Form ST 100 New York State and Local Quarterly Sales and Use Tax Return Revised 924

What is the Form ST 100 New York State And Local Quarterly Sales And Use Tax Return Revised 924

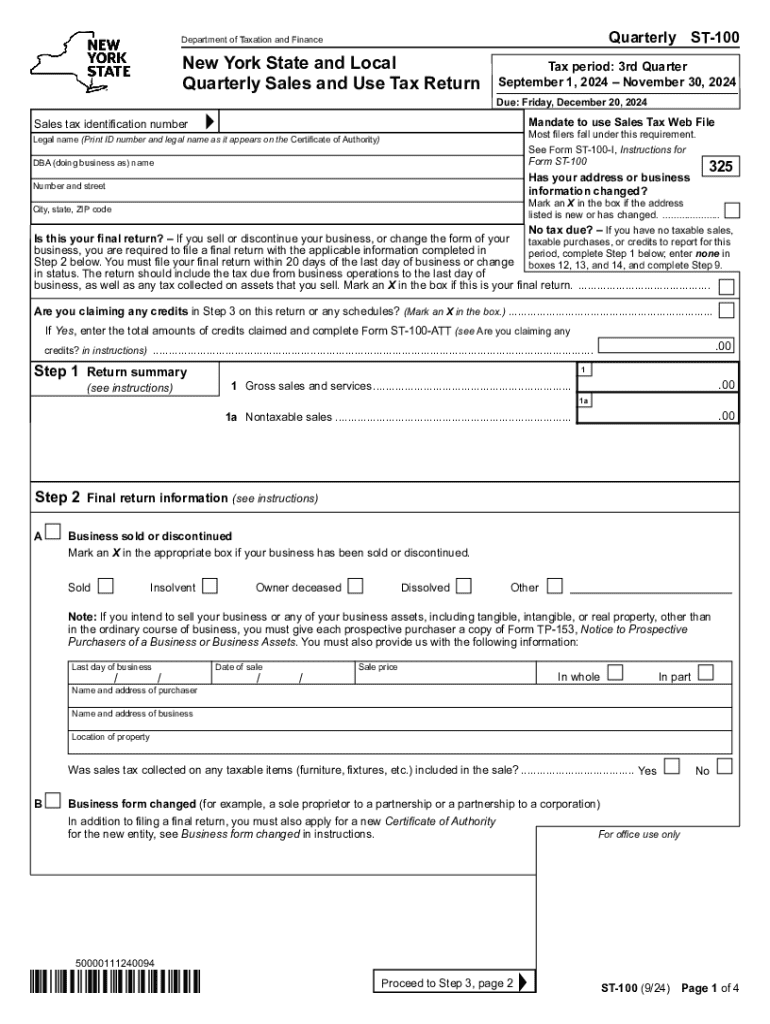

The Form ST 100 is the New York State and Local Quarterly Sales and Use Tax Return, revised in 2024. It is a crucial document for businesses operating in New York that collect sales tax. This form is used to report sales and use tax collected during the quarter and to remit the appropriate tax to the state. The ST 100 form is essential for compliance with New York tax laws, ensuring that businesses accurately report their tax liabilities to avoid penalties.

How to use the Form ST 100 New York State And Local Quarterly Sales And Use Tax Return Revised 924

To use the Form ST 100 effectively, businesses must first gather all necessary sales records for the quarter. This includes total sales, exempt sales, and any taxable purchases. The form requires detailed information about the business, including the sales tax identification number, business name, and address. Once all data is collected, businesses can fill out the form, ensuring that all sections are completed accurately. After completing the form, it can be submitted either electronically or by mail, depending on the preference of the business and the submission methods allowed by the state.

Steps to complete the Form ST 100 New York State And Local Quarterly Sales And Use Tax Return Revised 924

Completing the Form ST 100 involves several key steps:

- Gather sales records for the reporting period, including total sales and exempt sales.

- Fill in the business identification information, including the sales tax ID number.

- Report total sales, taxable sales, and any exempt sales in the designated sections.

- Calculate the total sales tax due based on the reported figures.

- Sign and date the form to certify that the information provided is accurate.

After completing these steps, the form can be submitted to the New York State Department of Taxation and Finance.

Filing Deadlines / Important Dates

Filing deadlines for the Form ST 100 are typically set for the 20th day of the month following the end of each quarter. The quarters are defined as follows:

- First Quarter: January 1 - March 31, due April 20

- Second Quarter: April 1 - June 30, due July 20

- Third Quarter: July 1 - September 30, due October 20

- Fourth Quarter: October 1 - December 31, due January 20

It is essential for businesses to adhere to these deadlines to avoid late fees and penalties.

Penalties for Non-Compliance

Failure to file the Form ST 100 on time or to pay the required sales tax can result in significant penalties. These may include:

- Late filing penalties, which can be a percentage of the tax due.

- Interest on unpaid taxes, accruing from the due date until payment is made.

- Potential legal action for repeated non-compliance, which can affect business operations.

Businesses are encouraged to file on time and ensure accuracy to mitigate these risks.

Digital vs. Paper Version

The Form ST 100 is available in both digital and paper formats. The digital version allows for easier filing through online platforms, which can streamline the submission process. Businesses can fill out the form electronically, ensuring that calculations are accurate and reducing the risk of errors. The paper version can be printed and filled out manually, but this method may require additional time for mailing and processing. Choosing the right format depends on the business's operational preferences and capabilities.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form st 100 new york state and local quarterly sales and use tax return revised 924

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NYS quarterly sales tax form ST 100 printable?

The NYS quarterly sales tax form ST 100 printable is a document that businesses in New York State use to report and pay their sales tax on a quarterly basis. This form is essential for compliance with state tax regulations and can be easily filled out and submitted online or via mail.

-

How can I obtain the NYS quarterly sales tax form ST 100 printable?

You can obtain the NYS quarterly sales tax form ST 100 printable directly from the New York State Department of Taxation and Finance website. Additionally, airSlate SignNow offers a convenient way to access and fill out this form digitally, streamlining the process for businesses.

-

Is there a cost associated with using airSlate SignNow for the NYS quarterly sales tax form ST 100 printable?

airSlate SignNow offers various pricing plans, including a free trial, allowing you to use the platform for the NYS quarterly sales tax form ST 100 printable without any initial cost. After the trial, you can choose a plan that fits your business needs and budget.

-

What features does airSlate SignNow provide for the NYS quarterly sales tax form ST 100 printable?

airSlate SignNow provides features such as eSignature capabilities, document templates, and secure cloud storage for the NYS quarterly sales tax form ST 100 printable. These features enhance efficiency and ensure that your documents are legally binding and easily accessible.

-

Can I integrate airSlate SignNow with other software for managing the NYS quarterly sales tax form ST 100 printable?

Yes, airSlate SignNow offers integrations with various software applications, including accounting and tax software, to help manage the NYS quarterly sales tax form ST 100 printable. This integration allows for seamless data transfer and improved workflow efficiency.

-

What are the benefits of using airSlate SignNow for the NYS quarterly sales tax form ST 100 printable?

Using airSlate SignNow for the NYS quarterly sales tax form ST 100 printable provides numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. The platform simplifies the filing process, ensuring that your submissions are timely and compliant with state regulations.

-

How secure is airSlate SignNow when handling the NYS quarterly sales tax form ST 100 printable?

airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards, ensuring that your NYS quarterly sales tax form ST 100 printable and other sensitive documents are protected. You can trust that your data is safe while using the platform.

Get more for Form ST 100 New York State And Local Quarterly Sales And Use Tax Return Revised 924

- Quitclaim deed from corporation to husband and wife west virginia form

- Warranty deed from corporation to husband and wife west virginia form

- Quitclaim deed from corporation to individual west virginia form

- Warranty deed from corporation to individual west virginia form

- Quitclaim deed from corporation to llc west virginia form

- Quitclaim deed from corporation to corporation west virginia form

- Warranty deed from corporation to corporation west virginia form

- West virginia corporation form

Find out other Form ST 100 New York State And Local Quarterly Sales And Use Tax Return Revised 924

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast