Publication 910 NAICS Codes for Principal Business Activity for New York State Tax Purposes Revised 1022 Form

Understanding Publication 910 NAICS Codes for New York State Tax Purposes

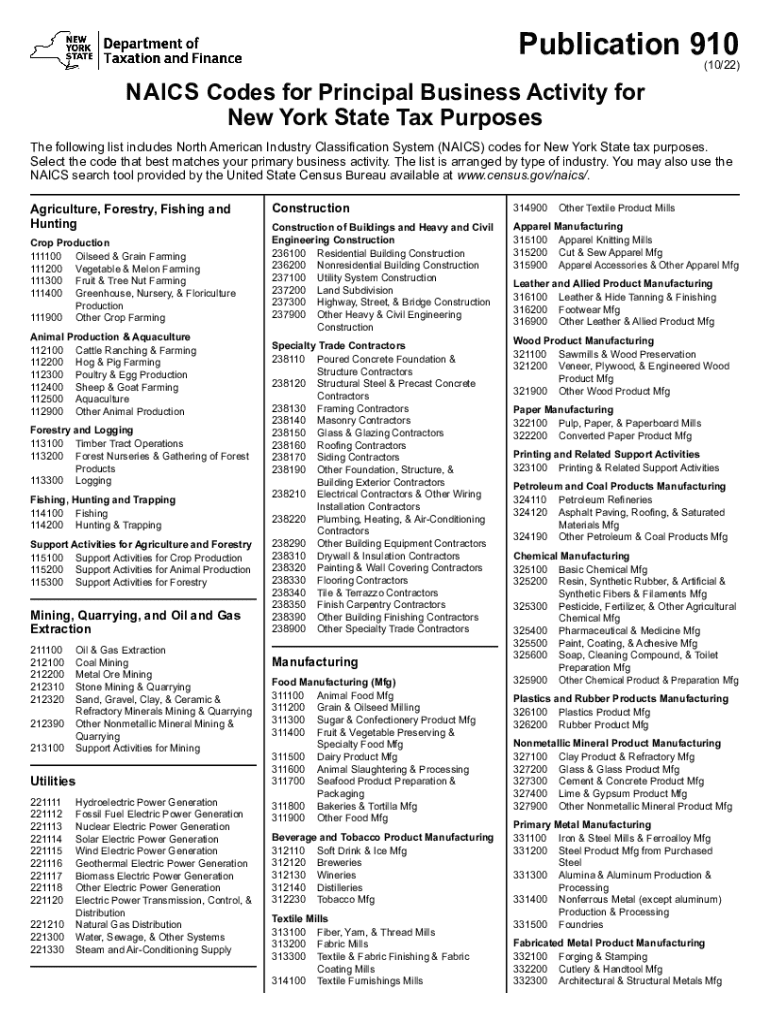

Publication 910 provides essential information regarding the North American Industry Classification System (NAICS) codes used for identifying principal business activities for tax purposes in New York State. This publication is crucial for businesses to accurately classify their activities, ensuring compliance with state tax regulations. The NAICS codes are numeric codes that categorize businesses based on their primary activities, allowing for consistent reporting and analysis.

How to Use Publication 910 for NAICS Codes

To effectively utilize Publication 910, businesses should first identify their primary business activity. This involves reviewing the detailed descriptions of various NAICS codes provided in the publication. Once the appropriate code is identified, it should be recorded on relevant tax forms to ensure accurate reporting. This classification not only aids in tax compliance but also helps in obtaining various permits and licenses required for business operations in New York State.

Obtaining Publication 910 NAICS Codes

Publication 910 can be obtained through the New York State Department of Taxation and Finance website. It is available as a downloadable PDF document, which can be printed for reference. Businesses may also request a physical copy by contacting the department directly. Ensuring access to the latest version of this publication is important for compliance, as tax regulations and codes can change over time.

Steps to Complete the NAICS Codes Section on Tax Forms

Completing the NAICS codes section on tax forms involves several steps:

- Identify your principal business activity by reviewing the descriptions in Publication 910.

- Locate the corresponding NAICS code that best fits your business activity.

- Enter the selected NAICS code accurately on your tax forms.

- Double-check the code for accuracy to avoid potential compliance issues.

Legal Use of NAICS Codes in New York State

The legal use of NAICS codes is mandated by New York State tax regulations. Accurate classification of business activities using these codes is essential for tax reporting and compliance. Misclassification can lead to penalties, audits, or delays in processing tax returns. Therefore, businesses should ensure that they are using the correct NAICS codes as outlined in Publication 910 to avoid any legal complications.

Examples of NAICS Code Applications

Examples of how NAICS codes are applied can vary widely across different industries. For instance, a construction company may use a specific NAICS code that reflects its primary activity, such as general contracting or specialty trades. Similarly, a retail business would select a code that accurately describes its operations, such as clothing retail or grocery stores. These examples illustrate the importance of selecting the correct code to ensure compliance and proper categorization for tax purposes.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the publication 910 naics codes for principal business activity for new york state tax purposes revised 1022

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are NAICS codes for principal business activity for New York State tax purposes?

NAICS codes for principal business activity for New York State tax purposes are numerical codes that classify businesses based on their primary activities. These codes help determine tax obligations and eligibility for various programs. Understanding your NAICS code is essential for compliance and accurate tax reporting.

-

How can airSlate SignNow help with NAICS code documentation?

airSlate SignNow provides an efficient platform for businesses to send and eSign documents related to NAICS codes for principal business activity for New York State tax purposes. Our solution simplifies the process of managing and submitting necessary documentation, ensuring compliance and accuracy. This can save time and reduce the risk of errors in your tax filings.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a range of features including customizable templates, secure eSigning, and document tracking. These features streamline the process of managing documents related to NAICS codes for principal business activity for New York State tax purposes. With our user-friendly interface, you can easily create, send, and manage your documents.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. Our pricing plans are flexible and cater to various needs, ensuring that you can manage your documents related to NAICS codes for principal business activity for New York State tax purposes without breaking the bank. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow. Whether you need to connect with accounting software or CRM systems, our platform can help you manage documents related to NAICS codes for principal business activity for New York State tax purposes efficiently.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning provides numerous benefits, including increased efficiency, enhanced security, and reduced paper usage. By digitizing the signing process, you can quickly handle documents related to NAICS codes for principal business activity for New York State tax purposes. This not only saves time but also contributes to a more sustainable business practice.

-

How secure is airSlate SignNow for handling sensitive documents?

airSlate SignNow prioritizes security and employs advanced encryption methods to protect your sensitive documents. When dealing with NAICS codes for principal business activity for New York State tax purposes, you can trust that your information is safe. Our platform complies with industry standards to ensure the confidentiality and integrity of your data.

Get more for Publication 910 NAICS Codes For Principal Business Activity For New York State Tax Purposes Revised 1022

- Floridarevenuecomformslibrarycurrentapplication for common paymaster rule 73b 10037 fac

- Wwwhomeforsalesnet2021 maryland withholding forms2021 maryland withholding forms real estate

- Successor form florida

- Florida dept of revenue discretionary sales surtaxdiscretionary sales surtax rate tablediscretionary sales surtax information

- Florida secondhand dealer license form

- Instructions residential petition for review of valuation fill form

- Arizona department of revenue gaostateazus form

Find out other Publication 910 NAICS Codes For Principal Business Activity For New York State Tax Purposes Revised 1022

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter