FTB 540 Booklet California Tax Table , FTB 540 Booklet, California Tax Table Form

Understanding the FTB 540 Booklet and California Tax Table

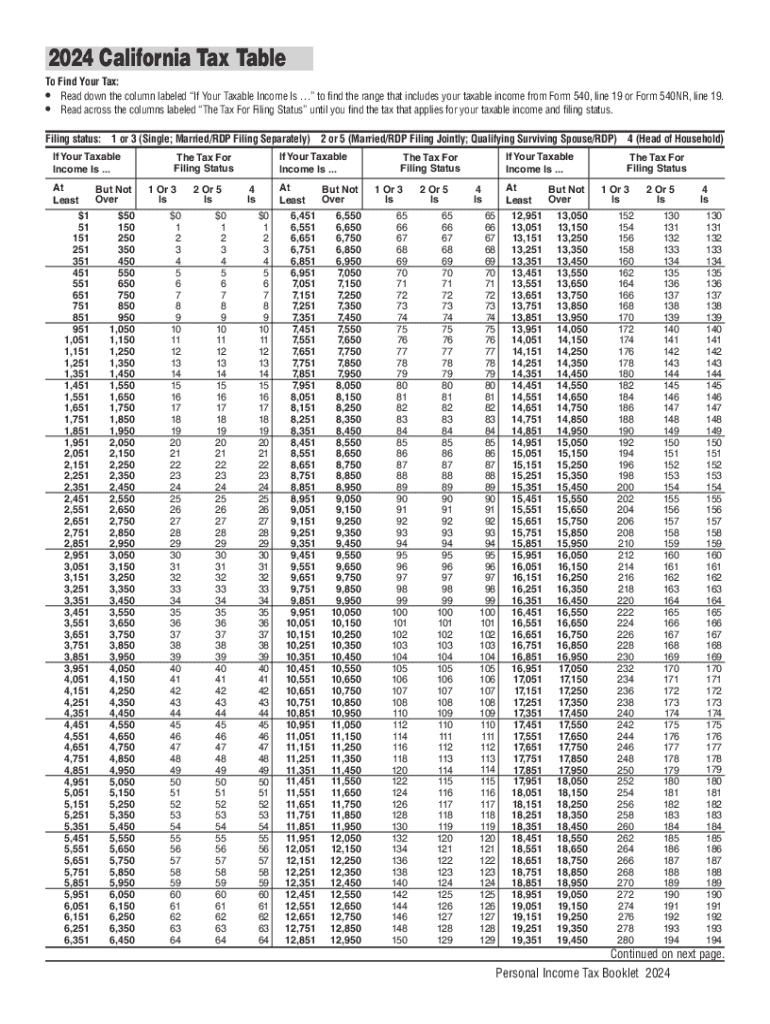

The FTB 540 Booklet is a crucial resource for California taxpayers, providing detailed instructions on how to complete the California personal income tax form. It includes the California Tax Table, which taxpayers use to determine their tax liability based on their income level. The tax table simplifies the process of calculating taxes owed, allowing individuals to quickly find the appropriate tax amount corresponding to their taxable income. This booklet is issued by the California Franchise Tax Board (FTB) and is essential for anyone filing their 2024 California income tax return.

How to Access the FTB 540 Booklet and California Tax Table

To obtain the FTB 540 Booklet and the accompanying California Tax Table, taxpayers can visit the official California Franchise Tax Board website. The booklet is available for download in PDF format, making it easy to access and print. Additionally, physical copies may be requested through the FTB's customer service channels. It is advisable to ensure you have the most current version for the 2024 tax year, as tax laws and rates may change annually.

Steps for Completing the FTB 540 Booklet and Using the Tax Table

Completing the FTB 540 Booklet involves several steps. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, fill out your personal information on the form. After that, calculate your total income and deductions. Once you have your taxable income, refer to the California Tax Table in the booklet to find your tax liability. Finally, ensure all information is accurate before submitting the form either online, by mail, or in person at designated locations.

Key Elements of the FTB 540 Booklet and California Tax Table

The FTB 540 Booklet contains several key elements that are vital for accurate tax filing. These include instructions for filling out the form, a breakdown of tax rates, and specific guidelines for various deductions and credits. The California Tax Table itself is organized by income brackets, making it straightforward for taxpayers to locate their applicable tax rate. Additionally, the booklet provides information on filing deadlines and important dates, ensuring taxpayers stay compliant with state tax regulations.

Legal Considerations for Using the FTB 540 Booklet and Tax Table

Using the FTB 540 Booklet and California Tax Table is a legal requirement for California residents when filing their state income taxes. It is important to follow the guidelines outlined in the booklet to avoid penalties for non-compliance. Taxpayers should also be aware of any changes in tax laws that may affect their filings. The FTB provides resources to help taxpayers understand their obligations and ensure they are using the correct forms and tables for their specific tax situations.

Examples of Utilizing the FTB 540 Booklet and California Tax Table

For instance, if a taxpayer has a taxable income of $50,000, they would locate this figure in the California Tax Table to determine their tax liability. The table will provide the exact amount of tax owed based on the income bracket. Another example involves claiming deductions, where the taxpayer must follow the instructions in the FTB 540 Booklet to ensure they correctly report their income and apply any eligible credits, ultimately affecting their total tax due.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ftb 540 booklet california tax table ftb 540 booklet california tax table

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the 2024 California tax income for businesses?

The 2024 California tax income is crucial for businesses as it determines the tax obligations they must meet. Understanding these requirements can help businesses plan their finances better and avoid penalties. Utilizing tools like airSlate SignNow can streamline document management related to tax filings.

-

How can airSlate SignNow assist with the 2024 California tax income documentation?

airSlate SignNow simplifies the process of preparing and signing documents necessary for the 2024 California tax income. With its user-friendly interface, businesses can easily create, send, and eSign tax-related documents, ensuring compliance and accuracy. This efficiency can save time and reduce stress during tax season.

-

What features does airSlate SignNow offer for managing 2024 California tax income documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing 2024 California tax income documents. These features help ensure that all necessary paperwork is completed accurately and on time. Additionally, the platform provides audit trails for compliance purposes.

-

Is airSlate SignNow cost-effective for handling 2024 California tax income needs?

Yes, airSlate SignNow is a cost-effective solution for businesses looking to manage their 2024 California tax income documentation. With various pricing plans, businesses can choose an option that fits their budget while still accessing essential features. This affordability makes it an attractive choice for small to medium-sized enterprises.

-

Can airSlate SignNow integrate with accounting software for 2024 California tax income?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage your 2024 California tax income. This integration allows for automatic data transfer, reducing the risk of errors and saving time during tax preparation. Businesses can streamline their processes by connecting their tools.

-

What are the benefits of using airSlate SignNow for 2024 California tax income?

Using airSlate SignNow for your 2024 California tax income offers numerous benefits, including enhanced efficiency, improved accuracy, and better compliance. The platform's intuitive design allows users to quickly navigate through document processes, ensuring that all tax-related documents are handled promptly. This can lead to a smoother tax filing experience.

-

How secure is airSlate SignNow for handling sensitive 2024 California tax income information?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive 2024 California tax income information. The platform employs advanced encryption and security protocols to protect user data. Businesses can confidently manage their tax documents, knowing that their information is safeguarded against unauthorized access.

Get more for FTB 540 Booklet California Tax Table , FTB 540 Booklet, California Tax Table

- Basketball registration form

- Truck dispatcher paperwork form

- Lic agent report form 380 pdf

- Land survey report sample pdf form

- Ea 800 receipt for firearms and firearm parts form

- Stipulated findings of fact conclusions of law order for judgment and judgment and decree form

- National register eligibility questionnaire resour form

- Office of the state fire marshal the state vermont division of fire form

Find out other FTB 540 Booklet California Tax Table , FTB 540 Booklet, California Tax Table

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation