Form 592 B Resident and Nonresident Withholding Tax Statement with Instructions , Form 592 B, Resident and Nonresident Withholdi

Understanding Form 592 B: Resident and Nonresident Withholding Tax Statement

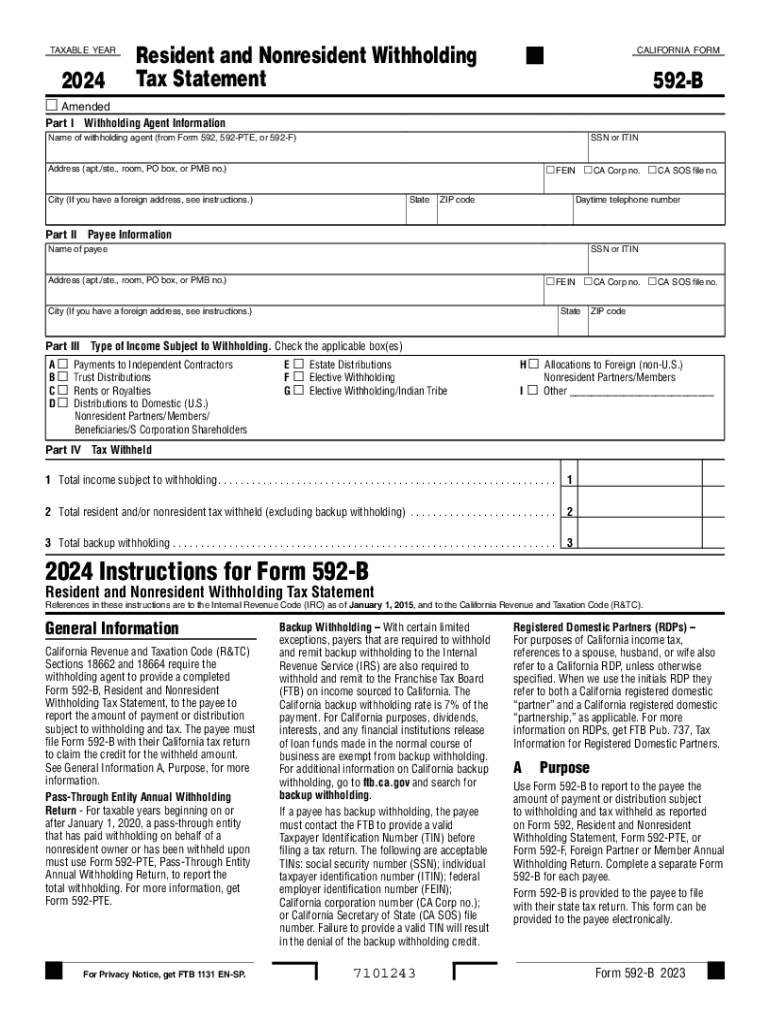

Form 592 B is a crucial document used in California for reporting withholding tax on payments made to both residents and nonresidents. This form is specifically designed for payers who are required to withhold taxes on certain types of income, such as rents, royalties, and payments to independent contractors. Understanding the purpose and requirements of this form is essential for compliance with California tax regulations.

The form serves as a withholding statement that outlines the amount withheld from payments made to payees. It is important for both the payer and the payee to accurately complete and retain this form for their records, as it may be necessary for tax filing purposes.

Steps to Complete Form 592 B

Completing Form 592 B involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the payee's name, address, and taxpayer identification number. Next, calculate the total amount of payments made to the payee during the tax year and determine the appropriate withholding rate based on the type of income.

Once you have the required information, fill out the form by entering the payee's details and the amounts withheld. It is crucial to double-check all entries for accuracy before submitting the form. After completing the form, retain a copy for your records and provide the payee with their copy for their tax filings.

Legal Use of Form 592 B

Form 592 B is legally mandated for use in California when certain payments are made that require withholding. This includes payments to nonresidents and specific types of income that fall under California tax law. Failure to use this form appropriately can result in penalties or fines imposed by the California Franchise Tax Board.

It is essential to understand the legal implications of withholding and reporting taxes accurately. Both payers and payees should familiarize themselves with the relevant tax laws to ensure compliance and avoid potential legal issues.

Key Elements of Form 592 B

Several key elements must be included in Form 592 B to ensure it is complete and compliant. These elements include:

- Payee Information: Full name, address, and taxpayer identification number of the payee.

- Payment Details: Total amount paid to the payee during the tax year.

- Withholding Amount: The total amount withheld from the payments made.

- Signature: The payer must sign the form to certify the accuracy of the information provided.

Including all these elements is vital for the form to be accepted by the California Franchise Tax Board.

Obtaining Form 592 B

Form 592 B can be obtained directly from the California Franchise Tax Board's website or through authorized tax professionals. It is available in a fillable format, allowing users to complete the form digitally. Additionally, paper copies can be printed for those who prefer to fill out the form manually.

Ensuring you have the most current version of the form is important, as tax regulations may change from year to year. Always check for updates, especially as you prepare for tax filing deadlines.

Filing Deadlines for Form 592 B

Filing deadlines for Form 592 B are critical for compliance. Typically, the form must be submitted to the California Franchise Tax Board by the end of January for the previous tax year. It is important to stay informed about specific deadlines, as missing them can result in penalties.

Additionally, payers should provide copies of Form 592 B to payees by the same deadline to ensure they have the necessary documentation for their tax filings.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 592 b resident and nonresident withholding tax statement with instructions form 592 b resident and nonresident withholding

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is b ftb and how does it relate to airSlate SignNow?

B ftb refers to the business features that airSlate SignNow offers for efficient document management. With b ftb, users can easily send, sign, and manage documents online, streamlining their workflow and enhancing productivity.

-

How much does airSlate SignNow cost for b ftb users?

The pricing for airSlate SignNow varies based on the plan selected, but it is designed to be cost-effective for b ftb users. You can choose from different subscription tiers that cater to various business needs, ensuring you get the best value for your investment.

-

What features are included in the b ftb package?

The b ftb package includes essential features such as document templates, eSignature capabilities, and real-time tracking. These features are designed to simplify the signing process and enhance collaboration among team members.

-

Can I integrate airSlate SignNow with other tools for b ftb?

Yes, airSlate SignNow offers seamless integrations with various applications, making it ideal for b ftb users. You can connect it with CRM systems, cloud storage services, and other productivity tools to create a cohesive workflow.

-

What are the benefits of using airSlate SignNow for b ftb?

Using airSlate SignNow for b ftb provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. It allows businesses to manage their documents digitally, saving time and resources while ensuring compliance.

-

Is airSlate SignNow user-friendly for b ftb customers?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for b ftb customers to navigate and utilize its features. The intuitive interface ensures that users can quickly learn how to send and sign documents without extensive training.

-

How does airSlate SignNow ensure the security of b ftb transactions?

AirSlate SignNow prioritizes security for b ftb transactions by implementing advanced encryption and compliance measures. This ensures that all documents and signatures are protected, giving users peace of mind when managing sensitive information.

Get more for Form 592 B Resident And Nonresident Withholding Tax Statement With Instructions , Form 592 B, Resident And Nonresident Withholdi

Find out other Form 592 B Resident And Nonresident Withholding Tax Statement With Instructions , Form 592 B, Resident And Nonresident Withholdi

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document