The Complete Guide to Managing Sales Tax Exemption Form

Understanding the Sales Tax Exemption Process

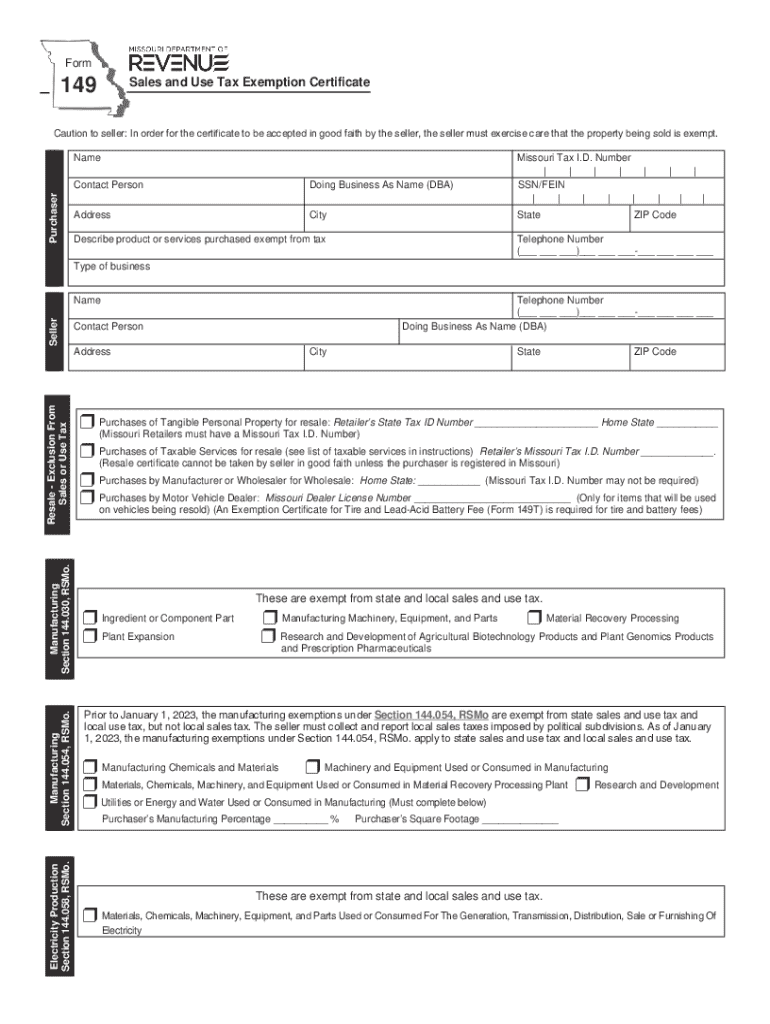

The Missouri Department of Revenue (DOR) Form 149, commonly referred to as the MO DOR 149, is a critical document used for claiming sales tax exemptions in Missouri. This form is essential for businesses and individuals who qualify for tax exemption under specific circumstances, such as purchasing goods for resale or for use in exempt activities. Understanding the purpose of this form and the types of exemptions it covers is crucial for compliance and effective tax management.

Steps to Complete the MO DOR 149

Completing the MO DOR 149 involves several key steps to ensure accuracy and compliance with state regulations. First, gather necessary information, including your business details, tax identification number, and the specific reason for the exemption. Next, accurately fill out the form, providing all required information in the designated fields. After completing the form, review it carefully for any errors or omissions. Finally, submit the form to the appropriate vendor or authority as required.

Eligibility Criteria for Sales Tax Exemption

To qualify for a sales tax exemption using the MO DOR 149, applicants must meet specific eligibility criteria set by the state of Missouri. Common eligibility factors include the nature of the purchase, the buyer's status (such as a nonprofit organization or government entity), and the intended use of the purchased items. It is essential to understand these criteria to determine if you can legitimately claim an exemption and avoid potential penalties.

Required Documents for Submission

When submitting the MO DOR 149, certain documents may be required to support your claim for exemption. These documents can include a valid tax identification number, proof of the exempt status of the purchaser, and any additional documentation that verifies the purpose of the purchase. Ensuring that all required documents are included with your submission can help facilitate a smoother review process.

Form Submission Methods

The MO DOR 149 can be submitted through various methods, depending on the preferences of the vendor or authority receiving the form. Common submission methods include online submission through the Missouri Department of Revenue website, mailing a hard copy of the completed form, or delivering it in person to the appropriate office. Understanding the preferred submission method can help ensure timely processing of your exemption claim.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the MO DOR 149 can result in significant penalties. These may include back taxes owed, interest on unpaid taxes, and potential fines for fraudulent claims. It is vital to adhere to all guidelines and ensure that the information provided on the form is accurate and truthful to avoid these repercussions.

Handy tips for filling out The Complete Guide To Managing Sales Tax Exemption online

Quick steps to complete and e-sign The Complete Guide To Managing Sales Tax Exemption online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Get access to a HIPAA and GDPR compliant platform for maximum simpleness. Use signNow to e-sign and send The Complete Guide To Managing Sales Tax Exemption for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the the complete guide to managing sales tax exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mo dor 149 in relation to airSlate SignNow?

Mo dor 149 refers to a specific feature set within airSlate SignNow that enhances document management and eSigning capabilities. This feature allows users to streamline their workflows, making it easier to send and sign documents securely and efficiently.

-

How does airSlate SignNow's mo dor 149 improve document signing?

The mo dor 149 feature in airSlate SignNow simplifies the document signing process by providing an intuitive interface and automated workflows. This ensures that users can quickly send documents for eSignature, reducing turnaround time and improving overall productivity.

-

What are the pricing options for airSlate SignNow with mo dor 149?

AirSlate SignNow offers competitive pricing plans that include access to the mo dor 149 features. Customers can choose from various subscription tiers based on their business needs, ensuring they get the best value for their investment in document management solutions.

-

Can I integrate mo dor 149 with other software?

Yes, airSlate SignNow's mo dor 149 is designed to integrate seamlessly with various third-party applications. This allows businesses to enhance their existing workflows by connecting with CRM systems, cloud storage, and other essential tools.

-

What benefits does mo dor 149 provide for businesses?

The mo dor 149 feature in airSlate SignNow offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security for document transactions. By adopting this solution, businesses can improve their operational workflows and focus on core activities.

-

Is mo dor 149 suitable for small businesses?

Absolutely! Mo dor 149 is tailored to meet the needs of businesses of all sizes, including small enterprises. Its cost-effective solution allows small businesses to manage their document signing processes without the need for extensive resources.

-

How secure is the mo dor 149 feature in airSlate SignNow?

Security is a top priority for airSlate SignNow, and the mo dor 149 feature includes robust encryption and compliance with industry standards. This ensures that all documents signed through the platform are protected against unauthorized access and data bsignNowes.

Get more for The Complete Guide To Managing Sales Tax Exemption

- Florida trespass warning form

- Lesson 3 homework practice add and subtract like fractions answer key form

- Intake form for day care service

- Troop meeting plan pdf form

- Declaration form for school

- Biogeochemical cycles webquest answer key form

- Military leave form pdf 229594973

- Portuguese certificate of immunization status form doh wa

Find out other The Complete Guide To Managing Sales Tax Exemption

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney

- How Do I Electronic signature South Carolina Unlimited Power of Attorney

- How Can I Electronic signature Alaska Limited Power of Attorney

- How To Electronic signature Massachusetts Retainer Agreement Template

- Electronic signature California Limited Power of Attorney Now

- Electronic signature Colorado Limited Power of Attorney Now

- Electronic signature Georgia Limited Power of Attorney Simple

- Electronic signature Nevada Retainer Agreement Template Myself