Form RP 459 C Application for Partial Tax Exemption for Real Property of Persons with Disabilities and Limited Incomes Tax Year

What is the Form RP 459 c Application for Partial Tax Exemption for Real Property of Persons with Disabilities and Limited Incomes?

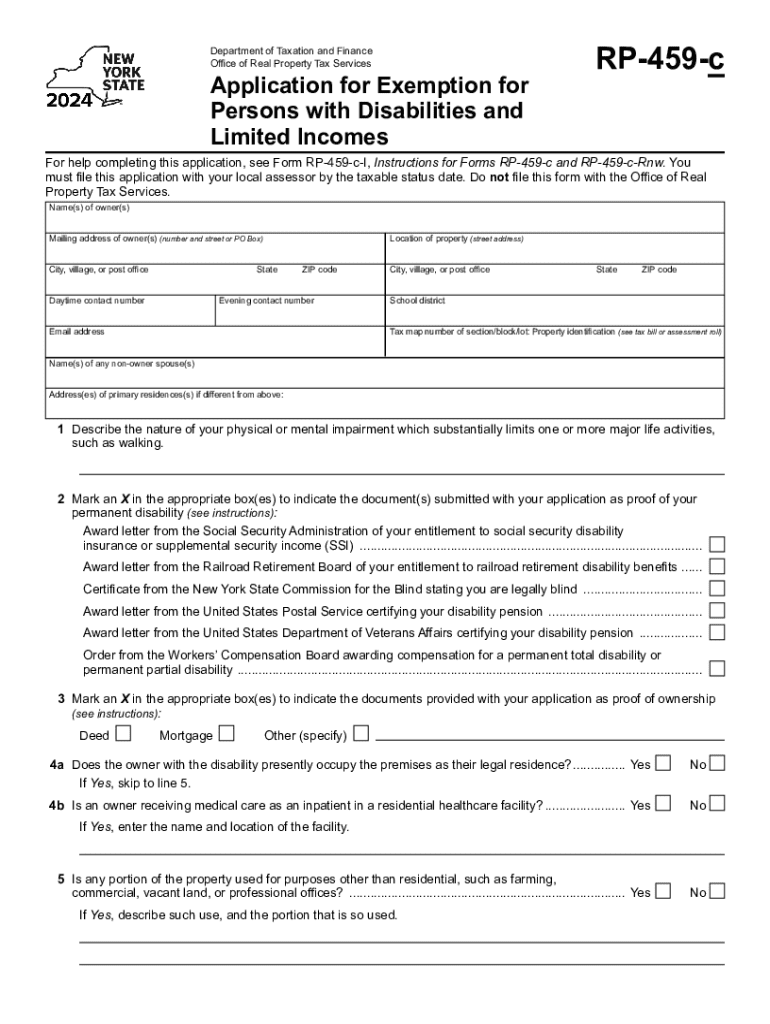

The Form RP 459 c is an application used in the United States for individuals seeking a partial tax exemption on real property due to disabilities or limited incomes. This form is essential for qualifying homeowners who meet specific criteria, allowing them to reduce their property tax burden. The exemption aims to provide financial relief to those who may struggle to afford their property taxes, ensuring they can maintain their homes without undue financial strain.

Eligibility Criteria for the Form RP 459 c

To qualify for the RP 459 c exemption, applicants must meet several criteria. Primarily, the individual must have a documented disability or limited income. Additionally, the property in question must be the applicant's primary residence. Income limits may vary by state, so it is crucial to check the specific guidelines applicable to your location. Applicants may also need to provide proof of income and disability status, ensuring they meet the necessary qualifications for the exemption.

Steps to Complete the Form RP 459 c

Filling out the Form RP 459 c involves several key steps to ensure accuracy and completeness. First, gather all required documentation, including proof of income and disability. Next, accurately fill out the form, providing personal information, property details, and any other necessary information. It is important to review the form for any errors before submission. Finally, submit the completed form to the appropriate local tax authority, either online, by mail, or in person, depending on your jurisdiction's requirements.

Required Documents for the Form RP 459 c

When applying for the RP 459 c exemption, applicants must prepare several important documents. These typically include:

- Proof of income, such as tax returns or pay stubs

- Documentation of disability status, which may include medical records or government-issued disability letters

- Identification, such as a driver's license or state ID

- Property deed or tax bill to confirm ownership

Having these documents ready can streamline the application process and help ensure a successful exemption request.

Form Submission Methods for the RP 459 c

Applicants can submit the Form RP 459 c through various methods, depending on their local tax authority's regulations. Common submission methods include:

- Online submission through the local tax authority's website

- Mailing the completed form to the designated tax office

- In-person submission at the local tax office during business hours

It is advisable to check with your local tax authority for the preferred submission method and any specific requirements they may have.

Application Process and Approval Time for the Form RP 459 c

The application process for the RP 459 c typically involves submitting the completed form along with the required documentation to the local tax authority. After submission, the review process can vary in length depending on the jurisdiction. Generally, applicants may expect to receive a decision within a few weeks to a couple of months. It is important to follow up with the tax authority if no communication is received within the expected timeframe.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form rp 459 c application for partial tax exemption for real property of persons with disabilities and limited incomes tax year 769895235

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is rptl 459 c and how does it relate to airSlate SignNow?

RPTL 459 c refers to a specific regulation that can impact how businesses manage their documents. With airSlate SignNow, you can easily comply with RPTL 459 c by ensuring that your electronic signatures are legally binding and secure. Our platform simplifies the process of managing documents in accordance with this regulation.

-

How can airSlate SignNow help me comply with rptl 459 c?

AirSlate SignNow provides features that ensure compliance with rptl 459 c, such as secure electronic signatures and audit trails. These features help you maintain the integrity of your documents while adhering to legal requirements. By using our platform, you can confidently manage your documents in line with rptl 459 c.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers flexible pricing plans to accommodate various business needs. Our plans are designed to be cost-effective while providing all the necessary features to comply with regulations like rptl 459 c. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow includes a range of features such as customizable templates, secure eSigning, and real-time collaboration. These features not only enhance your document management process but also ensure compliance with regulations like rptl 459 c. Our platform is designed to streamline your workflow efficiently.

-

Can airSlate SignNow integrate with other software I use?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow. Whether you use CRM systems, cloud storage, or project management tools, our platform can integrate smoothly to support your business processes while ensuring compliance with rptl 459 c.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security for your documents. By leveraging our platform, you can ensure compliance with rptl 459 c while streamlining your document workflows. This leads to signNow time and cost savings for your business.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! AirSlate SignNow is designed to be user-friendly and cost-effective, making it ideal for small businesses. With features that support compliance with rptl 459 c, small businesses can manage their documents efficiently without the need for extensive resources.

Get more for Form RP 459 c Application For Partial Tax Exemption For Real Property Of Persons With Disabilities And Limited Incomes Tax Year

- Real property taxdepartment of inland revenue form

- Pennsylvania form pa 40 pennsylvania income tax return printable pennsylvania income tax forms for tax year 2020pennsylvania

- 5076 small business property tax exemption claim under mcl form

- Wwwtaxnygovenforcementcollectionsoffer in compromise program department of taxation and finance form

- Fillable online registrationdeposit recd fax email print form

- Foreclosure filing systemdepartment of financial services form

- Wwwcourseherocomfile118749893personal property statement formpdf reset form michigan

- Small claims court maricopa county justice courts form

Find out other Form RP 459 c Application For Partial Tax Exemption For Real Property Of Persons With Disabilities And Limited Incomes Tax Year

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF