9465sp Electronic Form

What is the 9465sp Electronic Form

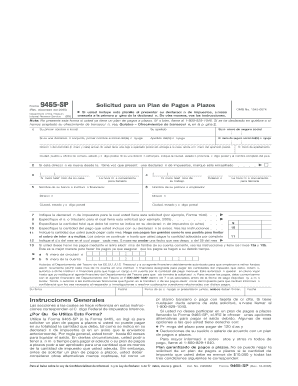

The 9465sp electronic form is a specific document used by taxpayers in the United States to request a payment plan for their tax liabilities. This form is particularly relevant for individuals who owe taxes but are unable to pay the full amount by the due date. By submitting the 9465sp, taxpayers can propose a structured payment plan to the IRS, allowing them to manage their tax obligations more effectively.

How to use the 9465sp Electronic Form

Using the 9465sp electronic form involves several straightforward steps. First, access the form through a reliable digital platform that supports eSigning. Next, fill out the required fields, including personal information and details about your tax liability. After completing the form, review all entries for accuracy. Finally, submit the form electronically, ensuring you receive a confirmation of submission for your records.

Steps to complete the 9465sp Electronic Form

Completing the 9465sp electronic form requires careful attention to detail. Follow these steps for a successful submission:

- Gather necessary information, including your Social Security number, tax information, and details about your financial situation.

- Access the electronic form through a secure platform.

- Fill in your personal details, ensuring accuracy in all fields.

- Indicate your desired payment plan terms, specifying the amount you can pay and the duration of the plan.

- Review the completed form for any errors or omissions.

- Submit the form electronically and save a copy of the confirmation for your records.

Legal use of the 9465sp Electronic Form

The 9465sp electronic form is legally binding when completed and submitted according to IRS guidelines. To ensure its validity, it must be filled out accurately and submitted through an authorized electronic platform. Compliance with eSignature laws, such as the ESIGN Act and UETA, further strengthens the legal standing of the form. This means that when using a trusted digital tool, the form is considered equally valid as a traditional paper version.

Required Documents

When filling out the 9465sp electronic form, certain documents may be required to support your request. These typically include:

- Your most recent tax return.

- Documentation of your current income, such as pay stubs or bank statements.

- Details of any other debts or financial obligations.

Having these documents ready will facilitate the completion of the form and help ensure that your payment plan request is processed smoothly.

Filing Deadlines / Important Dates

It is essential to be aware of filing deadlines when submitting the 9465sp electronic form. Generally, taxpayers should submit their payment plan request as soon as they realize they cannot pay their tax bill in full. The IRS recommends submitting the form before the tax payment due date to avoid penalties and interest. Keeping track of important dates will help you manage your tax responsibilities effectively.

Quick guide on how to complete 9465sp electronic form

Effortlessly create 9465sp Electronic Form on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal sustainable alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents rapidly without delays. Handle 9465sp Electronic Form on any device using airSlate SignNow Android or iOS applications and streamline any document-based workflow today.

The easiest way to modify and electronically sign 9465sp Electronic Form seamlessly

- Find 9465sp Electronic Form and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Eliminate issues with lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and eSign 9465sp Electronic Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 9465sp electronic form

How to create an eSignature for your 9465sp Electronic Form online

How to generate an eSignature for the 9465sp Electronic Form in Chrome

How to generate an eSignature for putting it on the 9465sp Electronic Form in Gmail

How to create an electronic signature for the 9465sp Electronic Form from your smart phone

How to generate an electronic signature for the 9465sp Electronic Form on iOS devices

How to make an eSignature for the 9465sp Electronic Form on Android

People also ask

-

What is the 9465sp Electronic Form and how does it work?

The 9465sp Electronic Form is a digital solution that allows businesses to streamline the process of sending and signing documents. With airSlate SignNow, users can easily create, customize, and manage the 9465sp Electronic Form, ensuring that all necessary information is captured efficiently and securely.

-

How much does it cost to use the 9465sp Electronic Form?

Pricing for the 9465sp Electronic Form varies based on the subscription plan chosen. airSlate SignNow offers several cost-effective plans that cater to different business needs, ensuring you can find a solution that fits your budget while maximizing the features available for the 9465sp Electronic Form.

-

What features does the 9465sp Electronic Form offer?

The 9465sp Electronic Form includes features such as customizable templates, secure eSignature capabilities, and automated workflows. These functionalities enhance the user experience, making it simpler to manage documents and collect signatures efficiently.

-

How can the 9465sp Electronic Form benefit my business?

Using the 9465sp Electronic Form can signNowly improve your business operations by reducing paperwork, speeding up the signing process, and enhancing document security. This streamlined approach saves time and resources, allowing your team to focus on more critical tasks.

-

Can I integrate the 9465sp Electronic Form with other software?

Yes, the 9465sp Electronic Form can be easily integrated with various third-party applications and software. airSlate SignNow supports numerous integrations, enabling you to connect the 9465sp Electronic Form with your existing tools for a seamless workflow.

-

Is the 9465sp Electronic Form compliant with legal standards?

Absolutely! The 9465sp Electronic Form created with airSlate SignNow meets all necessary legal and compliance standards. This ensures that your electronic signatures and documents are legally binding and recognized across various jurisdictions.

-

How secure is the 9465sp Electronic Form?

The 9465sp Electronic Form is designed with security in mind, utilizing advanced encryption and authentication methods. airSlate SignNow prioritizes the safety of your documents, ensuring that all data remains confidential and protected from unauthorized access.

Get more for 9465sp Electronic Form

- Cs es51 form

- Abt 6014 form

- Temporary permit application the alabama real estate reab alabama form

- Joint application and notification 2006 form

- Alabama annual permit form

- Adem application form

- Employeeamp039s withholding exemption certificate this form

- Form mo cr credit for income taxes paid to other states or

Find out other 9465sp Electronic Form

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe