DTF 17 I Form

What is the DTF 17 Form?

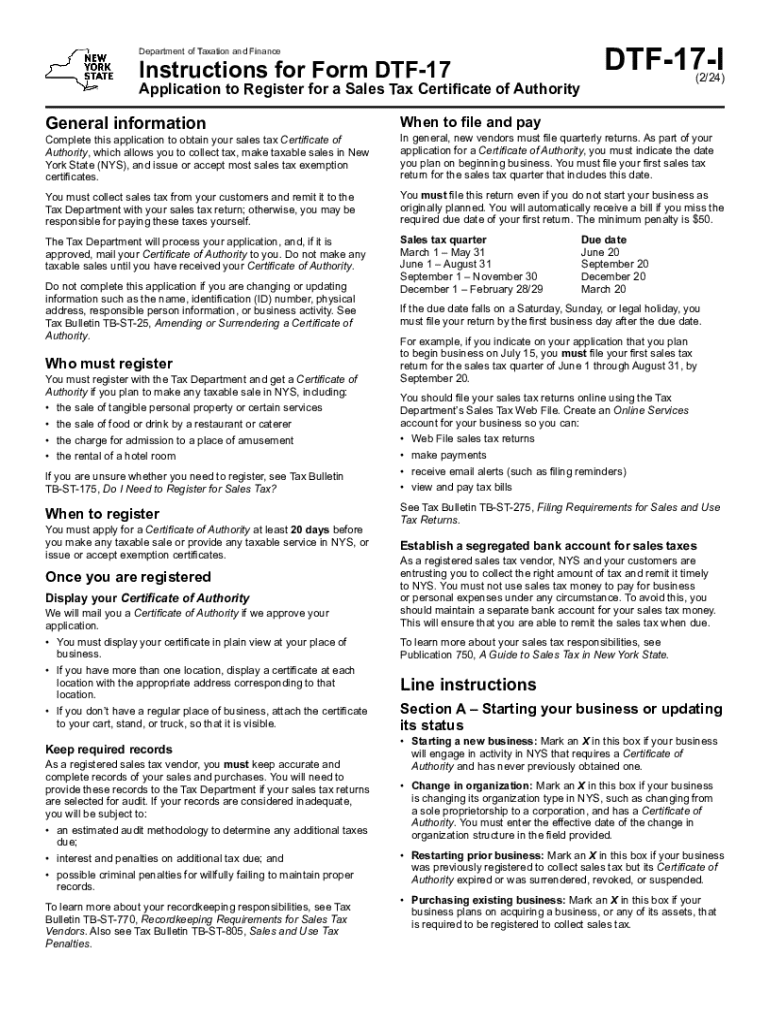

The DTF 17 form, also known as the New York State Sales Tax Certificate of Authority, is a crucial document for businesses operating in New York. This form allows businesses to collect sales tax from customers and remit it to the state. It is essential for any business that sells tangible personal property or services that are subject to sales tax in New York.

How to Use the DTF 17 Form

The DTF 17 form is used by businesses to apply for a sales tax certificate of authority. Once approved, this certificate enables businesses to legally collect sales tax on taxable sales. It is important for businesses to display this certificate prominently at their place of business and to ensure that they comply with all sales tax regulations to avoid penalties.

Steps to Complete the DTF 17 Form

Completing the DTF 17 form involves several key steps:

- Gather necessary information, including business details and ownership information.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions.

- Submit the form either online or via mail, depending on your preference.

Legal Use of the DTF 17 Form

The DTF 17 form is legally required for any business that wishes to collect sales tax in New York. Failure to obtain this certificate can result in significant penalties, including fines and interest on unpaid taxes. It is important for businesses to understand their obligations under New York tax law and to maintain compliance at all times.

Required Documents for the DTF 17 Form

When applying for the DTF 17 form, businesses must provide several key documents, including:

- Proof of business registration, such as a Certificate of Incorporation or a Business License.

- Identification information for the business owner(s), such as Social Security numbers or Employer Identification Numbers (EIN).

- Any additional documentation that may be required by the New York State Department of Taxation and Finance.

Form Submission Methods

The DTF 17 form can be submitted through various methods:

- Online: Businesses can complete and submit the form electronically through the New York State Department of Taxation and Finance website.

- Mail: Alternatively, businesses can print the completed form and mail it to the appropriate address provided by the state.

- In-Person: Some businesses may choose to submit the form in person at a local tax office, though this method is less common.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dtf 17 i

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the DTF 17 form PDF?

The DTF 17 form PDF is a document used for reporting and paying New York State sales tax. It is essential for businesses that need to file their sales tax returns accurately and on time. Using the DTF 17 form PDF ensures compliance with state regulations and helps avoid penalties.

-

How can I fill out the DTF 17 form PDF using airSlate SignNow?

With airSlate SignNow, you can easily fill out the DTF 17 form PDF online. Our platform allows you to upload the PDF, add necessary information, and eSign it securely. This streamlines the process, making it quick and efficient for your business.

-

Is there a cost associated with using airSlate SignNow for the DTF 17 form PDF?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. You can choose a plan that provides access to features for managing the DTF 17 form PDF and other documents. Our cost-effective solutions ensure you get the best value for your investment.

-

What features does airSlate SignNow offer for the DTF 17 form PDF?

airSlate SignNow provides features such as document editing, eSigning, and secure storage for the DTF 17 form PDF. Additionally, you can track the status of your documents and receive notifications when they are signed. These features enhance your workflow and improve efficiency.

-

Can I integrate airSlate SignNow with other applications for managing the DTF 17 form PDF?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to manage the DTF 17 form PDF seamlessly. You can connect with tools like Google Drive, Dropbox, and CRM systems to streamline your document management process.

-

What are the benefits of using airSlate SignNow for the DTF 17 form PDF?

Using airSlate SignNow for the DTF 17 form PDF provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the signing process, allowing you to focus on your business while ensuring compliance with tax regulations.

-

How secure is my information when using airSlate SignNow for the DTF 17 form PDF?

Security is a top priority at airSlate SignNow. When using our platform for the DTF 17 form PDF, your information is protected with advanced encryption and secure storage. We adhere to industry standards to ensure that your data remains confidential and safe.

Get more for DTF 17 I

- 11th biology target pdf download form

- Cheyenne arapaho covid relief 2022 form

- Safebridge jrc ecdis test answers pdf form

- City attorney avalon california form

- Gdmocpecommondmcewenfinance adminoffice of residential tenanciesnew rta march 07formsform 4wpd

- Images for is it true kc1500 1118 application for medical assistance for the elderly and persons with disabilities who can use form

- Sco letter sco ca form

- 1 ronald reagan presidential library and museum scavenger hunt form

Find out other DTF 17 I

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe