Earnings Tax Department Form

What is the Earnings Tax Department

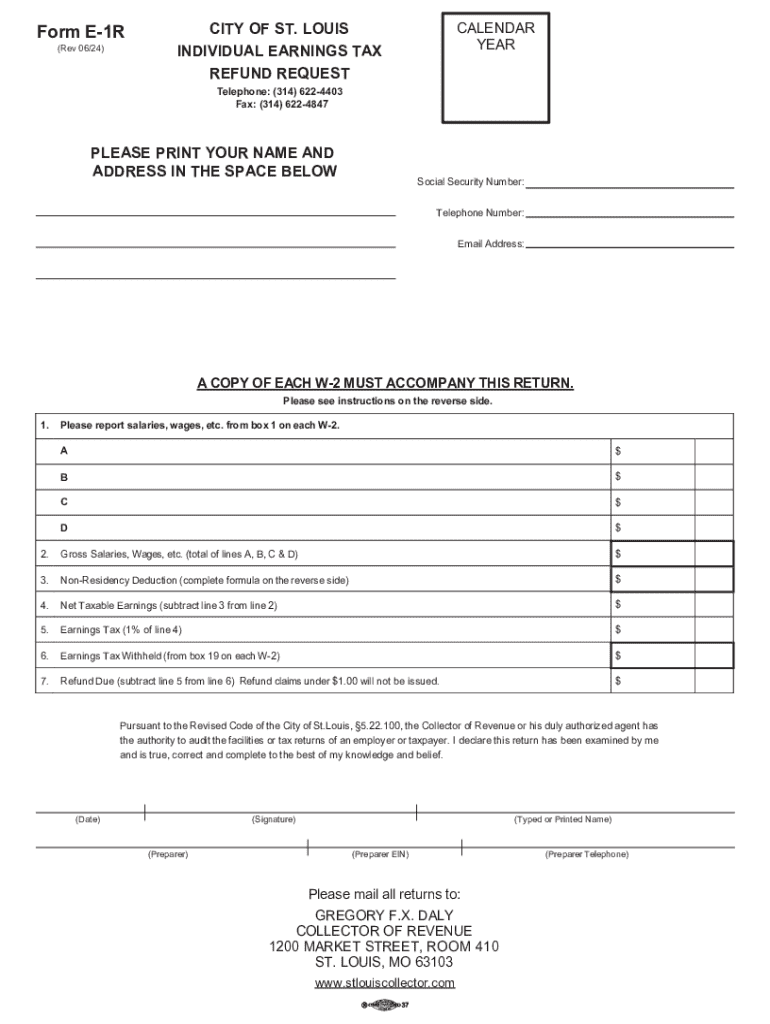

The Earnings Tax Department is a municipal entity responsible for administering and collecting earnings taxes within specific jurisdictions, such as St. Louis City. This department ensures compliance with local tax laws and provides necessary resources for residents and businesses to fulfill their tax obligations. The earnings tax is typically levied on individuals and businesses based on their income earned within the city limits.

Steps to complete the Earnings Tax Department

Completing the requirements of the Earnings Tax Department involves several key steps:

- Gather necessary financial documents, including income statements, W-2 forms, and any other relevant tax documents.

- Determine your residency status, as this affects your tax obligations.

- Complete the appropriate form, such as the form E-1R, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the designated deadline, either online, by mail, or in person.

Required Documents

To successfully file with the Earnings Tax Department, you will need to provide specific documentation. Commonly required documents include:

- W-2 forms from employers, detailing your annual earnings.

- 1099 forms for any freelance or contracted work.

- Proof of residency, such as a utility bill or lease agreement.

- Any other income statements that reflect earnings during the tax year.

Form Submission Methods (Online / Mail / In-Person)

The Earnings Tax Department offers multiple methods for submitting the form E-1R:

- Online: Many jurisdictions allow for electronic filing through their official websites, providing a convenient option for taxpayers.

- Mail: You can print the completed form and send it to the designated address provided by the Earnings Tax Department.

- In-Person: Submissions can often be made directly at the department's office, allowing for immediate confirmation of receipt.

Penalties for Non-Compliance

Failure to comply with the requirements set by the Earnings Tax Department can result in various penalties. These may include:

- Late fees for overdue filings.

- Interest on unpaid taxes, which accumulates over time.

- Potential legal action for persistent non-compliance, including liens on property.

Eligibility Criteria

Eligibility for filing with the Earnings Tax Department typically includes:

- Individuals who earn income within the jurisdiction, regardless of residency status.

- Businesses operating within city limits that generate taxable income.

- Compliance with local tax laws and regulations, ensuring all necessary forms are submitted accurately.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the earnings tax department

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form e 1r and how does it work?

The form e 1r is a specific document format used for electronic signatures and form submissions. With airSlate SignNow, you can easily create, send, and eSign the form e 1r, streamlining your document workflow. This ensures that your forms are completed quickly and securely, enhancing overall efficiency.

-

How much does it cost to use airSlate SignNow for form e 1r?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those who frequently use the form e 1r. You can choose from monthly or annual subscriptions, with options that provide access to advanced features for managing your documents. Visit our pricing page for detailed information on plans and features.

-

What features does airSlate SignNow offer for managing form e 1r?

airSlate SignNow provides a range of features for managing the form e 1r, including customizable templates, automated workflows, and real-time tracking. These features help you streamline the signing process and ensure that all necessary parties can easily access and complete the form e 1r. Additionally, you can integrate with other tools to enhance your document management.

-

Can I integrate airSlate SignNow with other applications for form e 1r?

Yes, airSlate SignNow supports integrations with various applications, making it easy to manage the form e 1r alongside your existing tools. Whether you use CRM systems, cloud storage, or project management software, our platform can connect seamlessly to enhance your workflow. Check our integrations page for a complete list of compatible applications.

-

What are the benefits of using airSlate SignNow for form e 1r?

Using airSlate SignNow for the form e 1r offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. The platform allows you to send and eSign documents quickly, which can signNowly speed up your business processes. Additionally, you can track the status of your form e 1r in real-time, ensuring that nothing falls through the cracks.

-

Is airSlate SignNow secure for handling form e 1r?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance with industry standards to protect your form e 1r and other documents. Our platform ensures that your data is safe during transmission and storage, giving you peace of mind when managing sensitive information. Regular audits and updates further enhance our security measures.

-

How can I get started with airSlate SignNow for form e 1r?

Getting started with airSlate SignNow for the form e 1r is simple. You can sign up for a free trial to explore the platform's features and see how it can benefit your business. Once you're ready, choose a pricing plan that suits your needs and start creating, sending, and eSigning your form e 1r with ease.

Get more for Earnings Tax Department

- Form forms

- Atm card block form state bank of india

- St george city irc equipment and duct plan form

- Child chuda chudi form

- Grammar and language workbook grade 10 answer key form

- Adr 106 petition to confirm correct or vacate contractual arbitration award alternative dispute resolution form

- Va form 21 2680 764050329

- Print file application for barber student license form

Find out other Earnings Tax Department

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample