensure that the form is filled out accurately and submitted on time to avoid any legal issues. Understanding the legal implications of the form helps businesses maintain compliance with state regulations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form r 1 virginia department of taxation business registration form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for a tax business in Virginia?

airSlate SignNow provides a range of features tailored for a tax business in Virginia, including secure eSigning, document templates, and automated workflows. These tools streamline the document management process, making it easier for tax professionals to handle client paperwork efficiently. Additionally, the platform ensures compliance with local regulations, which is crucial for any tax business.

-

How can airSlate SignNow benefit my tax business in Virginia?

Using airSlate SignNow can signNowly benefit your tax business in Virginia by enhancing productivity and reducing turnaround times for document processing. The platform's user-friendly interface allows for quick eSigning and document sharing, which can improve client satisfaction. Moreover, the cost-effective pricing plans make it accessible for businesses of all sizes.

-

What is the pricing structure for airSlate SignNow for tax businesses in Virginia?

airSlate SignNow offers flexible pricing plans suitable for tax businesses in Virginia, allowing you to choose a plan that fits your budget and needs. The pricing is competitive and designed to provide value, especially for small to medium-sized firms. You can also take advantage of a free trial to explore the features before committing.

-

Is airSlate SignNow compliant with Virginia tax regulations?

Yes, airSlate SignNow is designed to comply with Virginia tax regulations, ensuring that your documents are handled securely and in accordance with local laws. This compliance is essential for maintaining the integrity of your tax business in Virginia. The platform regularly updates its features to align with changing regulations.

-

Can I integrate airSlate SignNow with other tools for my tax business in Virginia?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software commonly used by tax businesses in Virginia. This capability allows you to streamline your operations by connecting your existing tools, enhancing efficiency, and reducing manual data entry. Popular integrations include QuickBooks and Xero.

-

How secure is airSlate SignNow for my tax business in Virginia?

Security is a top priority for airSlate SignNow, especially for sensitive documents related to your tax business in Virginia. The platform employs advanced encryption and security protocols to protect your data. Additionally, it offers features like two-factor authentication to further safeguard your information.

-

What support options are available for tax businesses in Virginia using airSlate SignNow?

airSlate SignNow provides comprehensive support options for tax businesses in Virginia, including live chat, email support, and an extensive knowledge base. This ensures that you can get assistance whenever you need it, whether you're troubleshooting an issue or looking for tips on maximizing the platform's features. The support team is knowledgeable about the specific needs of tax professionals.

Get more for Form R 1 Virginia Department Of Taxation Business Registration Form

- Power attorney children form

- Newly divorced individuals package wisconsin form

- Wi statutory form

- Contractors forms package wisconsin

- Power of attorney for sale of motor vehicle wisconsin form

- Wi statutory 497431228 form

- Wedding planning or consultant package wisconsin form

- Hunting forms package wisconsin

Find out other Form R 1 Virginia Department Of Taxation Business Registration Form

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed