UXRB RETURN of EXCISE TAX by UTILITIES * 7 0 2 1 1 6 Form

Understanding the UXRB Return of Excise Tax by Utilities

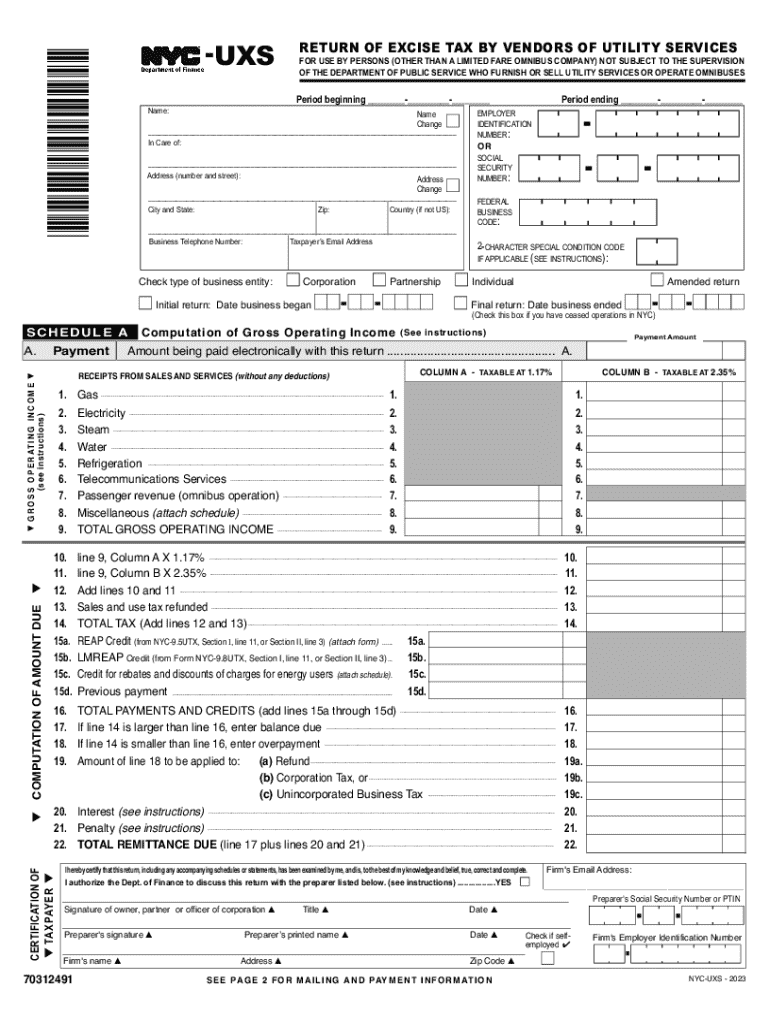

The UXRB Return of Excise Tax by Utilities is a crucial document for utility companies operating in New York City. This form is designed to report and remit excise taxes that are applicable to utility services. The excise tax is a tax imposed on specific goods and services, and for utilities, this includes services such as electricity, gas, and telecommunications. Understanding the purpose and requirements of this form is essential for compliance with local tax regulations.

Steps to Complete the UXRB Return of Excise Tax by Utilities

Completing the UXRB Return of Excise Tax involves several key steps:

- Gather necessary financial records, including revenue from utility services and any previous tax filings.

- Access the official form, ensuring you have the correct version for the current tax period.

- Fill out the form accurately, detailing all required information such as the total taxable revenue and applicable tax rates.

- Review the completed form for accuracy, ensuring all calculations are correct.

- Submit the form by the designated deadline, either electronically or via mail, according to the guidelines provided by the local tax authority.

Required Documents for Filing the UXRB Return

When filing the UXRB Return of Excise Tax, certain documents are necessary to support your submission. These typically include:

- Financial statements detailing revenue from utility services.

- Previous tax returns for reference and consistency.

- Any relevant correspondence from the tax authority regarding previous filings or changes in tax law.

Having these documents ready can streamline the filing process and help ensure compliance with tax obligations.

Filing Deadlines for the UXRB Return of Excise Tax

It is important to be aware of the filing deadlines for the UXRB Return of Excise Tax. Typically, utility companies must submit their returns quarterly, with specific dates established by the New York City Department of Finance. Missing these deadlines can result in penalties and interest on unpaid taxes, so keeping track of these dates is crucial for compliance.

Penalties for Non-Compliance with the UXRB Return

Failure to file the UXRB Return of Excise Tax on time or inaccuracies in the submission can lead to significant penalties. These may include:

- Monetary fines based on the amount of tax owed.

- Interest charges on late payments.

- Potential legal action for persistent non-compliance.

Understanding these penalties emphasizes the importance of accurate and timely submissions.

Obtaining the UXRB Return of Excise Tax by Utilities

The UXRB Return form can be obtained from the New York City Department of Finance website or directly from their offices. It is essential to ensure that you are using the most current version of the form to avoid any issues during submission. Additionally, many utility companies utilize tax preparation software that may include the UXRB Return, making the process more efficient.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the uxrb return of excise tax by utilities 7 0 2 1 1 6

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for filing an NYC UXS return tax using airSlate SignNow?

Filing an NYC UXS return tax with airSlate SignNow is straightforward. You can easily prepare your documents, eSign them, and submit them directly through our platform. Our user-friendly interface ensures that you can complete your NYC UXS return tax efficiently and without hassle.

-

How does airSlate SignNow help with NYC UXS return tax compliance?

airSlate SignNow provides tools that ensure your NYC UXS return tax documents are compliant with local regulations. Our platform offers templates and guidance tailored to NYC tax requirements, helping you avoid common pitfalls. This way, you can confidently manage your NYC UXS return tax filings.

-

What are the pricing options for using airSlate SignNow for NYC UXS return tax?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those focused on NYC UXS return tax. You can choose from monthly or annual subscriptions, with options that provide access to essential features for tax document management. This ensures you get the best value for your NYC UXS return tax needs.

-

Can I integrate airSlate SignNow with other tax software for NYC UXS return tax?

Yes, airSlate SignNow seamlessly integrates with various tax software solutions to streamline your NYC UXS return tax process. This integration allows you to import and export documents easily, ensuring that your tax filings are accurate and timely. Enhance your workflow by connecting airSlate SignNow with your preferred tools.

-

What features does airSlate SignNow offer for managing NYC UXS return tax documents?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure storage specifically designed for NYC UXS return tax documents. These tools simplify the preparation and submission process, allowing you to focus on your business. With airSlate SignNow, managing your NYC UXS return tax is efficient and secure.

-

Is airSlate SignNow suitable for small businesses handling NYC UXS return tax?

Absolutely! airSlate SignNow is designed to be cost-effective and user-friendly, making it ideal for small businesses managing NYC UXS return tax. Our platform provides all the necessary tools to ensure compliance and efficiency without overwhelming your budget. Small businesses can benefit greatly from our solutions.

-

How secure is airSlate SignNow for handling NYC UXS return tax documents?

Security is a top priority at airSlate SignNow, especially for sensitive documents like NYC UXS return tax filings. We utilize advanced encryption and secure cloud storage to protect your data. You can trust that your NYC UXS return tax documents are safe with us.

Get more for UXRB RETURN OF EXCISE TAX BY UTILITIES * 7 0 2 1 1 6

Find out other UXRB RETURN OF EXCISE TAX BY UTILITIES * 7 0 2 1 1 6

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement