Instructions for Form ET 133 Application for Extension of Time

What is the ET-133 Application for Extension of Time?

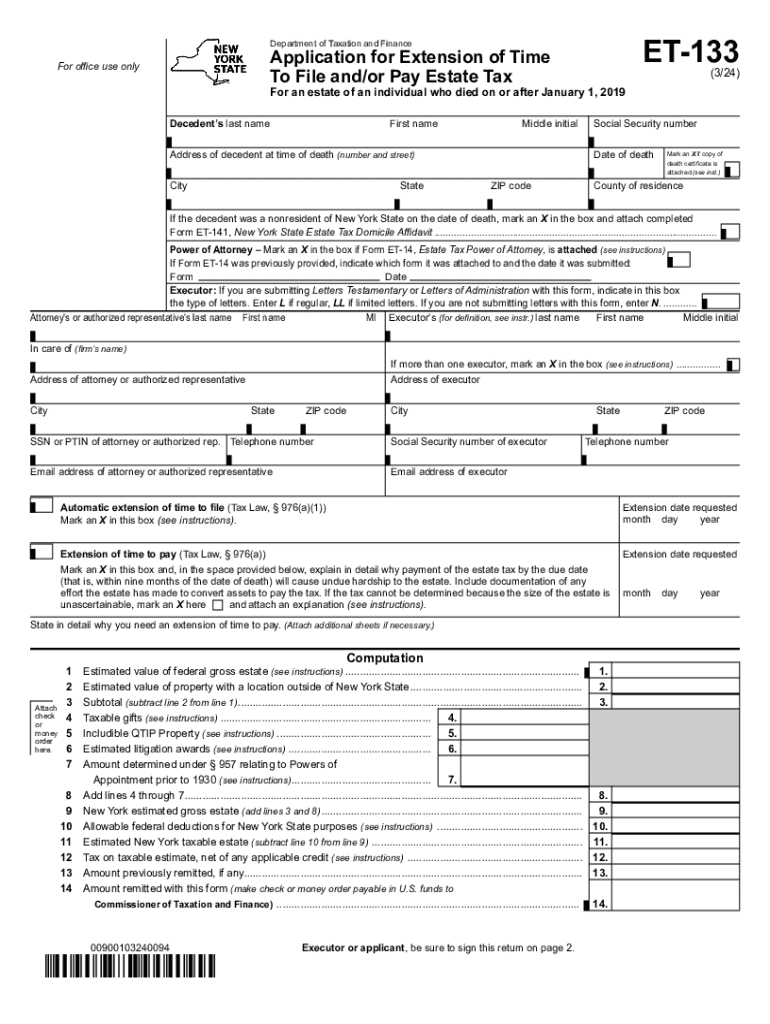

The ET-133 form, also known as the Application for Extension of Time to File Estate Tax Return, is a crucial document for individuals and entities in New York seeking an extension for filing their estate tax returns. This form allows taxpayers to request additional time to submit their estate tax return, which is typically due nine months after the date of death of the decedent. By filing the ET-133, taxpayers can avoid penalties associated with late submissions while ensuring they have adequate time to gather necessary information and documentation.

Steps to Complete the ET-133 Application

Completing the ET-133 form involves several key steps to ensure accuracy and compliance with state regulations:

- Obtain the Form: Download the ET-133 from the New York State Department of Taxation and Finance website or request a physical copy.

- Fill in Decedent Information: Provide the full name, date of death, and Social Security number of the decedent.

- Indicate the Requested Extension Period: Specify the length of the extension being requested, typically up to six months.

- Sign and Date the Form: Ensure that the form is signed by the executor or administrator of the estate, along with the date of signing.

- Submit the Form: Send the completed ET-133 to the appropriate address as indicated in the instructions, either by mail or electronically if applicable.

Filing Deadlines and Important Dates

Understanding the filing deadlines for the ET-133 is essential to avoid penalties. The application for extension must be submitted before the original estate tax return due date, which is nine months after the decedent's date of death. If the ET-133 is filed on time, it grants an automatic extension of up to six months for filing the estate tax return. It's important to mark your calendar to ensure compliance with these deadlines.

Required Documents for the ET-133 Application

When submitting the ET-133, certain documents may be required to support your application. These may include:

- A copy of the decedent's death certificate.

- Documentation proving the relationship of the executor to the decedent.

- Any relevant financial documents that may assist in the preparation of the estate tax return.

Having these documents ready can streamline the process and ensure that your application is processed without delays.

Eligibility Criteria for the ET-133 Application

To be eligible to file the ET-133, the applicant must be the executor or administrator of the estate. Additionally, the request for an extension must be made for a valid reason, such as needing more time to gather necessary financial information or documentation. It is also important that the estate meets the filing requirements set by the New York State Department of Taxation and Finance.

Form Submission Methods

The ET-133 form can be submitted through various methods to accommodate different preferences:

- Mail: Send the completed form to the address specified in the instructions.

- Online: If available, use the state’s online portal for electronic submission.

- In-Person: Deliver the form directly to a local office of the New York State Department of Taxation and Finance.

Choosing the right submission method can help ensure that your application is received and processed in a timely manner.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form et 133 application for extension of time

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form et 133 and how can airSlate SignNow help?

Form et 133 is a specific document used for various administrative purposes. airSlate SignNow simplifies the process of filling out and signing this form by providing an intuitive platform that allows users to easily create, send, and eSign documents securely.

-

How much does it cost to use airSlate SignNow for form et 133?

airSlate SignNow offers competitive pricing plans that cater to different business needs. Depending on the features you require for managing form et 133, you can choose from various subscription options that provide excellent value for your investment.

-

What features does airSlate SignNow offer for managing form et 133?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure eSigning capabilities specifically designed for documents like form et 133. These features enhance efficiency and ensure compliance with legal standards.

-

Can I integrate airSlate SignNow with other applications for form et 133?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing you to manage form et 133 alongside your existing workflows. This integration capability enhances productivity by connecting with tools you already use.

-

What are the benefits of using airSlate SignNow for form et 133?

Using airSlate SignNow for form et 133 streamlines the document management process, reduces turnaround time, and minimizes errors. The platform's user-friendly interface ensures that even those unfamiliar with digital signing can navigate it easily.

-

Is airSlate SignNow secure for handling sensitive form et 133 documents?

Absolutely! airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. This ensures that your form et 133 and other sensitive documents are protected throughout the signing process.

-

How can I get started with airSlate SignNow for form et 133?

Getting started with airSlate SignNow for form et 133 is easy. Simply sign up for an account, choose a plan that fits your needs, and start creating or uploading your form et 133 to begin the eSigning process.

Get more for Instructions For Form ET 133 Application For Extension Of Time

- Dorgeorgiagov600 corporation tax return600 corporation tax returngeorgia department of revenue form

- Instructions for form cst 240 ampquotwest virginia claim for refund or credit

- Dorscgovforms siteformsdepartment of revenue sc4506 request for copy of tax return

- Dorscgovforms siteforms1350 department of revenue c 268 certificate of tax

- Scllr1350 state of south carolina department of revenue south carolina income tax rebate 20221350 state of south carolina form

- 2020 r delaware individual resident income tax return form 200 01

- Ct form os 114 online filing

- Get the free all department heads and budget managers form

Find out other Instructions For Form ET 133 Application For Extension Of Time

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample

- Can I Electronic signature Minnesota Mutual non-disclosure agreement

- Electronic signature Alabama Non-disclosure agreement PDF Safe

- Electronic signature Missouri Non-disclosure agreement PDF Myself

- How To Electronic signature New York Non-disclosure agreement PDF

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms